What does it mean to be retired in the United States? The age of disappearing pensions, dependence on Social Security, and stock market speculation.

- 3 Comment

A few days ago the stock market experienced a mini panic as someone hacked a reputable news source Twitter account and posted a sensational headline. The markets quickly reacted to this news. What was troubling is many algorithm-based trading systems are setup to scour internet information for these kinds of dramatic changes. Many of the quick trades hit with machines simply acting on their own programming within seconds. Of course the stock market came back up after the hack was mentioned but how in the world are regular Americans suppose to compete with this kind of stock market trading? First, most Americans have no investment in stocks. One in three Americans has no savings to speak of. In the early 1980s the idea was that Americans would move away from pensions and save into accounts like 401ks and little by little plug along so when retirement came, they would have a nice nest egg. 30 years later, this isn’t remotely the case. The plan has failed. For many, retirement is largely just a giant illusion. Many will be working well into their very last years. Pensions are becoming a massive anomaly. So what does it mean to be retired in the United States?

Disappearing pensions

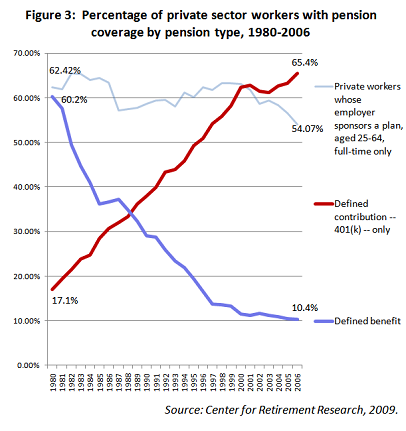

The number of Americans with any sort of pension is largely going away. In 1980, over 60 percent of Americans employed in the private sector had some form of a pension. Today it is down to 10 percent and is trending even lower. Most now have the option of a 401k. Yet as we have discussed, after 30 years the results have been rather poor. For one part, many Americans with an average per capita wage of $26,000 have a hard time saving after the cost of living is factored in. Items like housing, healthcare, and college have eaten a large part of most wages.

The idea was, that Americans would stash away money for 30 years or more into a 401k and when retirement came, a nice nest egg would be there. Well for one, the stock market has become a larger speculation based machine where short-term profits are favored over longer term stability. The idea that a regular investor can compete with algo-based system developed by MIT physicists is simply naïve. This is assuming Americans have a sizable amount of money to stash away to begin with. So the reality that incomes are back to levels last seen in 1995 for US households reflects a declining standard of living. Yet the US is as wealthy as it has ever been. What is occurring is most of the productivity gains and real wealth gains are going to a very small percentage of the population.

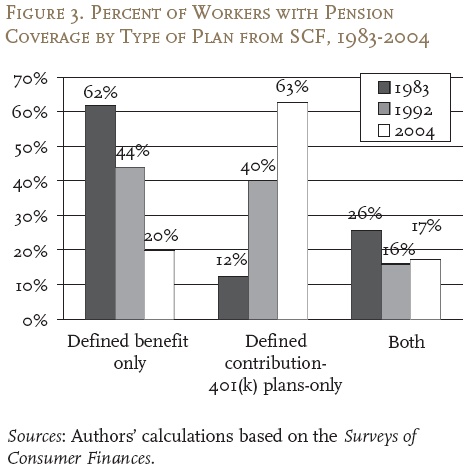

What is interesting is how quickly the pension is going away. The above chart is the most updated data but look at how big things have changed from only 2004:

Back in 2004, about 20 percent of workers still had access to a pension. It has been cut in half to 10 percent over the last decade. The trend is unmistakable here.

It is clear that the vast majority simply did not utilize the 401k for a variety of reasons. Even those that did, the amount in your typical 401k is minimal. One interesting study from Fidelity showed that of those that even utilize their 401ks, the typical amount put aside was $2,700 a year. This is much too low and keep in mind these are people that first, use Fidelity and second, actually utilize their retirement account which most Americans do not.

