Money Markets, CDs, 401ks, and Savings Accounts that Lose Against Inflation: A Society that Punishes Savers.

- 4 Comment

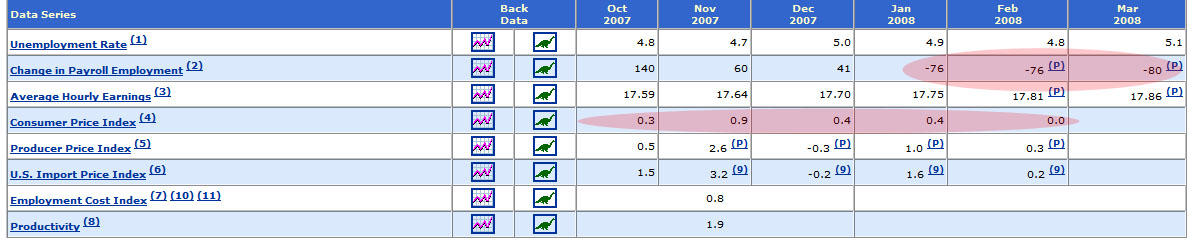

One of the unintended consequences of this housing market is the punishment conservative savers are taking. Last month we had the rather astonishing release of data from the Bureau of Labor and Statistics telling us for the month, that inflation was at 0 percent. As disconnected as this is from reality, there is a reason the Federal Reserve is chopping rates even further and it is the opposite of what they are telling you. Behind closed doors, they are hoping that you go out and spend and go into further debt. In fact, they are setting up a system where savers are actually punished for not spending. This game and charade of course can only go on for so long. First, let us take a look at the current inflation rate and adjust it to an annual basis:

click to enlarge

The first thing I want to point out is the CPI. You’ll notice that last month, the reported inflation rate was 0 percent even though oil touched about $110 a barrel and has remained at those levels for sometime. Let us first calculate the current annual inflation rate based on the above numbers:

If we add up the previous five months of data, we get 2. Since this is five months of data we’ll have to adjust this for a 12 month calendar:

(2/5)=(x/12) gives us X as being 4.8 percent

So currently the annual inflation rate is at 4.8 percent. You will also notice that we have lost jobs in the previous three months to the tune of 76,000, 76,000, and 80,000. Keep in mind that during the previous three recessions, job losses during peak times reached over 300,000 a month even during the minor recession earlier in the decade. This can be looked at a couple of ways. Much of the data from the BLS lags the actual market. That is why people were predicting a recession in the middle of 2007 even while jobs were still being added. Keep in mind the way these things are calculated they leave out much of what the majority of Americans are facing on a daily basis. For one, the CPI does not calculate mortgage payments and taxes but owners equivalent of rent which understates the current burden of housing prices on many homeowners. Also, energy is blunted in the data so the rise in fuel cost isn’t reflected either. Then, you also get complicated uses of hedonics for healthcare, food, and education which again understate the true nature of consumer inflation.

So with that said, for someone to simply preserve their wealth in the current market they will need to achieve a return of 4.8 percent after taxes. Keep in mind that interest earned in CDs, savings, or money market accounts is taxed so a par rate of return is still not keeping up. But let us take a look of a few major institutions to show you how any saver in the current market is being punished:

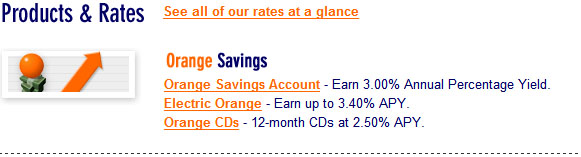

The first one we’ll look at is Emigrant Direct. They have offered very competitive rates on their savings accounts and currently they are offering a 2.75% rate of return. You may think this is low but as we’ll show further, this is actually competitive for savings in the current market. The next place we’ll look at is ING Direct:

The current Orange Savings Account from ING is offering a rate of 3%. You notice that their CD offers a higher rate of return but let us look at what is required of this:

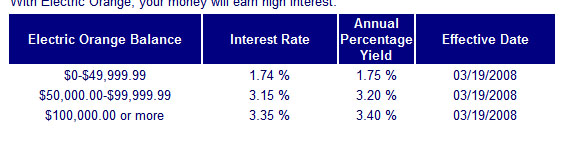

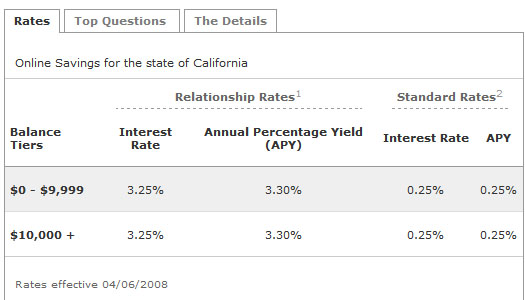

In order to achieve a yield of over 3%, you will need to deposit at least $50,000 or more. This isn’t even calculating the after tax amount you’ll be getting. We are simply looking at the current rates going for safe investments. When I say safe investments, I mean accounts that are protected by the FDIC which insurers individual accounts up to $100,000. The next place is your typical brick and mortar place that is also offering an online product like Emigrant Direct and ING. Washington Mutual is offering an online savings rate of 3.25% so long as you have a checking account with them:

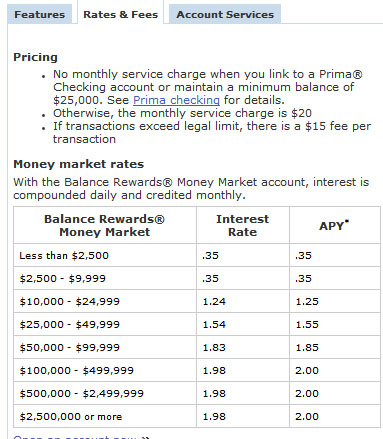

You’re probably starting to notice a pattern here. The savings rate for many of these places hovers from 2.75% to 3.25%. Let us look at a different kind of account with Bank of American and their Money Market Savings Account:

