Meet the New Recession, same as the Old Recession – Financial sector devouring a disproportionate amount of revenues. Share of wealth to financial sector at record levels.

- 0 Comments

The middle class is being squeezed like a ripe tomato out of existence in the United States and the media is largely fixated on trivial nonsense, political theatre, and flashy car advertisements to keep people numb from the grim reality. The financial sector has become a large drag on the overall economy instead of serving as the lubricant of real business growth. A similar thing happened during the years prior to the Great Depression. A massive amount of wealth was pushed to a segment of society based on gambling and large bets. Making money on doing no actual work or really producing anything of real substance. These massive misallocations of resources cause bubbles and pop with gusto. The big difference this time, and this is even more troubling, is that nothing has been changed to fix the system that led us into this precarious dark hole of financial graft. Our politicians work for the large financial institutions and most of the public is starting to realize what is good for banks is not necessarily what is good for the middle class.

Meet the New Recession, same as the Old Recession

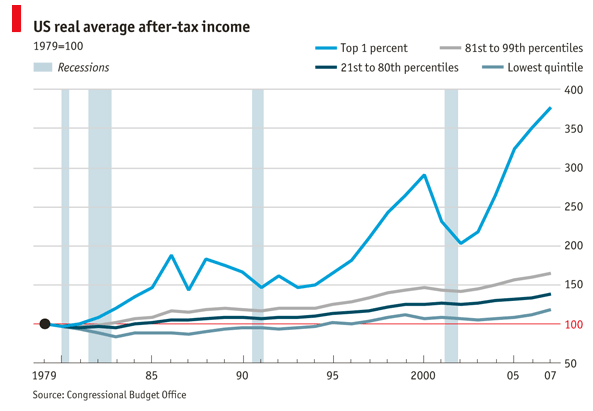

Income inequality is not necessarily a bad thing. Yet like most things in life, there are always extremes and unfortunately we have a system that doesn’t reward hard work but actually rewards those that are politically connected and have power to write the laws even if they economically fail. They thrive merely because of their plutocratic connections. Massive income inequality leads to distortions in the system:

Source:Â CNN

The last time this kind of income distortions occurred was during the years prior to the Great Depression. Yet this shows us how psychological ploys seem to make us feel that this time is different. It is not. Gambling is gambling and this system is setup like one giant freak show of financial speculation. Just think of John Paulson making a giant bet on horrible toxic mortgages and making billions of dollars on this bet. This person had keen insight into this market and what benefit did this add to the economy? It was a transfer of wealth to one man from taxpayers since we are bailing out these banks that failed and this is simply a sophisticated form of money laundering. It isn’t like he built a great company and is selling a product to Americans. He bet people were going to fail and made money on it and the funds are coming from taxpayers vis-à -vis the banking sector. The problem is when trillions of dollars are sloshing around the economy and this is the main source of profit for many investment banks.

Where the income flows

The mathematical computation of income shows a demonstrated aggregation of wealth to a smaller and smaller group:

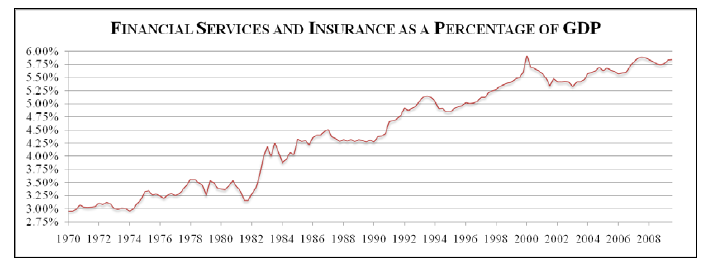

Even more disturbing is the amount of this money flowing to the financial sector:

Source:Â FCIC

More and more wealth is being rammed into a glorified casino. The middle class is being thrown to the financial wolves and the media seems content to ignore this entire process.

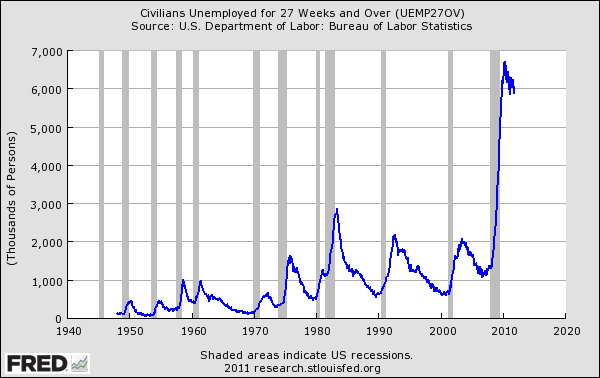

Unemployment claims drop, or are people falling off the data stream?

We hear that unemployment claims keep dropping but you also have to keep in mind that you have many people exhausting their unemployment benefits. The long-term unemployment rate is at historical highs:

The long-term unemployment problem is devastating to our economy and the numbers are somewhat distorted. You also have a large number entering into lower paying service sector fields. A decade of financial shenanigans and little has been done to remedy even the most egregious issues like:

-1. Split the too big to fail banks up

-2. Separate commercial from retail banking

-3. Surcharges on high frequency trading to encourage long-term investing instead of short-term bookmaking

-4. Take money out of politics in a significant way

At the moment we are meeting the New Recession, same as the Old Recession.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!