The death of the American pension: Shifting the retirement burden from employers to workers has created an enormous financial crisis.

- 10 Comment

The American pension offered once by many companies was a benefit once afforded to most workers. That is, until the press started chanting the Wall Street party line and all of a sudden 401ks and mutual funds were all the rage. Who wants a tiny pension when you can become a millionaire by simply saving a few dollars per month? Well this experiment started in the early 1980s and here we are, one full generation into the plan and most Americans are entering retirement on the verge of being broke. And this is with the stock market recovering from the lows of 2009. Yet somehow, many Americans never had enough left over to invest after the bills were paid. It is interesting how the pension has been painted as some evil sin while corporate CEOs have ridiculous pay packages that would make Marie Antoinette blush. That is the environment we currently live in. Worship the financial gods while everyone that is poor or struggling is somehow a pariah. Corporate welfare for the connected and painful austerity for the working class. The pension has undergone a slow and painful death at a time when millions of baby boomers are retiring.

The slow death of the American pension

Pensions were very common even in 1980:

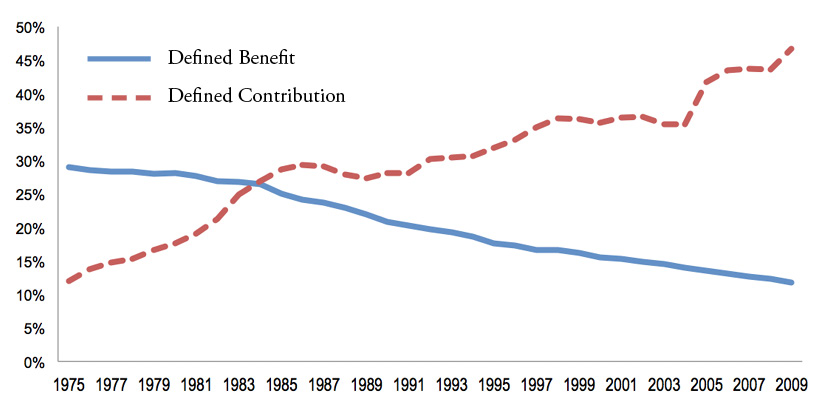

“(Third Way) The critical point is who bears these risks. Workers shoulder all the risks in a DC plan while these risks are shared in DB plans between workers and employers. This is a key point because since the 1970s DC plans have become the dominant retirement plan type. In 1980, more than 148,000 DB plans covered 30 million active workers (38% of the workforce), but by 2008 just over 48,000 DB plans covered 18.9 million American active workers (13% of the workforce). Over the same period, the number of DC plans increased from 340,850 to 669,156 with an increase in active workers covered from 14 million (14% of the workforce) in 1980 to more than 67 million (46% of the workforce) in 2008.15 Figure 2 below shows the percentage of the American workforce covered by DB and DC plans since 1975.â€

38 percent of the workforce had access to a pension in 1980 and now it is down to 13 percent as of 2008. But this has trended even lower over the last seven years as the crisis has given more pretext to companies to chop benefits. This trend has come in multiple forms. One way for employers to save money is on cutting pensions and shifting the retirement burden to employees. This was ushered under the guise of helping out workers. Well here we are 35 years later and the plan has been an abject failure. This has ushered in the new retirement model of working until you die.

Most retirees are now fully reliant on Social Security. This has become the default “pension†option. Keep in mind that the plan was to have three major sources of income for retirement: pensions, Social Security, and your own retirement savings. What ended up happening is that most Americans now fully rely on Social Security alone since pensions are becoming extinct and with a low wage employment revolution, many have a tough time saving for retirement.

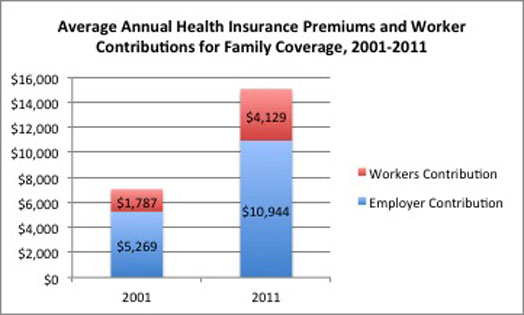

Another source where you can see this trend in healthcare costs:

Many employers have shifted the cost burden to employees. The burden to employers has also risen. In the end, it is the worker that is shouldering the rising costs of healthcare but also with saving for retirement. This brings up an odd calculus: wages are stagnant and living costs are rising yet somehow, workers are to save more for retirement. Yet they were already having a tough time when wages were rising let alone in a climate were wages are stagnant.

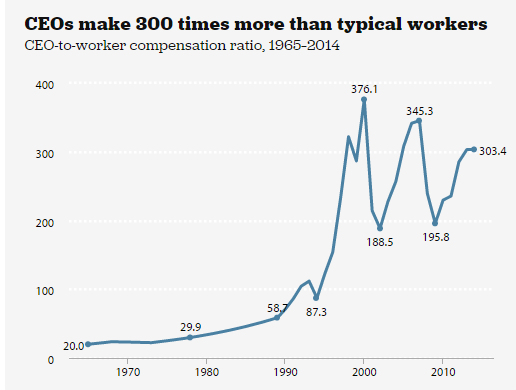

Unfortunately this is coming under the umbrella of a race to the bottom with wages. You always hear corporate CEOs talking about pressure from abroad with wages but look at their own pay:

Interesting that in 1980 CEOs earned about 29 times the pay of the regular worker, right at the time that the death of the pension started. Today, with all the talk of tight budgets CEOs are earning 300 times the amount of the typical worker. They don’t have to worry about pensions. Ironically even in this time, CEOs have access to incredibly robust pension plans on top of stellar pay:

