Wealth inequality rivals the months prior to the Great Depression – Americans would prefer a more evenly distributed wealth system. Over 80 percent of Americans still feel we are in a recession.

- 4 Comment

The official announcement that the recession is over underscores the massive disconnect between Wall Street and the rest of America. Wealth inequality in America is at levels last seen right before the Great Depression ravaged our economy. Yet the inequality has grown even more intense as this crisis has gone forward. 43 million Americans are now classified as being in poverty. This trend hasn’t shifted in the last decade, recession or no recession. The system is absolutely flawed and that is why we have over 16 percent underemployment, 41 million Americans on food stamps, 4 out of 10 workers in low paying service sector jobs, the median household income falling under $50,000, record monthly foreclosure filings, and yet the recession is over according to a small group of economists. The recession may be over for Wall Street but the rest of America is still struggling.

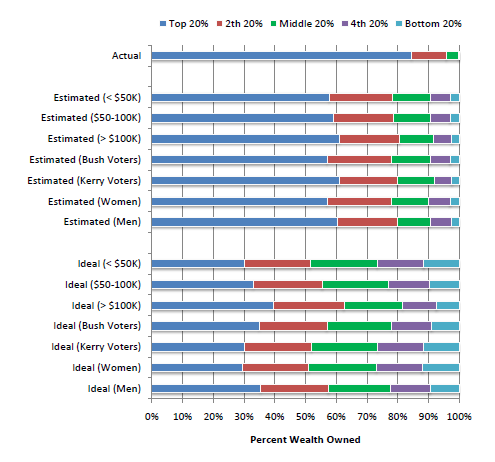

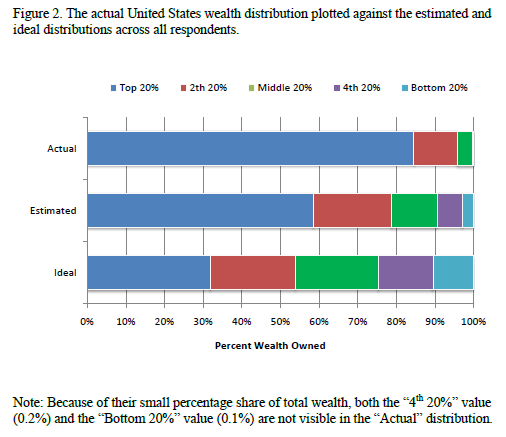

Wealth inequality has been exacerbated by the casino like behavior of investment banks on Wall Street. A recent study shows how out of touch with the facts most Americans are when it comes to wealth inequality in their own country. One fascinating finding is that most Americans, even between those that make $50,000 and $100,000 actually envision optimal wealth distributions that are very similar:

Source:Â Â Norton, Ariely

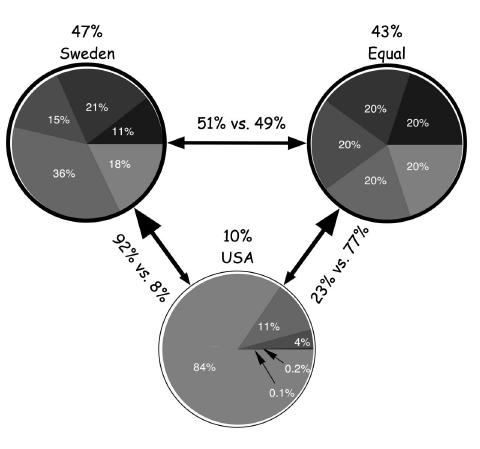

Let us explain the study. For this part, the researchers asked over 5,000 Americans their ideal wealth distribution in the U.S. The participants were also asked what they estimated the wealth distribution of the U.S. looked like. For the most part, their estimates were significantly off. Most estimated that the top 20 percent controlled roughly 60 percent of all wealth. In reality, the top 20 percent control over 83 percent of the pie. We’ve talked about this when the top 1 percent actually controls over 40 percent of all U.S. wealth. However, when asked for their ideal distribution regardless of income or political affiliation most Americans thought the ideal wealth for the top 20 percent would be 20 to 30 percent. Ironically the ideal that most Americans have looks more like Sweden than our current system:

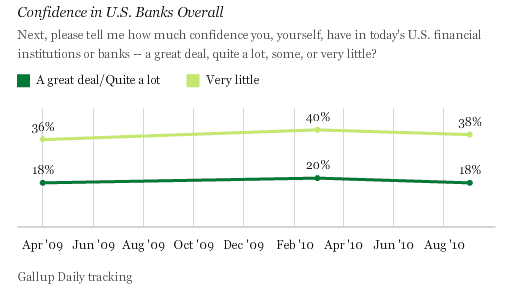

The respondents were also given these items below and most preferred the Swedish model. The equal distribution lost out by a small margin showing that Americans realize that there will be an inequality in the system but nothing like we currently have. The middle class is being squeezed out of the pie. The propaganda from Wall Street is that everyone can be rich but the reality shows otherwise. In fact, Wall Street tries to sell the sizzle of the steak to Americans by conjuring up political fears and other distracters to detract from the fact that Wall Street is robbing Americans blind. When the politics are put aside, most Americans want a radically different system when it comes to wealth distribution. Our economy is broken on so many levels and banks are to blame. Many Americans feel this way:

It is interesting that only 18 percent of Americans have confidence in U.S. banks. A larger majority have very little confidence in the banking system as they should when you have the broke FDIC backing $13 trillion in banking assets. With no actual reform in the banking system we can expect another crisis to come up shortly. Why? The real economy isn’t responding because what is happening is you have actual real wealth being drained out of the economy through bailouts for the rich. It doesn’t happen directly but through a connected system. The absolute richest Americans own the bulk of stocks so the fact that the bailouts have boosted stock values has helped this tiny group of Americans bounce back. That is why only a few months after the stock market crashed in early 2009 the first folks to start posting billion dollar profits were the banks. Of course this happened because of the taxpayer funded bailouts. Shift money from taxpayers, to Wall Street, to the wallets of the elite.

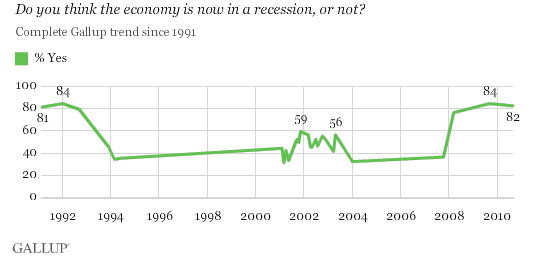

According to the NBER the recession is over but try telling that to Americans:

Over 80 percent of Americans still think we are in a recession. Why? Because we are if you define it as a poor economy for the bulk of inhabitants! Foreclosures remain near peak levels, 1 out of 7 are now in poverty, and good luck finding good work in this economy. The other 20 percent think things are getting better because the modern day casino known as Wall Street is up by 70 percent from the low in 2009. Yet what use is that if it doesn’t translate into jobs? GDP grows because productivity is squeezed out of each worker and CEOs can use the recession as an excuse to cut workers while boosting their own paychecks. Also, you have banks that are now making the bulk of their profits through speculating on Wall Street without even producing actual value in the real economy. How is that even good for the economy? Isn’t speculation the reason we are in this mess in the first place?

Why don’t we hear about the giant inequality gap in America? Because the mainstream media doesn’t actually report what matters to most Americans. Just look at the divergence again:

When we set aside politics, most Americans want an economy that allows for a robust middle class. We expect that people will have differing views in our country but right now much of the political noise is being stoked by Wall Street to keep you from focusing on the above chart. Which candidate is even bringing up the above as a key issue to their campaign? The small elite in our country realize they have a sweet thing going and the fact is, most Americans want to make wealth equality a priority when it comes to wealth. At the very least, banks and Wall Street don’t want Americans wising up to the fact that 83 percent of the nation’s wealth is in the hands of the top 20 percent.

When labels are removed Americans prefer a wealth distribution that looks like Sweden. If we look carefully at the charts above, you can see how the middle class is being slowly erased.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!4 Comments on this post

Trackbacks

-

Stephanie said:

The answer to this is to apply laws EQUALLY to all. What we have here is the result of the top 1-2% that are in power due to the ‘funding’ provided by the big banks, make the laws, which are then applied only to the ‘little people.’ Note the ‘financial reform’ Act was partially written by the banking industry, and while it sounded like it would benefit consumers, it did no such thing – it actually allows for the banks to further take advantage of the public.

In addition ZIRP itself ONLY benefits banks. In 2005 with the Bankruptcy Modernization Act, again, banks (Bank of America to be specific) wrote the reform, touted as ‘helping the people’ but all it did was make it harder for people to discharge all their debts in bankruptcy when they became insolvent.

We need laws to be enforced for ALL people EQUALLY. This means a good chunk of Congress and perhaps 75% of Wall Street and all of the large banks officers and employees should be in jail. Not continuing to find ways for Congress to pass laws to give them further advantage over the rest of us. Until or unless the corruption is rooted out and prosecuted, this will continue to get worse.

September 25th, 2010 at 5:24 pm -

Elephant-Butt said:

I’d like to know who the morons are (20% of Americans) who think we are no longer in a recession. Any brain inside?

Or maybe those 20% of people realize that there is no recession – that the DEPRESSION has begun. That would make us 80% of Americans who think we are still in a recession to be the morons!

September 26th, 2010 at 2:02 am -

Swamp Fox said:

The survey asks if people have a little or a lot of trust in banks?

I have great confidence that they will be complicit with the fedgov to take my IRA. I have small trust that they will not take every nickle they can from me.

Make up my mind for me- what are you getting at? I’m old, confused and the trees in the yard look spooky at night.September 26th, 2010 at 2:35 pm -

Chris said:

I find it interesting the bottom 40% is estimated to have any wealth at all, by anyone let alone 10% by most peoples estimates.. and its too bad there is not a 250k+ and a 1mil+ category to the study as well.

Would be interesting to see the “actual field” data by decade starting around 1900, as I would like to see the top 20% ramp up towards the great depression, then fall off.. only to come back with a vengeance.

September 26th, 2010 at 3:08 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!