Mortgage CSI: Investigating a Countrywide Pay Option ARM under the Financial Microscope.

- 0 Comments

Unless you’ve actually gone through the hardship of losing your home through foreclosure, it may be difficult to understand the intricacies of how one mortgage loan can upset your entire budget. We get anecdotal stories of people having their loans reset or losing their home but we rarely get a glimpse at the loans. For one, individuals would rather not discuss the loan and most of time which is completely understandable, people for the most part want to keep the situation private. So the public normally doesn’t get to see how toxic some of these mortgage products really are.

In addition, the other side of the coin from the lenders perspective is that the details want to be held off as long as possible as to not cause panic amongst investors. Well that is about to change. California Attorney General Edmund G. Brown Jr. amended their lawsuit against Countrywide Financial, the now taken over mortgage lender and some of the evidence presented is simply startling. What we are given is a keen insight into some of the financially irresponsible loans put out by the institution.

The problem with Pay Option ARMs is that they are deceitful to both the borrower and also the lender. They are misleading to borrowers because the artificially low starter payment doesn’t come close to reflecting the real payment should full interest and principal be included as in a conventional 30-year fixed mortgage. It is also misleading to a lender since they are allowed to book deferred interest as income and many of these lenders blindly made these loans in the heyday thinking they would be paid in full at sometime in the future. All of the assumptions rested with the one caveat that home prices would continue to go up. If this one assumption were to ever not hold up, the entire house of cards would come crumbling down.

Well as we all know, prices not only came down but came down hard. Many of the borrowers are still current at the artificially low rate while lenders now painfully sit back as they sit with ticking mortgage time bombs. Recent estimates put the outstanding amount of Pay Option ARMs at $500 billion with $300 billion residing in one of the heaviest hit states, California. So let us recap really quickly before we look at an actual Countrywide loan example:

1. $500 Billion in Pay Option ARMs Outstanding

2. $300 Billion here in California

3. Lenders still look profitable with those that are current and the note hasn’t recast

4. Borrowers are still “okay” until the recast date

5. California median home prices are down 35% on a year over year basis (no option of selling since many were zero down loans)

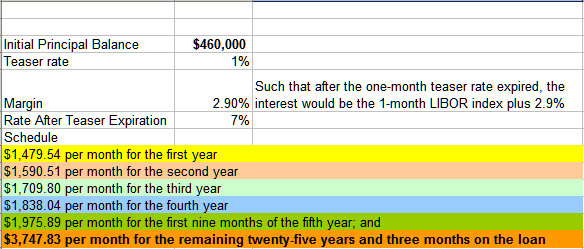

Now I wanted to pull one loan and summarize it to give you a quick view of how quickly things can go bad with these loans. Look at this Excel sheet I put together from one loan example in the lawsuit:

What you’ll notice here, that for the first year of the payment the borrower is only paying $1,479.54 per month which for a $460,000 mortgage, is not a bad deal. Yet the mortgage quickly starts increasing. For the second year, the mortgage has now gone up to $1,590.51, an increase of 7.5%. The third year payment jumps to $1,709.80. Forth year, $1,838.04. Part of the fifth year is $1,975.89 until it jumps to the stunning $3,747.83 for the remaining 25 years. The payment has more than doubled in this short time frame. All it would take is one recast and a person would be on the verge of losing their home.

That is why Pay Option ARMs are so horrific. Now that prices have crashed in California, people are left with no option. They can’t refinance unless they have equity. The only option would be for a loan modification but this would hurt the lender’s bottom line which many are not in a place to do especially if you are current. You can’t sell unless you come to the table with money. So your option is to walk away or pay over double your original monthly payment knowing that you may not break even for over a decade.

According to the lawsuit, as of December 31, 2006 almost 88% of the Pay Option ARMs in Countrywide’s mortgage portfolio have experienced some sort of negative amortization. This rate jumped to 91% as of December 31, 2007. You can only imagine where the rate stands given the rapidly deteriorating California market. With the negative amortization, even a more toxic situation has arisen. That is, the principal balance has increased at a time when housing prices have decreased. This is simply a recipe for disaster.

There are other absurd practices done by Countrywide in the lawsuit that everyone should read. If anything, it offers a rare glimpse at how financially destructive these loans are and why the current housing problems are not going away anytime soon. We are also given some examples at loans that should have never been approved:

“The CLUES report for the loan therefore raised doubts about the borrower’s ability to repay the loan. Nonetheless, Countrywide approved a 3/27 ARM with a 3-year prepayment penalty, to an 85-year old disabled veteran with a 509 FICO score, a 59.90 DTI and 69.30 CLTV. The loan closed in February 2005, and a Notice of Default issued in July 2005.”

You can download and read the full 46 page amended lawsuit PDF here.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!