The near extinct pension – US pensions aggressively invest in equities relative to other countries to make up for shortfalls.

- 6 Comment

The pension is nearly extinct. Overly optimistic returns left many pension plans practically insolvent and not ready to adapt to a low yield environment. The benefit of pensions however is that it forced people to save over time for retirement. What we have learned via the 401k is that when left to their own devices, people simply are not good at planning for the future especially when it comes to retirement. So now, a full generation into this experiment we are left with many older Americans fully relying on Social Security as their main source of income. That was never the intended use of that program. When we look at US pension plans we realize that they are aggressively betting on equities to make up for the larger returns needed to payout retirees. It might seem that the stock market only goes up over the last few years but as we all know, tides do shift.

The US pension plan

Relative to other countries US pensions aggressively invest in equities. The purpose of this is to chase higher yields since many plans are based on unrealistic 7, 8, or even 9 percent annual returns. This is what is expected to meet beneficiary payout expectations. That is simply unrealistic in this low yield environment.

Pensions in the US are heavily invested into equities:

While other countries are more cautious in investing retiree money, the US has the largest portion of funds in equities. Over the last seven years this has been fine but what happens when things inevitably correct? The 401k has been largely a disaster for the average working American. Of course you have many that did well but the point of a program say like Social Security is that a basic amount is there when you retire. Right now, many people are left with nothing and some are doing okay. That is why half of retirees are going to rely on Social Security as their primary source of income.

We can debate the above merits of pensions but the reality is the pension, or the defined benefit plan is going extinct. Only a small portion of the population now gets access to a pension whereas one generation ago this was the most popular option.

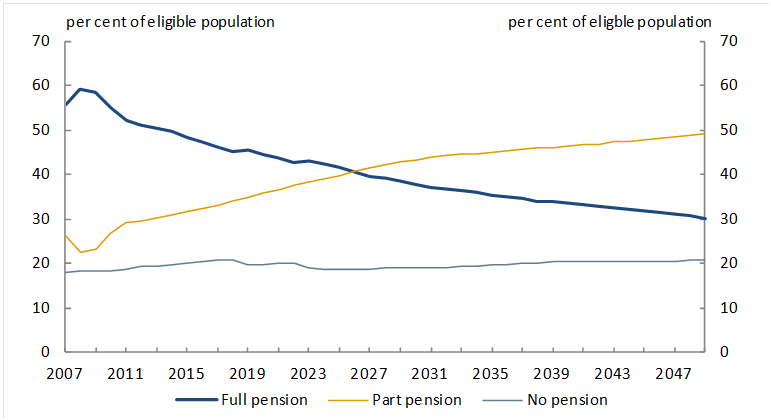

Also, most of those on pensions are going to have to adjust expectations because payouts are unlikely to be full based on overly optimistic projection:

We already see those receiving full pensions falling and those on partial pensions jumping. In reality the market returns needed to generate full payouts is going to be difficult to achieve. People have already forgotten the 2007 to 2009 period and how quickly that can shift expectations.

Memories are short when it comes to recessions. Part of it has to do with the way we are wired. We are wired to look forward simply by our biology. So this is good when it comes to going for a hunt and missing out on that deer. You need to be optimistic you will get it next time. But when it comes to learning about financial history, this can hurt us. Just look at casinos. Most think they are going to be the lucky “one†that is going to be a big winner even though they lost in their last trip. They don’t build casinos on losses.

So existing US pension plans are heavily invested in stocks. I’m sure we are now in a new normal world and we are done with recessions forever.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!6 Comments on this post

Trackbacks

-

DavidC said:

The reason 401k plans have not been successful is because of the deteriorating interest rate environment and it just proves how the whole pension/retirement scheme has been screwed up. An individual plan will have only the money you set aside for yourself, and that money has to provide for almost as much time in retirement as your working career. Nobody can earn 7 percent on an ongoing basis, despite the lies told constantly by pension administrators. If somebody were to actually save a million dollars in an individual plan, and the prevailing interest rate was 7 percent, the plan would throw off $70k per year. Even Calpers in California, the biggest pension system in the country, earned 2.5 percent last year. That means that a million dollars in assets will throw off only $25k, one-third of the promised value. Most people with 401k plans only have access to crappy mutual funds that may throw off only one to two percent a year.

The reason most pension plans can pay out the promised sums is because they can quietly pull forward the contributions of the younger participants to pay the retirees. They aren’t actually successful, they are building a ponzi scheme that will spectacularly fail at some point.

The combination of poor interest rates and longer retirements means that traditional savings plans, whether 401k, pension, or ira, will not provide the carefree retirement that they have promised.

December 26th, 2016 at 3:05 pm -

Patrick Trussell said:

How are the criminals who are managing these pension plans doing ? I am sure that they are getting theirs!

December 27th, 2016 at 5:52 am -

Patrick Trussell said:

How are the Wall Street criminals who are encouraging and managing these pensions doing ? As unusual ,they are getting theirs ,and making out like bandits .

December 27th, 2016 at 5:54 am -

JohnF said:

The Article Left Out The Main Reason For This Catastrophe – Our Corrupt Politicians Are In Bed With The Too Big Too Jail Corporations, CEO’s, Wall Street & The Banksters Who Cheated Everyone in Their Rigged High Speed Computer Controlled Stock Markets.

Their Big Banks Have Been Fined Hundred of Millions to Billions of Dollars in Fines For Fraud, Corruption & Manipulation of the Markets.

December 27th, 2016 at 6:32 am -

Don Levit said:

David

I saw an interesting statistic which showed the amount of equities in pension plans versus fixed income investments

It was around 60 percent equity for the fixed interest was a sure loser

I was under the impression there were laws restricting the amount of stocks in defined benefit pension plans due to their higher riskDecember 27th, 2016 at 3:10 pm -

Roddy6667 said:

People think they can get a higher return by just changing to another investment. The AVERAGE return may be higher, but that is discounting the people who have huge losses in the same investment. When you are retired or trying to preserve assets, this is a foolish move.

December 28th, 2016 at 8:26 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market! Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market! Â