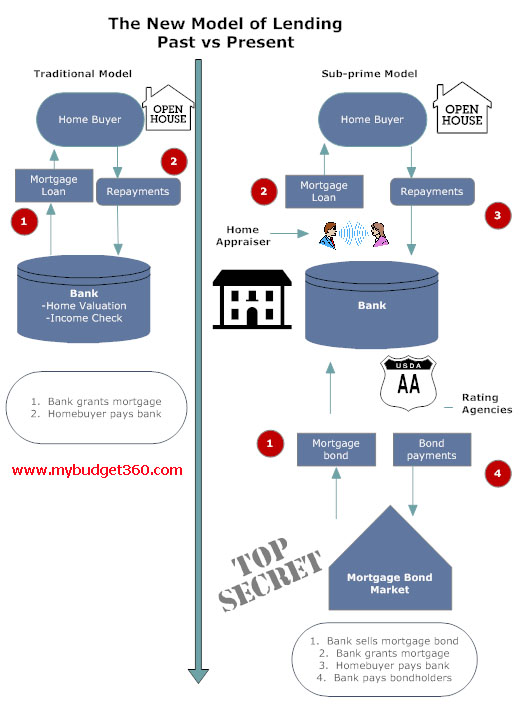

Mortgage Lending: Past vs Present Diagram. Where it went wrong.

- 1 Comment

Someone sent me an e-mail with a graph of the difference between past and current mortgage lending. I decided to spruce up the diagram to give you a better idea of how many additional layers have been added to the current mortgage lending process. What you’ll notice is the detachment from the actual real estate asset in the new model. In the old model, banks had a major incentive to make sure you did not default on your loan. In the current scheme of things, independent rating agencies and appraisers supposedly were the buffer to all this yet they of course had no actual money in the game. That is, they were paid by the banks and investment firms to meet their expectations or face being out of a job. Hence the new allegations that are now coming out where appraisers inflated real estate prices at the behest of banks and investment firms essentially had rating agencies over the fire in terms of rating whatever they brought to the table AAA.

1 Comments on this post

Trackbacks

-

Carolina Mortgage Makers said:

You have a number of options when buying real estate internationally – you can apply for an international mortgage from an offshore bank, you can approach a lender in the country in which you want to buy, you can re-mortgage existing property if you have accrued equity on your home and use the released capital to buy overseas, or you could even approach your local bank and see if they offer mortgages to buy abroad.

May 25th, 2008 at 11:29 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!