Standard American Retirement plan equates to flying by the seat of your pants: The majority of older Americans rely on Social Security as primary source of retirement income.

- 2 Comment

Social Security keeps half of elderly Americans out of poverty. You need to recall that many older Americans came of age during the 401k cult worship of Wall Street. Greed is good as portrayed in the movie Wall Street. Stories developed as a sign of caution actually drove many to aspire to become financial mavens that sought to make as much as possible even if it meant setting a torch to the underlying economy. Many made billions of dollars during the housing crisis betting on the failure of regular American families. As many baby boomers now find themselves looking over the retirement cliff, many realize that the annihilation of pensions in place of 401ks was not exactly the lost city of El Dorado. Most retired Americans rely on Social Security as their main source of income. This was never the intention of the system. Social Security was supposed to be one leg of a three part stool. You had pensions, 401ks or other retirement plans, and finally Social Security. Since most Americans have no savings and pensions are largely going extinct, many are now forced to rely on Social Security as their primary source of income. The only issue is that we now have a demographic tsunami of people entering old age and many are going to fly by the seat of their pants into retirement.

The aging of America

In the 1980s, only about 10 percent of the population was 65 and older. By 2030 it will be 20 percent. And the growth curve is going to accelerate dramatically from here on out. Since it is hard to go back in time and save, the path is set for many Americans.

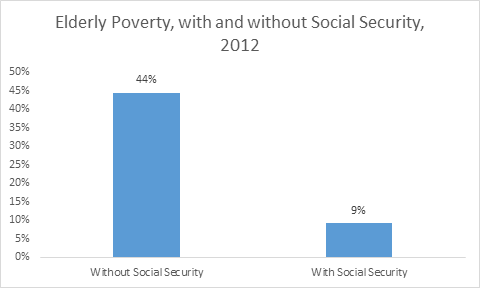

For most Americans Social Security will be the only thing keeping them from being in the streets living a life of financial tragedy. The trend is clear:

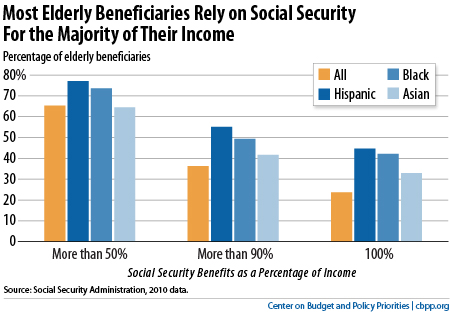

It should be apparent that more strain is going to be put on the Social Security system. The majority of older Americans rely on Social Security as their primary source of income:

Over 60 percent of Americans derive most of their monthly income from Social Security. That is enormous. This is something that is not going to go away but will place additional burdens on those working. Those working are the young and they are in a world full of deep college debt and lower wages. You also have many older Americans working into old age because they simply need additional income.

Since you need workers actively paying into the system the math is becoming problematic. In the past you had more workers for each retiree. The number of workers per retiree is shrinking like a raisin in the sun:

And money is taken out as a percentage of income. So if you earn lower wages as many younger Americans do, you are having fewer dollars being put into the system. Also, Social Security has an income ceiling so unlike other taxes, there is a cap here. Bottom line is that there is no free lunch and we are going to face the repercussions of this.

And don’t think Social Security is going to go away. It is absolutely necessary for the majority of older Americans. Many elderly Americans would be in poverty without it:

So what is likely to happen? It is likely that some change in the taxing structure will occur. Older Americans are a powerful voting bloc and will do everything to keep this secure. Younger workers are struggling to get by. If you are young you can begin to plan and start saving today. Invest in yourself and be careful how much debt you take on to pursue a college degree. For older Americans it is important to manage your budget wisely and stretch those dollars out. Ultimately though the math is daunting and radical changes will happen. Flying by the seat of your pants is not a great retirement strategy but unfortunately many Americans have gone down this path for living into old age.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!2 Comments on this post

Trackbacks

-

Ame said:

In our family, those who retired sold their home and moved to a state with a much lower cost-of-living. We who are working quit our jobs in our home state and moved with them.

The dream of retiring in a warm state and golfing is for the elite, not the average Joe.January 3rd, 2015 at 9:11 am -

DavidC said:

My wife and I are 62 and we live in upstate New York where the cost of living is a fraction of what it is in NYC or Boston. We bought a fixer-upper six years ago, renovated it ourselves, and now we live here full time. The total cost for our house and 1.3 acres, including the upgrades, was only about $130k, and we financed it through the sale of our coop in NYC. We have no debts, and we have money in the bank. Our expenses are so low that we can live our preferred lifestyle, with no sacrifices, on what we receive from early payouts from Social Security. Our nest-egg goes much further, and we don’t have to pay any income taxes on our monthly checks. Neither of us were ever employed by companies with pensions. And we saved outside the IRA/401k madness. By stepping down each time we sold real estate, we now have a comfortable retirement with no debts and low expenses.

December 18th, 2015 at 4:57 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!Â