The Futile Act of Saving in America Today – No Money Down Car Purchases, Low Down Payment for a big Mortgage, and High Interest Credit Cards for Everyday Spending.

- 1 Comment

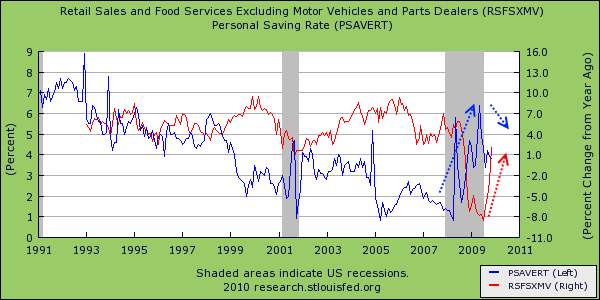

This recession did change spending, at least for a few months. When the recession hit Americans had a negative savings rate, the first time ever we had the ability to spend more than we actually brought in. As the recession progressed, Americans did start saving and we took the personal savings rate to 6% (this may sound low but it is much better than 0) and with this we were back to the early 1990s savings rate. Yet that hasn’t lasted. The savings rate is now below 4 percent and retail spending is now up strongly. Given the balance sheet for most middle class Americans this is not a good sign but shows the “spend until you go broke mentality†is alive and going strong. But part of this is largely engineered by the Federal Reserve and U.S. Treasury.

Let us look at the personal savings rate and retail spending for the last 20 years:

The savings rate has been trending to the negative side for many years so that trend is unmistakable. Retail spending has always been growing yet as you will notice on the chart above, the only major dip came from this current recession. Why? Because other recessions did not impact credit (debt) to the level of this recession. This recession cut at the core of the banking debt machine that was fueling our economy for decades. Americans were spending each and every dollar that was coming in. Yet at the same time, the Federal Reserve was harming those who were looking for safe saving avenues like CDs or even government bonds:

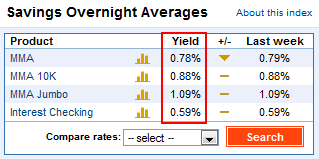

Source: Bankrate

Now keep in mind that even in 2000, these money market rates were up to 5 or 6 percent depending on what bank you kept your money in. The Federal Reserve has made it so unattractive to save, that many Americans changed their habit of saving even in the middle of the Great Recession. In a way, it is merely the public doing what the Fed wants them to do. The Fed would like everyone to spend every penny that comes in each payday even though this is counter to becoming financially secure. In the past, using debt for leverage was a cautious enterprise but today every important financial decision does not require any savings. Let us go through some major life purchases to show you this.

Buying a Car

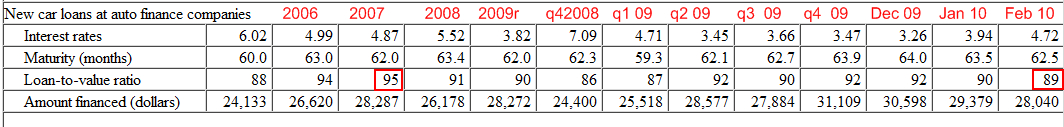

The term for buying a car with nothing down is “100% financing.â€Â This was extremely common during the credit bubble but seems to be back in focus today. The Fed puts out monthly data on this:

At the height of the mania in 2007, Americans were able to finance a car up to 95 loan-to-value on average. Keep in mind many dealers were offering zero down and the average amount financed was $28,287 over five years. Today, after the massive credit crisis Americans can leverage up to 90 percent of the car purchase price and take on a $28,040 loan at 4.7 percent. And many dealers will allow you to use a variety of sources for that 10 percent down (i.e., getting a $2,800 cash advance on your credit card). They won’t say this but many do it like this. In other words, zero down is still very much a possible deal.

Buying a car is the second biggest purchase Americans will make and as you can see, if you wanted to buy a car today, even up to $28,000 and you are middle class with no savings this is something that is very doable. In fact, the way the Fed is artificially keeping rates low it would seem that this is something they want you to do.

Buying a Home with Little Down

Many Americans now think that the housing market has somehow stabilized because loan requirements have become much tougher. That is true to a certain degree but low money down mortgages are equally as dangerous. Sure a 3.5% down FHA insured loan won’t blow up in your face like a nothing down option ARM that recasts with a vengeance and sends your payment from $1,500 to $3,500, but having a big down payment isn’t necessary.

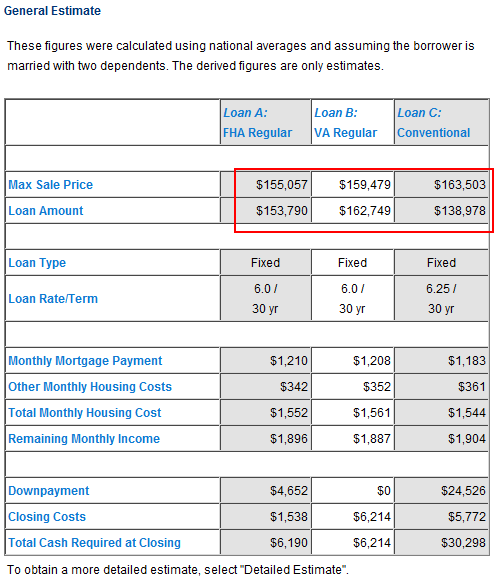

Nearly four out of ten homes bought in the U.S. last month were insured through the FHA. The FHA doesn’t fund the actual loan but insures the funds. Which as we have learned with credit default swaps and AIG, insurance isn’t always the most secure line of business. The median home price in the U.S. today is $170,000. How much would you need saved up to buy a home at this price?