The idea that the baby boomers are retiring in mass is a lie

We keep hearing that baby boomers are retiring in mass, something like 10,000 per day and that they are somehow enjoying the large sums of cash they have saved. As we have just noted, there is no treasure of El Dorado keeping older Americans afloat. Many rely on Social Security as their primary source of income. With a less affluent young workforce and a more dependent older generation, this is going to be a challenging recipe moving forward.

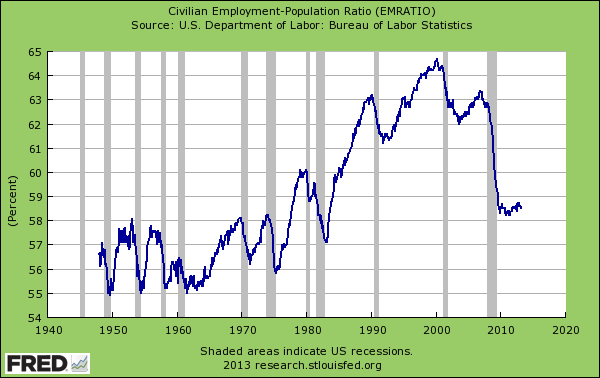

I’ve seen this argument utilized to explain the drop in the civilian employment population ratio:

The argument surrounds itself on the idea that the big drop is coming from many walking into the retirement sunset. Yet if we look at the actual labor force participation rate of this specific group, we realize that older Americans are working in full force:

So this counters the argument that the big drop is coming from this group dropping out of the workforce. After all, Social Security isn’t exactly a large sum of money either so some have to supplement their income. The big drop has come from:

-1. Many entering college (at a time of incredibly high debt).

-2. A large jump in disability recipients.

-3. A big structural change where many have given up on working.

-4. A larger permanent temporary workforce.

In other words, retirement in the idealized world of lying on the beach with margaritas and enjoying your endless cash flow from monthly withdrawals is simply not there for the vast majority. In the United States, retirement is largely a tight time for most Americans when healthcare costs rise simply because of older age. The best outcome would be is if the economy adds a solid amount of good paying jobs for young Americans and the tax base is solid to continue to fund programs like Medicare and Social Security. Yet demographics do not favor this. What is worse, the saving rate of current young Americans is abysmal showing that we are stacking challenges upon challenges. Retirement in the US is likely to include work for many.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!3 Comments on this post

Trackbacks

-

stephen verchinski said:

Interestingly is the role here of actuarial companies and their staff collusion with academia to further their business model. Having been hired by Fortune 100 companies to save them money they did exactly that, promoting DC over DB plans (except for the corporate execs?). Now the model is to complete the transition and make money by taking the more intensively managed DC plans under their wings.

The ideal would be to put (union) worker representation on Boards of Directors like they do in Germany to leverage knowledge on these anti worker movements into pushback. Especially when the only function of these changes is to put the worker out there as an individual investor surrounded by wolves.

May 12th, 2013 at 2:16 pm -

Roger said:

What you are overlooking are government workers. About 30% of the workforce are government workers (teachers, cops, the military,etc.)

They enjoy extremely generous benefits, often 100% of their retiring salary, free or heavily subsidized health care, cost of living adjustments, etc.

There are several retired firement, teachers, and govt. lawyers in

my neighborhood. Most of them take multiple cruises per year,

and are “never home”.May 12th, 2013 at 4:09 pm -

Roddy6667 said:

It is not necessary to invest in the stock market to save for retirement. Many of my friends lost half of their savings when the market tanked. I plugged along just saving every week. I don’t believe all the bullshit “investment experts” say. They quote rates of return from “investing for the long term”. These are cherry-picked and never coincide with anybody’s savings and retirement timelines.

I am now retired with no mortgage or debt of any kind. I also moved to a cheaper area to make my money go further.

To sum it up:

No debt-ever.

Save, don’t speculate in the markets. Most people lose.

Make your money where the pay is good and retire where it goes the farthest.May 13th, 2013 at 9:32 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!