Un-preparing the future with the higher education bubble – graduating students with more debt and with degrees that have little demand in the marketplace. For-profits now account for nearly 10 percent of all undergraduate enrollment when in 1997-98 they accounted for 3 percent.

- 7 Comment

The higher education bubble only continues to spiral out of control because the profits are so good for the massive banking industry that is pushing student loan debt to the trillion dollar level. At the same time the return on investment in education has been slowly diluted as more for-profit degrees enter the market place and water down what it once meant to have a bachelor’s degree. If you can get what is the equivalent to a piece of paper and claim you have an education then the marketplace is going to add more scrutiny to those that graduate. On a bigger scale is the fact that our country is largely run by gambling bankers that are exploiting the population in every facet from housing, education, and even healthcare. Our financial system is a predatory mess and this can be seen in the form of the higher education bubble. What is more troubling is the subject areas students are studying in and the amount of debt they are going into for these degrees.

Students are simply not preparing for jobs in the current marketplace

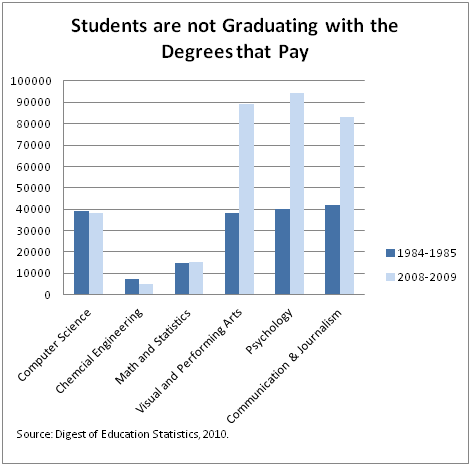

I saw this fascinating chart that also propelled me to dig deeper into the massively expanding for-profit sector:

Source:Â Marginal Revolution

This was a fascinating chart. We are essentially graduating the same number of computer science, chemical engineers, and math majors as we were in 1984-1985. These are fields with incredible amounts of growth and innovation yet people are not graduating with these degrees. At the same time the amount of student loan debt has reached astronomical levels. But take a look at the other degrees that are being granted. These are typically lower paying fields and with the troubling economy of today, many are left with no jobs.

Yet I want to highlight a deeper point. If you graduated with an arts degree in 1985 the odds of you being massively in debt were slim. So you had the ability to retool and get by with your life with a college education and a degree in a field that largely did not land you a job. Today, these people are coming out with the same amounts of debt as say a chemical engineer yet the median wage for most Americans is $26,000. In many cases these students are graduating with more debt than their first annual salary when 25 years ago this was not the case. Maybe your degree didn’t land you a job but you were better off because of the knowledge you acquired without going into debt serfdom.

This leads into the expansion of the for-profit institutions. This is a big problem in higher education. These systems have proven time and time again that the return on investment is not worth it. Yet they spend large amounts on their marketing budgets to lure in unsuspecting students.

“A report found that as a sector the for-profits spend 20 to 25 percent on marketing and 10 to 20 percent on actual faculty.â€

This is a big problem. Take a look at the share of their growth:

Source:Â Chronicle of Higher Education

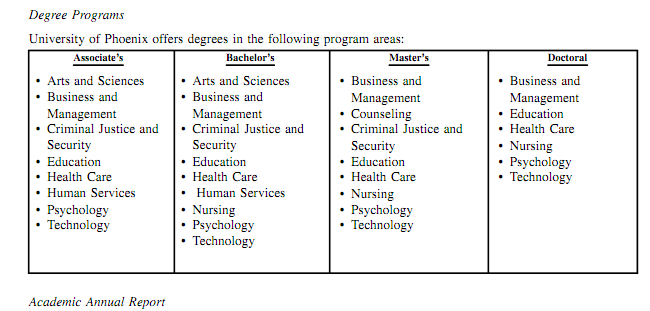

In 1997-98 the for-profits enrolled 3 percent of total undergraduates. In the above dataset that number grew to 9 percent (I saw a recent figure pitting it at 10 percent). They also consume a large portion of federal aid. And what degrees are they pumping out with large amounts of debt and government aid? Take a look at one of the largest, University of Phoenix:

Source:Â University of Phoenix annual report 2010

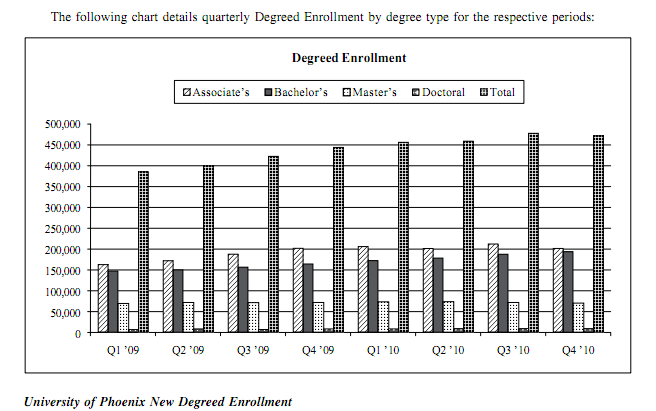

Where is chemical engineering? Where is computer science? What about biology? And this is where the large growth is occurring. Make no mistake, the enrollments are high even if we simply look at one institution:

As of Q4 of 2010 this one institution has over 450,000 students enrolled. The profits at higher education institutions have been so good because of banking’s close relationship with the government. In the end this is a large burden placed on society just like the housing bubble bursting. It certainly isn’t Wall Street that is paying for their unethical gambling.

