U.S. Dollar Only Down 2 Percent for the Year. Since the Crisis Started in August of 2007, the U.S. Dollar is Unchanged. Yet the Dollar is Down 33 Percent Since the Start of the Decade. The Currency Race to the Bottom.

- 4 Comment

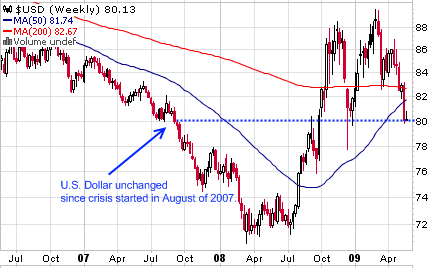

People have a hard time grasping that given the tumultuous market of 2009 and all the liquidity being funneled into the market by the U.S. Treasury and Federal Reserve, that the U.S. Dollar has only fallen 2 percent for the year. What is even more surprising to many is the U.S. Dollar has remained unchanged since the crisis started in August of 2007. How can that be you say? The U.S. Treasury and Federal Reserve have bailed out Wall Street and banks with commitments and direct credit injections to the tune of $13 trillion yet the dollar remains unchanged. Let us first look at a graph to show this:

In fact, at the market bottom in March of 2009, the dollar flirted with the 90 mark. This would have been a 10 percent jump from the same point back in August of 2007. How can the dollar remain strong with so much money being funneled into the economy and the U.S. lagging in a deep recession? First, it is important to understand that at the bottom in March over $50 trillion in global wealth was destroyed. That is simply a mind-numbing amount. In the massive panic of the market lows, many people still had faith in the dollar and rushed into it. It is still largely viewed as a safe haven. Also, the major decoupling philosophy has been largely put to rest since this recession is global. If you look at the chart above, in the spring and summer of 2008 the dollar was in the low 70s. This occurred because a large number of investors believed that the world would largely remain healthy while the U.S. fell into a deep recession by itself. That of course was not the case.

Yet over the longer term, the U.S. dollar has suffered and has suffered in big ways. Let us look at a longer-term chart:

Looking at this chart, we realize how much the dollar has really declined. Since the start of the decade, the dollar has fallen a stunning 33 percent. Keep in mind with currencies these kind of large fluctuations are not a sign of health. Major market volatility is never the sign of a healthy market. As I have stated before the U.S. Treasury and Federal Reserve are actively trying to crush the value of the dollar. There weapon of choice is inflation.

Why would the central bankers aim for inflation? For one, our country is a debtor nation to the ultimate degree. There is simply no way we are ever going to pay back our obligations. Inflation is an excellent way to make current debts less costly in the long run (at least in the view of the Federal Reserve). Yet inflation is rarely an easy target to set especially when we are dealing with the prospect of deflation. Deflation is kryptonite for debtors because the debt does not decrease over time. Think of a home that has lost 50 percent of its value. The home is now worth $200,000 while the mortgage stays at $400,000. In a simple theoretical world, a weak dollar would make our products more desirable around the world thus boosting domestic production. The only problem is we have outsourced a large part of our manufacturing base. There is no amount of lowering that is going to compete with wages put out by China and India for example.

The dollar problem is compounded by the fact that globally, central banks have been cutting rates simultaneously. It has been a race to the bottom. Each economy facing their own internal pressures had to lower their fund rates to stay competitive. That is why our zero bound Fed rate has largely left the market moving in the same place. Other global bankers have also cut back like the ECB for example.

Yet the U.S. Treasury and Fed are trying to exercise this dollar destruction as quietly as possible. What do you think the public would say if they realized that the central bank of our country is deliberately trying to dilute their respective currency? People would be in an uproar. Yet the fact of the matter is we now have some 25,000,000 unemployed or underemployed Americans that have taken a major hit to their purchasing power. Why do Americans feel poorer? Because since the start of the decade our U.S. dollar has lost 33 percent of its value. Couple this with stagnant wages and you can understand why this recession has been so destructive.

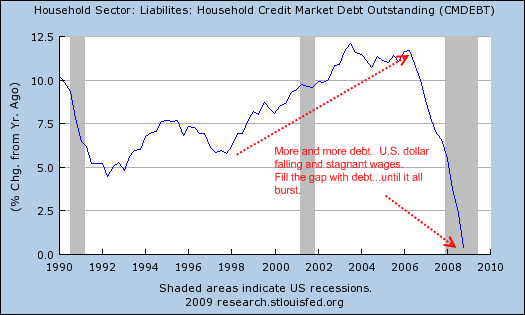

The dollar has been declining for the entire time but what pushed it over the edge was our current recession. Most Americans for the early part of the decade didn’t feel this drop because they made up for their lost purchasing power by borrowing more and more debt:

What we are now coming to terms with is the reality of our situation. A currency that is worth 33 percent less from the start of the decade and the revelation that a large part of the wealth created in the 2000s was largely based on pure debt. Hard to envision a second half recovery. Looks like we are heading more to a second half realization.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!4 Comments on this post

Trackbacks

-

Phinance said:

We are a debtor nation and hope to inflate our way out of this mess. The other countries recognize this as the largest holders of US debt and will jump into commodities and other resources, abandoning the dollar and causing a severe financial collapse. We ain’t seen nothing yet.

May 27th, 2009 at 1:58 pm -

factsnews said:

Once again, another excellent article. I am going to blog it on my site and hopefully give it some more exposure. I love how you take a question “why is the dollar not collapsing?” and analyze it with factual data that is very easy to grasp. Keep up the good work and I would love to speak with you if you have the time. Thank you!

May 27th, 2009 at 6:04 pm -

andy mellon said:

What commodities?

BK United, FL., said ‘failing’ merged w/ stronger bank,

yet cost fdic about five billion.

see web on soy beans $12/b 60 lbs. in short supply. will

lack of physical beans hurt futures markets?

People can switch to much cheaper items, corn $6/b 60 lbs.May 28th, 2009 at 3:30 pm -

QUESTRADE COUPONS - All Coupons, discounts, promo codes, offers, and reviews said:

Good write-up. The problem with America is that it is a serious spender and with this constant mindset in its people that we can live beyond our means we continue to spend more than we save. In the end America might lose its top position in the world unless somethng changes.

June 1st, 2009 at 5:03 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!