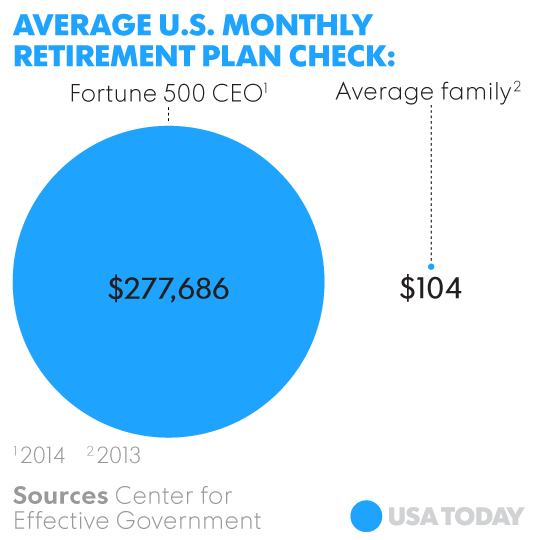

“(USA Today) The gap between CEO retirement benefits and the nest eggs of average U.S. workers is even wider than the imbalance between compensation for the highest- and lowest-paid employees, a report issed Wednesday shows.

The 100 largest U.S. CEO retirement packages are worth a combined $4.9 billion, equal to the entire retirement account savings of 41% of American families, according to the report by the Center for Effective Government and the Institute for Policy Studies watchdog groups.

The CEO nest eggs on average are worth more than $49.3 million, enough to produce a $277,686 monthly retirement check for life, the report said.â€

Yet the pension for the typical worker is a grievous sin against humanity. Just look at the data above. This is part of the corporatocracy system that has a deep captured over our financial infrastructure. It is no surprise that the pension system is dying a slow death and the press is cheering it on. Don’t you know that everyone is just a temporarily embarrassed millionaire?

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!10 Comments on this post

Trackbacks

-

YEP said:

IF THEY ATTACK PENSIONS YOU WILL SEE A REVOLUTION LIKE YOU HAVE NEVER SEEN BEFORE, THIS WILL NOT BE PRETTY, AND LIKE SOME PEOPLE SAY, IF YOU DON’T HAVE NOTHING, YOU GOT NOTHING TO LOSE AND IT WILL NOT MATTER IF THAT PERSON WHO LOST HIS PENSION, HE/SHE WILL TAKE THEIR ANGRY ON THE GOVERNMENT

WATCH OUT OR EVERYBODY WILL LOSE

December 27th, 2015 at 12:10 pm -

Shorebreak said:

Federal government worker pensions remain outstanding. For the time being, most state and municipal worker pensions are good except for funding issues down the road. Thus, former government workers will be comfortable while private sector retirees will be dependent more on Social Security and poorer than ever.

December 29th, 2015 at 7:23 am -

stan said:

“If they attack pensions you will see a revolution…” What do you call inflation? We are being robbed of our pensions and savings every month as we live in a country that borrows and prints to make up their out of control spending deficits. Greenspan said it best when he told congress the US will never default on its SS payments as they can just print the money, the real question being if that money will be worth anything.

December 29th, 2015 at 8:31 am -

Kylo said:

Individuals are already loosing pensions from corporate America this is nothing new. The illusions that Americans have about guaranteed pensions are coming to fruition.

December 29th, 2015 at 7:37 pm -

Dave said:

Pensions will be lost (actually, stolen) and the backlash will be severe.

They know it and this is why they’re creating mass shooting hoaxes like Sandy Hoax in order to get the most dangerous weapons we have away from us; our mil pattern rifles.

They must get this accomplished prior to their fragile house of cards comes crashing down.

Have a great day!December 30th, 2015 at 10:10 am -

Idahoser said:

it never was possible for all those boomers to retire as they’d been promised. SOMETHING was going to happen, either the system would collapse under the weight, or somebody would figure out a way to steal it, but there was no way they were going to get to retire in comfort with so few people supporting them.

December 30th, 2015 at 1:01 pm -

sth_txs said:

I big part of the problem is the corrupt monetary system. The US declared bankruptcy in 1971 when Nixon ended what was left of a commodity money system. It has been downhill ever since whether you are blue collar or white collar or just some guy trying to make a living.

The taxation is also a killer. No real incentive to work when local, state, and federal taxation consumes a solid 1/3 before and after your check in addition to the taxes and regulations you can’t see.

December 31st, 2015 at 8:33 am -

Not a Pensioner said:

No pension, just savings, 401k + Social Security-I see the problem that Americans just aren’t big savers and are very much consumers. Going into my 4th year of full retirement, doing well, + yes, it can be done with frugality + awareness of where your money is going.

January 22nd, 2018 at 7:31 pm -

Not a Pensioner II said:

Very much agree with above commenter-my husband + I are both retired, have SS, 401Ks + savings. Americans are huge consumers + known for keeping up with the Joneses. Have fun with your stuff + worries whether your pension will be cut. I’ll be watching my backyard birds, just to see if they can still fly.

January 20th, 2019 at 4:42 pm -

namen8 said:

“In 1980, …DB plans covered 30 million active workers (38% of the workforce), but by 2008 … DB plans covered 18.9 million American active workers (13% of the workforce). Over the same period, the number of [workers covered by] DC plans increased from 14 million (14% of the workforce) in 1980 to more than 67 million (46% of the workforce) in 2008.”

If the 14M covered by DC plans in 1980 was 14% of the workforce, then the 30M covered by DB plans in 1980 was 30%, not 38%. The graph agrees with my math.

February 5th, 2019 at 8:36 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market! Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market! Â