The FHA provides a link to Ginnie Mae with a calculator to see how much home you can afford. We’ll assume you make the median annual household income of roughly $50,000, have a $300 car payment and nothing else (which of course is not the case):

For the FHA insured loan, all you would need is $6,190 for a down payment and closing costs. As we know today, many sellers are anxious and some will even cover that closing cost portion. Add in the $8,000 tax credit that is soon to expire, and you basically bought a home for nothing down. This is why the housing market has supposedly stabilized over the last year. We’ve brought back similar lending that brought on the housing bubble in the first place. Sure, we are checking your income but is that really performing due diligence? I’ve heard lenders say, “well now, we actually check income†as if this was somehow the new vault at the bank. And what a shock that FHA insured loans are now defaulting in record amounts:

“(WSJ) Defaults on home mortgages insured by the Federal Housing Administration in February increased from a year earlier.

A spokesman for the FHA said 7.5% of FHA loans were “seriously delinquent” at the end of February, up from 6.2% a year earlier. Seriously delinquent includes loans that are 90 days or more overdue, in the foreclosure process or in bankruptcy.â€

When you have no skin in the game, there is little reason to stay. This is a clear lesson we have learned with this bubble. If you had to save say one, two, or even three years to buy your home with a 20 percent down payment as it was in the past, you did everything possible not to lose your home. You also came in with a 20 percent cushion if you ever needed to sell. In that time, you also demonstrated to the lender that you had the ability to live within your means to pay your mortgage. Today, with Wall Street turning our economy into a casino and taxpayers bailing everything out, what do they care if you default? The taxpayer (aka you) will end up paying for it. We are simply setting ourselves up for round two since no real reform has occurred.

Credit Card Debt

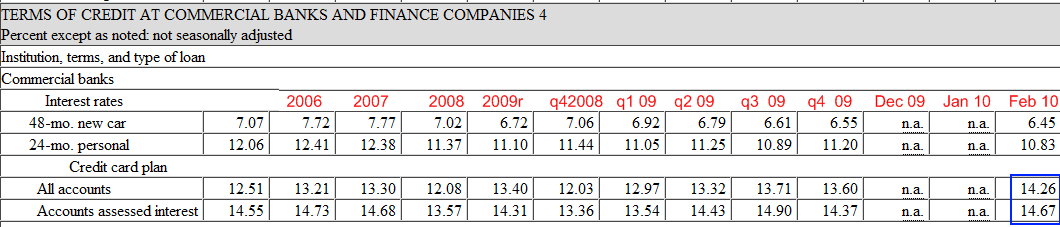

Banks have tightened up on credit cards. Even as the Fed has given banks the access to cheap money, banks are now gouging customers with high rates just because they can do it:

Even today with the Fed lending money out to banks at zero percent, the average credit card annual rate is over 14 percent. How is this helping consumers? Wasn’t this the supposed reason why banks needed trillions of dollars in easy capital? So this is what is happening; in housing since 99 percent of the market is there because of government backing up mortgages, lenders are willing to lend whatever they can at whatever terms they can get since it isn’t there money. But with credit cards, since this will impact their bottom line more directly they are now turning the screws tighter because Americans with a 16.9 percent underemployment rate are having a harder time making their payment. So it is easier to purchase a $170,000 home than it is to charge up your credit card for a $1,000 flat screen.

Credit card debt has contracted in this recession from $970 billion to approximately $850 billion. This would be good if it happened without trillions in government funds. This would have happened anyway.

So what incentive do Americans have to save? Access to debt is still very much largely there. The only thing is we are now a poorer country. Yet Wall Street somehow is back to being wealthy again. This is the same Wall Street that back in March of 2009 was one inch away from being dismantled. And you know what? It should have been broken up at that time. What people think as “Wall Street†is the big banking system (they can make the distinction between big banks that produce nothing and companies that actually provide an actual good or service). That was the moment to break up the banks and funnel money into Main Street. Now, after a year and a roaring stock market, banks are greasing up their lobbyist to keep any real reform from happening. These people don’t care about you. They operate under the model of fear. They wanted to scare the public into believing that the financial system would have collapsed without the bailouts. And people voted and had more courage and Congress pushed it down. Yet that didn’t last and Congress against the will of the people did the biggest wealth transfer in the history of our country in 2008. That has continued to this day.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!1 Comments on this post

Trackbacks

-

Don Levit said:

This mortgage mess seems a lot like the new health insurance legislation.

No doc policies, no need to prove health.

Don’t have enough money to pay the premiums?

Don’t worry, we’ll subsidize you.

Don’t have any savings for a higher deductible?

No problem, your deductible will be very low.

In fact, for a lot of preventive measures, you will have no deductible.

No worry about annual limits or lifetime limits.

And, all of this coverage for a family that will cost about what your mortgage payment is.

Don LevitApril 24th, 2010 at 3:29 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!