The Two Income Trap has only gotten worse: America has become a dual-income nation since one income isn’t enough to maintain a household.

- 6 Comment

America has become a nation where households depend on multiple streams of income just to get by. Many people think that having two incomes is a luxury when in most cases, you need two incomes just to get by and keep up with the rising cost of living. This is reflected in the two income trap. Take for example a couple that works and makes the median household income of $52,000. In many cases if the couple has a child, daycare costs are needed and these can run exceptionally high. Healthcare costs are also incredibly high and have grown unbelievably fast over the last two decades. This recent recession could have been called a Mancession since most of the jobs lost went to men. America is a nation of dual-income households because people are too broke to get by on one income. The current state of the economy hasn’t helped much in supporting economic growth for working families.

The two income trap

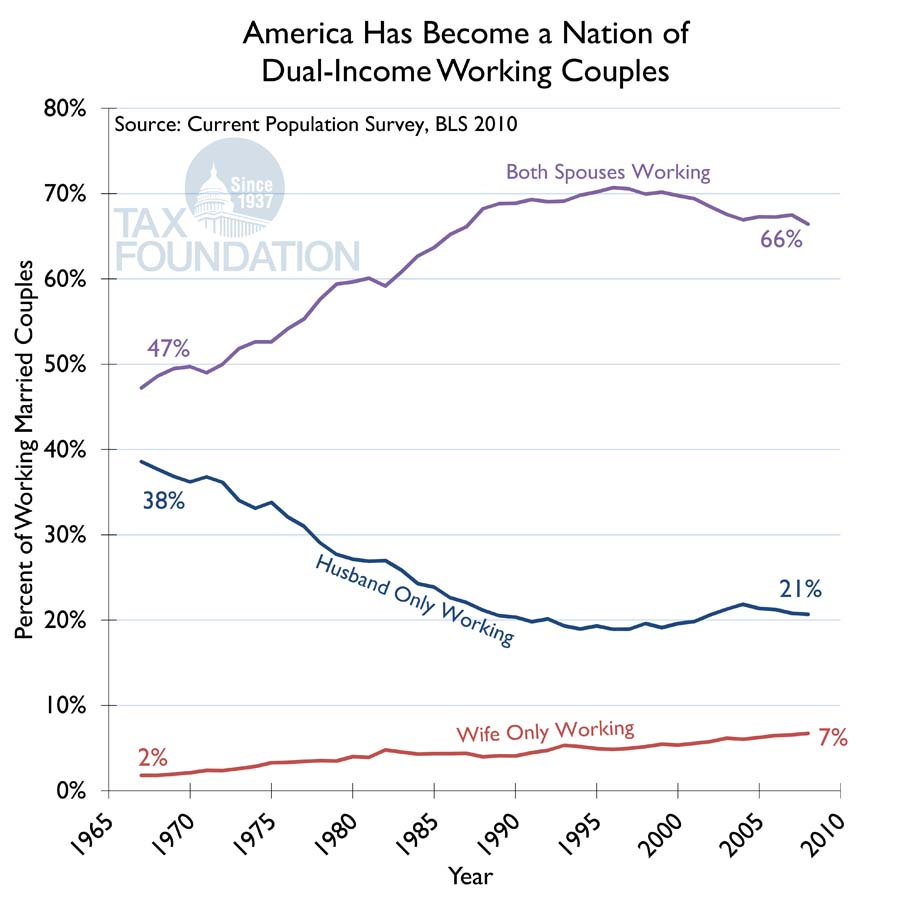

Back in 1965 47% of families had both spouses working. That figure is now up to 66% and it is extremely rare to find a household where only the husband works. You also find it more common today that a household will have only the wife working.

