Going for broke: The multiple lost decades of US household income. Is it possible to have a recovery while the standard of living collapses?

- 3 Comment

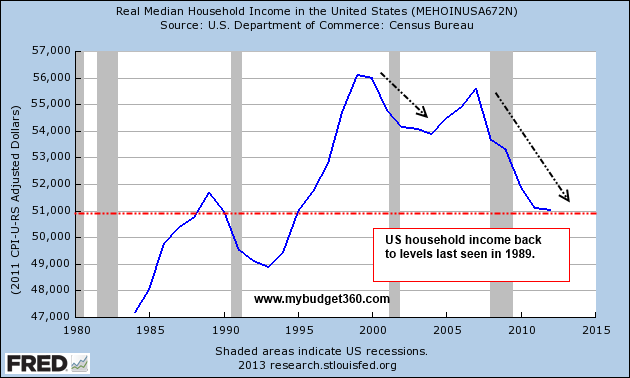

The recent Census data highlights a stark difference between the stock market and what families are facing across the United States. Households are struggling to keep ahead while the standard of living slowly erodes with the juggernaut that is the banking tide. There will be repercussions for what the Fed has done in terms of bailing out the banks. One longer term problem is the decline in household incomes. Adjusting for inflation, American families are making what they did in 1989. How long ago was this? The most popular shows on TV were The Cosby Show and Roseanne. In other words, this was a generation ago. The standard of living continues to decline for many but for others the bailouts are working out magnificently like rubbing on a central bank genie lamp. The Fed is going for broke here but only a small portion of our population is really coming out ahead.

Back to the Future

While the market went bananas on the Fed’s non-taper announcement, household incomes continued on down a very familiar and gloomy path:

This is not a positive trend if the chart above were not so apparent. Contrary to the stock market and the booming real estate market being driven by investors, household incomes continue to fall. Since the recession hit, many organizations have boosted their bottom lines by cutting wages and benefits.

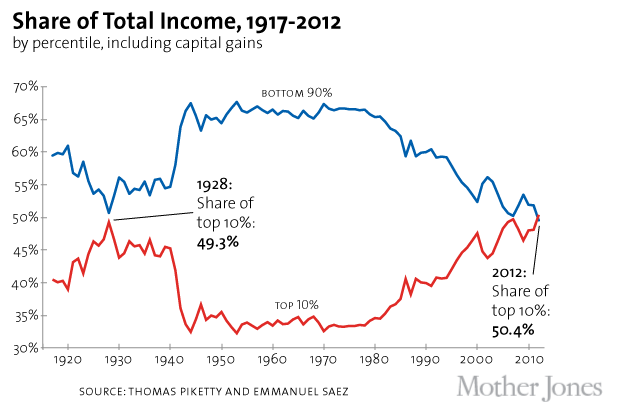

One of the dramatic pieces of data recently released is the amount of income going to the top 10 percent of income earners:

Source: vMother Jones

Back in 1928, the top 10 percent of income earners took in 49.3 percent of all incomes. Of course a little thing known as the Great Depression rampaged through the nation only a year later. Today this income inequality is even more evident than it was nearly 100 years ago. The problem with this is that most Americans are trying to get by on the crumbs of what is falling from the uber-wealthy. For example, over 47 million Americans are getting by on food stamps. This is an incredibly high number of our population (around 1 out of 6 people in a time when the stock market is at an all-time high). Even the CEO of Panera Bread is trying to live on a food stamp budget:

“(USA Today) Panera Bread CEO Ron Shaich is very hungry. “I can’t stop thinking about food,” he wrote on his LinkedIn blog yesterday. That’s because he was on day 4 of a week-long challenge to eat on just $4.50 per day. He’s doing it to raise awareness of how people on food stamps live: That’s how much a person on the Supplemental Nutrition Assistance Program receives, Shaich explains.â€

One of the problems with the mythology of the stock market is that somehow, a high stock market will reflect a booming economy. Today with the casino-like transformation of banking, you can have banks making billion dollar bets on people failing and this will turn a healthy profit. You have trillions of dollars in derivatives being traded in black boxes. None of this of course translates to a real world benefit and each piece of income data seems to reflect that.

Where the gains are flowing

Many people are one paycheck away from being broke. Millions are already broke. The median amount saved for retirement by those 25 to 34 is zero dollars. Actually, they are in a more dire position since many carry a negative net worth with tens of thousands of dollars of student debt.

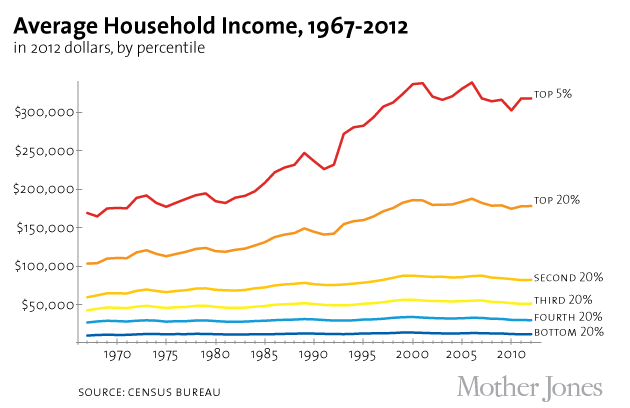

Most of the gains have flowed to a small portion of our population:

While most are scratching to get by, the top 5 percent have done spectacularly since 1970. There will no doubt be income inequality in any market based system but these kinds of gains are unprecedented. Especially when you consider that banks are being bailed out for essentially causing the first financial crisis! Where else can you implode the economy, get away with legalized bank robbery, and make away with generous bonuses? This can only occur in a system where most of Congress is in the millionaire ranks and does the bidding for these interests.

People seem to be going broke and as long as the next shiny device is working, all is well. Well not all is well on the income front as many families continue to slowly go broke.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

3 Comments on this post

Trackbacks

-

Carter said:

Every week I follow your blog and I appreciate your honesty when it seems that in many other places everything is all flowers and sunshine. But, I have to ask… What is the solution to this slow motion trainwreck? Events are unfolding and I worry that our future is becoming more and more bleak… There’s plenty of bad news to go around… What about the opportunity? Where is the growth? Where is the advancement for the benefit of everyone and the nation as a whole?

September 20th, 2013 at 5:35 am -

Ametrine said:

This story below was in Yahoo news yesterday. Very dire situation.

http://news.yahoo.com/census-no-sign-economic-rebound-many-us-040228468.html

September 20th, 2013 at 12:36 pm -

The Curmudgeon said:

Severe U.S. income inequality was highlighted in this post:

http://www.fiendbear.com/Curmudgeon47.htmSeptember 21st, 2013 at 12:48 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!