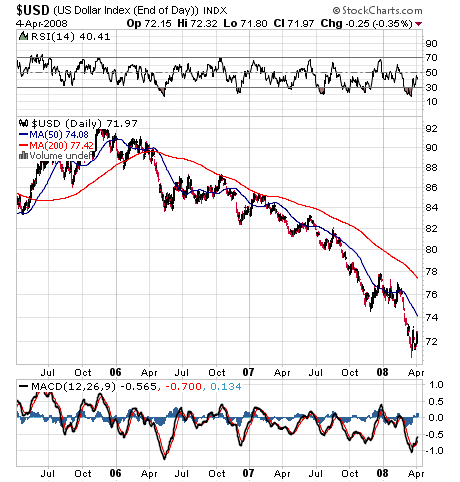

Here, you’ll notice that the rates up to $10,000 will only yield you .35 percent. You will need $10,000 or more to get a rate above 1.24%. Bottom line is that if you stick your money into these accounts and let it sit, your money is actually eroding simply because the rate of inflation will eat it away. And this isn’t to say anything about a dollar that is also going down as well:

During the past two years, the US Dollar Index has decline by 21.7 percent. Given that many of the items Americans consume are imported, that means your purchasing power has declined by an incredible pace. If you have any doubts about this just take a trip to Europe or anywhere in the world for that matter.

There may not be a direct correlation from the Federal Funds Rates and the actual payments you make on mortgages simply because market risk is so high at the moment. But the funds rate does have a direct impact on the above savings rate on conservative accounts. What the Fed is telling you is that if you plan on saving your money in guaranteed accounts, you will in fact be losing money. Then you may be saying, what about playing the stock market. Let us look at the performance of the three major indexes:

Looking at these three even after the recent rallies and major intervention actions by the Federal Reserve they are still down on a year to date basis by:

DOW: -4.94%

S&P 500: -6.67%

NASDAQ: -10.60%

Clearly, the market is making it more difficult for people to protect their wealth. The places that have done well are in foreign currencies and commodities. Why are these doing well? Because they are simply reflecting the true devaluation of the dollar and the real rate of inflation that most Americans are feeling. Let us look at a few currencies:

The Japanese Yen is up 9.91% for the year against the dollar. This has a lot to do with the carry trade unwinding and also the extremely low central bank rates over in Japan. If you think we have low rates here, you just need to take a look over there. But there is more to this than just easy rates. In fact, the Euro is holding up strongly as well too because the ECB has held steady with their rates:

The Euro is up 7.68% for the year against the dollar. Now given that Europe may also be facing a credit bubble as big as our own by the reflection of recent writedowns on mortgage backed debt, their currency is perceived at least by foreign exchange markets as more valuable than the dollar.

The irony is that most Americans do not even have a tiny amount of money in commodities or foreign currencies to hedge their bets. Given that we are in a recession short of the technical definition, if the Fed cuts rates again expect the yield on the already inflation lagging savings accounts to go down even further and expect foreign currencies to go up and also, commodities. In this market, it is important simply to preserve wealth as many that are now seeing their equity evaporate in their homes are realizing. Even the stimulus checks that are coming out next month are not touted as savings checks but a way for you to spend even further. If anything, take those rebate checks and put them in a savings account or foreign currency. The Fed wants you to spend and be in debt since that is the last straw of our economy. Yet this is not good for you on a personal level. No wonder why Americans now have a negative savings rate. Conventional buy and hold investing styles are going to be proven extremely wrong in 2008 and if you want any more proof, just look at these scary charts. Be wise and don’t follow the advice of the Fed.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!4 Comments on this post

Trackbacks

-

Name said:

Oh please.

The real level of inflation is more more like 8+%.

Also anyone who saves money is an idiot.

If your gonna save you need to put hta tmoney into use…such as into an education or into a business…anyone know saves their money into a CD or money market account has always been “treading water” where the return was around equal to inflation.

But now inflation is at least 8%…look at the price of fuel, rising rents, rising cost of food, etc.April 8th, 2008 at 10:25 am -

RUking said:

The rates you mentioned for ING Direct are incorrect. The interest rate on their Orange Savings account is 3% APR regardless of your balance. The figures you provided were for their Electric Orange Checking Account.

April 8th, 2008 at 12:48 pm -

mybudget360 said:

@Name: I agree that the government does understate inflation. Even with their low figure of 4.8%, you are still treading water with typical savings accounts. Of course using owner’s equivalent of rent and balancing out for energy and food is simply absurd. But many cost of living adjustment are tied to the CPI so there is an incentive to report artificially low rates. Anyone that shops, uses gas, has gone to a doctor, and looks at education costs realizes inflation is much higher than 4.8%.

@RUKing,

Actually, there are two rates above. One is for a CD offered through ING and the other is the Orange Savings Account. The point is, rates are hovering around 2.5 to 3.5% and these are the higher paying institutions. Just take a look at the Bank of America numbers. .35 percent?

April 8th, 2008 at 9:14 pm -

Idiot said:

Hey, Name, Idiot here.

I have money. Have education already. Need to put money somewhere.

Could buy house. Down 20% in my area.

Could buy stocks. Down, up, down. Having heart attack.

Could buy business. Half broke in first 5 years. Then… see stocks.

Could buy Gold. Pays nothing. Goes UP UP. happy. Then DOWN DOWN. not happy.

Mattress lumpy.Bank takes care of money, give back when I want. (So far)

At least I pay nothing for them to keep it for me and they send me a letter each month to tell me they still have it. Nice of them.April 16th, 2008 at 12:26 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!