The froth before another stock market crisis: Stock market is overvalued by 27 percent based on historical price to earnings ratio.

- 3 Comment

The stock market has once again become an overvalued casino where only the large financial players can use massive leverage to enjoy short-term rewards. Even looking at historical price-to-earnings (PE) ratios we find that stocks are dramatically overpriced. Yet the stock market is a sham for most Americans. In fact 53 percent of Americans don’t even own any stock outright. What is troubling is that for the first time in a generation, we are seeing real declines in household income occurring at the same time that the stock market is reaching all time highs. This is the first time in 30 years that this kind of pattern has occurred. This is playing out because the Fed has injected all sorts of liquidity into the banking sector expecting the financial segment of our society to responsibly guide the investment markets. Of course, all that has happened is a large amount of froth is now spilling over and signs of a bubble are all over the place.

Price-to-earnings ratios getting frothy

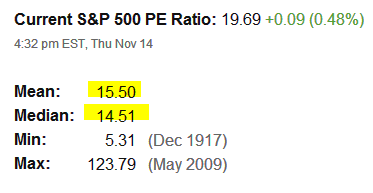

First, earnings are not justifying current prices:

Looking at well over 100 years of stock market history, we find that the current PE ratio of the S&P 500 is overvalued by 27 percent. A 20 percent correction to most economist amounts to a bear market.Â

Yet the stock market continues to move up oblivious to historical earnings. People are back to paying absurd amounts of money for companies with no long-term revenue stream. For every eBay you have 20 Pets.com.

This casino like behavior is being brought on by a Federal Reserve focused on boosting the banking sector. To the Fed, any hiccup in the economy merits an ease in banking policy. When you’re a hammer everything looks like a nail. So it is no surprise that this policy has been a financial godsend for banks but a major problem for the real economy that is still suffering. Most jobs that were added since the recession ended have gone to low wage jobs.

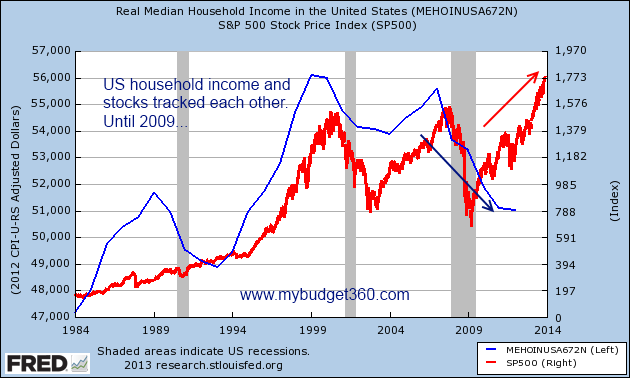

For the first time in a generation, we see that household income while moving down is also happening at a time when the stock market is actually making new peaks.

Less money for you but bigger gains for stocks

A trend that is rarely examined is the divergence between household income and stock values:

Going back 30 years stocks and real household income changes went hand and hand as you would expect. A healthier stock market reflected more dollars in the pockets of Americans. This is no longer the case when the Fed can digitally print money and stuff it into the pockets of their banking allies. The results are a fully disconnected economy. This is also how we can have a peak usage of means tested programs while stocks continue to make new highs.

Is this good? Of course not. Hot money in the form of debt is being deployed at crazy speeds into stocks and real estate and crowding out regular households. The definition of what is happening right now is financial mania. Stocks are no longer tracking underlying fundamentals and neither are prices in real estate. Manias can last longer than we expect.

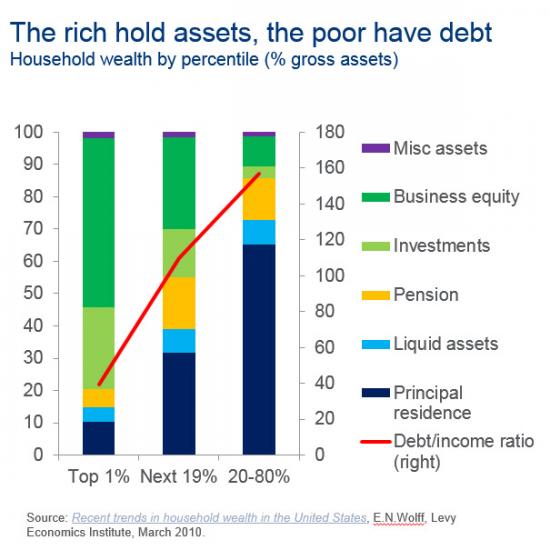

The formula is very simple:Â the rich own assets the poor own debt:

More to the point, in the last few years even the poor have exhausted their access to debt and are now going into programs like food stamps that now exceed 47 million Americans. We also have an incredibly large number of Americans unable to find permanent work. Income inequality is at levels last seen during the Gilded Age.

The froth in the stock market is telling. Earnings don’t look good? Stocks go up. Unemployment U6 figures higher? Stocks up. Food stamps at a peak? Stocks up. It doesn’t seem to matter what news comes out and stocks still move up.   This disconnect is happening because the Fed is fully manipulating the debt and real estate markets and allowing banks to go deep into speculation mode. I’m sure this is going to end well again.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!3 Comments on this post

Trackbacks

-

Ametrine said:

Quoting: “What is troubling is that for the first time in a generation, we are seeing real declines in household income occurring at the same time that the stock market is reaching all time highs. This is the first time in 30 years that this kind of pattern has occurred. This is playing out because the Fed has injected all sorts of liquidity into the banking sector expecting the financial segment of our society to responsibly guide the investment markets.”

I know for a fact that a lot of publicly traded companies boosted their stock prices by laying off workers and making those still employed do the work of their former co-worker for no more increase in pay. Denying pay raises and slashing existing pay for those “lucky” enough to have kept their positions is another favorite way to show shareholders an ongoing “profit” year over year. Those shareholders don’t care that in order to get that blood from the turnip the company cut good workers.

November 14th, 2013 at 5:34 pm -

ginny said:

the company wasn’t created for the workers.

the “good workers” can sell their skills to another company that needs them.

the smart workers know that if they act like they own their own company – they sell their skills/services or knowledge to the highest bidder – they’ll be fine. they invest in themselves. they’re always trying to improve. maybe they relocate to different industries.

the workers who think someone owes them something will always be struggling. this is the real world, baby, the real world.

November 17th, 2013 at 7:32 pm -

stephen said:

The “free market” is where the knowledge is there for all to see about a corporation. Take Germany where the worker’s council representative is on the board of directors and has full information as to what the corporation is doing. The workers do see when the corporation does owe them something and conversely when times are bad to either tighten belts or leave.

May 12th, 2014 at 12:59 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!