Zero effective policy and stalling QE3 – Why QE3 will have little financial impact if implemented. Deposits at US commercial banks quickly approaches $9 trillion.

- 1 Comment

The markets eagerly await the words of central bankers over the next few days. The markets are on the fence waiting to see if Ben Bernanke gives the green light for QE3. What many fail to realize is the Fed already has other mechanisms to force banks to lend in the current marketplace. First, there is no need to pay interest excess reserves. Even the European Central Bank has dropped interest paid on excess reserves down to zero. So the Fed already has some alternatives to what QE3 would provide. It is also the case that deposits at US commercial banks are already nearing $9 trillion. Banks have the means and ability to lend if they only had the desire to do so. In spite of the US public bailing out the entire banking edifice, they have little faith in the American public.

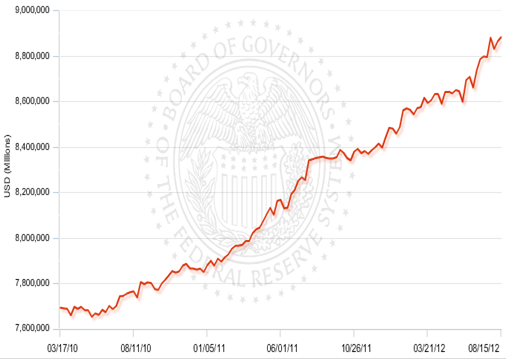

Deposits at US commercial banks

Anytime the market has sneezed, the Fed has been right there to step right in with a handkerchief. This has been very positive to the stock market but has done very little for the bottom line of most Americans. While the stock market has recovered most of its losses, the typical American family has seen their net worth evaporate by 40 percent.

Those that think QE3 is baked in the cake may fail to realize that the banking system already has the means to lend. Simply adding more risk into the already debt laced system is not exactly a smart move. Take a look at deposits at US institutions:

Deposits at US commercial banks (source: Fed Reserve)

The above already demonstrates that banks have a deep enough base of funds to make loans against. This is the nature of fractional reserve banking. Yet banks are more concerned with shoring up tattered balance sheets and investing in other lucrative ventures instead of lending to Americans. Even with the housing market, most loans are being backed by the government so the banks do not even have faith in the American Dream cornerstone of housing. Yet what were all those bailouts for then?

Fed comes in whenever market sneezes

The Fed seems to pop in every time the market hits a snag in the road:

Source:Â Dshort.com

The market is now addicted to this easy monetary policy. Much of this policy has not helped the typical American. Sure, it has allowed the financial sector to continue on their methodical rent seeking path of taking productive dollars out of the economic system. Yet Americans are in a worse position even in this supposed recovery. Wages continue to drop. 46 million Americans are still on food stamps. Fuel, education, and healthcare all are facing spiraling costs.

So in the next week you will have central bankers in the US and Europe speaking with vague sentences that only can be deciphered by their banking colleagues. Just realize if QE3 takes place it will have very little impact on the financial well being of your middle class family.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!1 Comments on this post

Trackbacks

-

Horse237 said:

I saw a paper from the IMF admitting that the cause of our problems is a fractional reserve system. Their paper was called The Chicago Plan Revisited.

I have been reading your blog for 2 1/2 years or so. You can read my essay on the IMF here with references to their paper and a video from another commentator.

IMF Economists: ‘We Were Wrong.’ Will Someone Please Tell The Press And The Politicians.

Thanks for your work. I also follow Professor Steve Keen on Debt Cancellation though my ideas are better at funding it without inflation.

August 30th, 2012 at 8:42 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!