There is little value being added here. Where are the reports showing placement rates here? And the stories of the for-profits are troubling and investigations have found incredibly aggressive selling tactics similar to mortgage brokers pushing subprime loans when they should have been pushing more traditional and cheaper fixed rate mortgages. Yet what do we expect? Our banking system now largely controls a puppet government system that even five years into the worst crisis since the Great Depression, has done absolutely nothing to reform or change the system. In the meantime we allow this incredible bubble to expand in higher education and allow the for-profits to suck more and more government resources that should go to legitimate programs that meet the demands of our future economy.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!7 Comments on this post

Trackbacks

-

ted Kramedas said:

Their aint nothing gooder then a edukation.

November 3rd, 2011 at 4:34 pm -

Ant With a Megaphone said:

While it is hard to say how the current educational loan bubble issues will resolve (other than badly, with negative impact on working people and the economy in general), you can bet your booty that multiple hedge funds worldwide are poised to profit when the bubble pops. Is it comforting to know that some rich people will get richer when this happens? God Bless the CDS.

A special type of Bankruptcy, I believe it has been suggested as “Chapter M” for mortgagees has been proposed by some smart person (Adam Levitin?). Why not get to work on a resolution before the school loan disaster materializes and create a “Chapter E” bankruptcy?

While we are at it, if we want more Computer Scientists, Chemical Engineers and Mathematicians, get a federal bill to forgive the educational debt of anyone who graduates in those fields and goes to work in them. You can make it conditional, maybe 100% forgiveness for an A average, 75% forgiveness for a B average and 50% for a C (yes we have jobs for Chem/Science/Math Majors with a C average, they just don’t pay as well as for the A average graduates) make employers give the forgiveness out over 4 years of employment in their field.

Hell why don’t we put the research centers in the rust belt, (plenty of empty commercial space there) and throw in a free house too! We should also be paying foreign nationals who come here and graduate with top honors in those fields to stay here and give them a house too. Plenty of federally owned housing inventory at the GSE’s. I know there has to be a real good reasons why the (still) richest country on earth does not want productive graduates, so please someone tell me what they are?

November 4th, 2011 at 7:37 am -

Martin Zehr said:

Let’s not omit the fact that students are choosing the majors with the highest status in this society. I suggest that people begin to address how our priorities as a nation are reflected in these stats and not simply use it as another opportunity to bash the banks. Why do you think there is such a demand for the majors in Visual and Performing Arts and communications and Journalism?

November 6th, 2011 at 3:11 pm -

and you were saying? said:

unless it’s a professional degree that is in demand, the ROI is horrible.

trade school is actually a better alternative for most. and who’s to say that a degree will guarantee you success. Bill/Steve and countless others were successful without a degree (they might have gotten one later after being successful)..the days of going to college to enlighten oneself are over. and there’s many routes to get to same location, do you folks know 25% of the doctors practicing medicine in US got their degrees outside of US? in many cases, faster and cheaper. think outside the box.November 7th, 2011 at 5:02 pm -

and you were saying said:

i posted on another column but it works just as well here..

————————

college is overated unless you are going for a professional degree and even at that, you end up paying up the nose for it. but at least, you have a way to pay it back..for most nowadays, trade school is a way better investment.

having said that, for all ye who cries about carrying a debt they “can’t possibly pay off so let’s find a way for forgive it” crowd…i feel you and your sad situation but YOU signed on the dotted line, so take some responsibility and live with it! be a big boy there. hindsight is 20/20, now you see that you’ve made a dumb ass mistake. no one was FORCING you to goto college. you freaking wanted to goto college but don’t have the money so you ask another bunch of assholes to lend money to you. it all started with YOUR DESIRE TO GOTO COLLEGE! deal with it. personally, this happened to me when i decided to goto college. i got accepted into a top 10 EE school in cali..only problem is it will cost so much $ that i have to take out a huge loan AND work just to go. so i decided to NOT goto that college and went to my local state college. before i grad, i already had a job offer while my other buddies that DID goto that very same school cause his daddy’s rich didn’t sniff a EE job for 1.5 years. so it IS possible and you DO make choices you have to live with. there’s never only ONE road you can walk. now whether you open your eyes to see other roads is up to you.

same goes for all those who cries “they didn’t know their interest rates would go up†or “their house would lose value over timeâ€. the most popular thing to do nowadays is to BLAME ANYONE BUT THEMSELVES for their own troubles. no asshole ask you to buy a house either. and who said housing prices goes up FOREVER.

the bailout to the banker were a total waste of money and it is totally wrong. BUSH/OBAMA/CLINTON and all dem politicians etc,etc, they are all to blame.

but 2 wrongs don’t make a right. you chose to take a loan out for whatever reason and now you can’t pay it. deal with it…lesson learned and move forward. BLAME your own poor choice of decisions cause i am hella sure if everything were reversed (your prop is now worth 2x what you paid..and your degree you earn now commands a 200g a year job) that you pat yourself on the back for making such a great decisions and not complain about ‘predatory†anything..whiners. so much whiners in the USA..i am sad.November 9th, 2011 at 1:35 pm -

and you were saying said:

to clarify..when i wrote “all dem politicians”…it’s a reggae slang..

i don’t mean democrats…i meant THEM….both sides are the same,

they are just playing the divide and conquer game..if you lean heavily left or right, you will never see the light!

November 9th, 2011 at 1:38 pm -

Martin Zehr said:

Any ideas out there? Possible actions by banks may include: caps on lthe amounts of student loan disbursements, increases in interest, more co-signers on student loans, collateral requirements for loans, requirements for cash paid on a percentage of the tuition by colleges, payments required prior to student loans going into repayment and other actions are bound to be the kind of issues college administrators and student loan lenders will look at given the current circumstances.

November 10th, 2011 at 1:13 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!