Women entering the workforce has shifted how people deal with daily life. But the thought of economic freedom by having an additional income in the household has been largely swept away by inflation. Take a look at this chart:

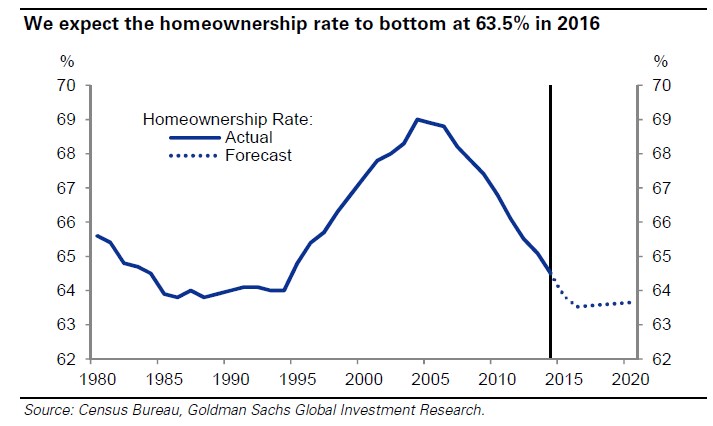

You would think that this would be providing American families more financial freedom but instead it is merely keeping people from being out on the streets. The homeownership rate is now down to generational lows. Why? Because home prices are inflated thanks to banking policies and investors that have gutted the market and have created a shortage of housing for working families. So what is left is higher rents and higher home prices.

In 1950 typical healthcare costs ran about $1,000 per year adjusting for inflation. Today they run over $10,000 per year and this isn’t factoring a serious illness or injury. This is merely to have routine insurance coverage for your family.

More money does not mean more flexibility if inflation is eating away the cost of living. With two working people, you have more money spent on childcare, food, and it is very likely that two cars are necessary with people commuting to separate jobs. Cars eat up a lot of money in payments, gas, and maintenance. In the end, you have a large amount of unexpected expenses that eat away at that additional paycheck.

This is the trap. You have two incomes so why are people struggling more today than that single income from the 1950s and 1960s? In short the answer is inflation and the destruction of our manufacturing base. There is a race to the bottom in this low wage economy. The middle class is now a minority and the two income trap is even getting harder to dig out of. This is why people are so angry during this election because there really isn’t a champion for the middle class.

People do have options to make things better and being able to budget is absolutely critical. Many couples also buy homes that are beyond their means just to keep up with the Joneses. And you absolutely need to plan for retirement. Don’t be like many that are using the “work until you die†model of retirement. The two income trap may make things hard but don’t compound your financial problems with inadequate planning.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!6 Comments on this post

Trackbacks

-

captan amerika said:

If I/my family can’t make it on two incomes how can I save for retirement when all goes just to stay alive ?

April 30th, 2016 at 4:36 am -

roddy6667 said:

Young couples buy a house based on two incomes. If one of them breaks a shoelace they lose everything.

April 30th, 2016 at 7:28 pm -

Bob said:

This is a symptom caused by fiat and greed. We were born into this “trap” and all that is left is the twitchin!

May 3rd, 2016 at 6:36 am -

Cheryl Henninger said:

OK, so what’s the solution to the dual-income family problem? Is there a solution??

January 19th, 2018 at 6:56 pm -

Perry said:

Yes there is a solution. Choose to live smaller and stop being embarrassed by a car that is over 10 years old, a house that is over 70 years old and clothes that come from Volunteers, Goodwill or similar. Sorry it is about choices, albeit very hard ones, especially when your kids ding and ding and ding that they “hafta” have x,y,z to “fit in”. Ooops. Family will be there for you when those “friends” are divorced and working 3 jobs to pay alimony for that big house they bought with the “love of their” lives who now has the kids, everything and still wants more. Reality.

April 8th, 2018 at 6:30 pm -

Ashley said:

The solution is to plan. Don’t have children when you can’t afford them. There is absolutely no reason to have more than one child especially when you don’t have the time nor energy to invest in that one child. People are living well into 80s and beyond. A woman can have a child at 25-30 years old and later. That requires additional planning of not destroying the woman’s body via lifestyle choices, but there is a trade off for everything.

November 10th, 2018 at 8:24 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market! Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market! Â