Why There will be no other Bubble to Save us from this 40 Year Financial Bubble: From Manufacturing, Technology, and Financial Services. Real Estate Bubble. Drop in Corporate Tax Receipts.

- 6 Comment

This recession is already the longest since the Great Depression. Now merely saying that this recession is the longest does not expose the magnitude and depth of the economic damage inflicted on the market. $11.2 trillion has been wiped off the balance sheet of American households.  In this article I want to examine a few different economic indicators that go beyond the mainstream data points. It is important to put this recession in context because it will also guide our progress moving forward.

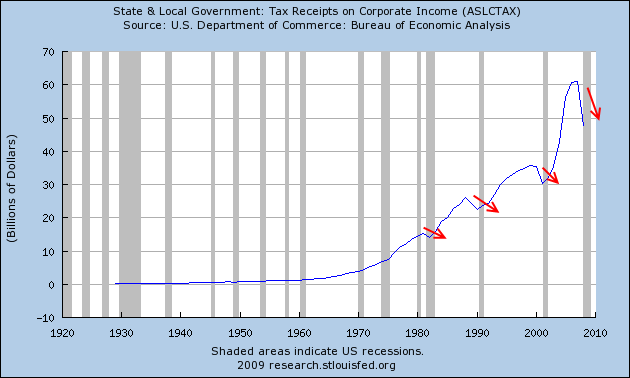

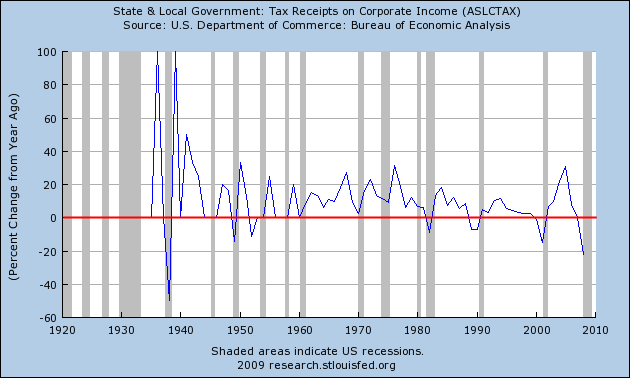

A solid indicator to look at is tax receipts on corporate income. Let us look at the chart from two different perspectives:

As you can see from the charts above, tax receipts on corporate income have fallen to levels not seen since World War II (in percent terms). Just think about that. The last time corporate income has fallen this steep was when we were gearing up to fight alongside the Allies in a World War! I’ve put these two charts up because they expose what is really going on. Both in a raw and year over year change, we can see that corporate income has fallen dramatically. What this means is the government has a larger burden because it will be forced to run larger deficits. Now the reason looking at tax receipts is useful is that institutions that have tough years (i.e., losses) will be paying less in taxes. Also, drops in revenue, the life blood of a company will also show up here. The fact that we are at levels that go to pre-World War II show the severity of this crisis.

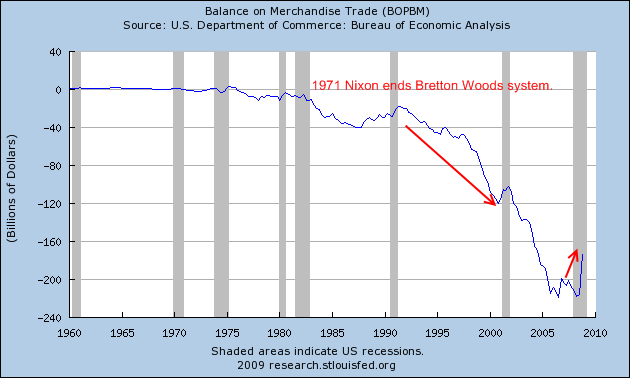

Another crucial trend from our current situation is the trade balance actually decreased:

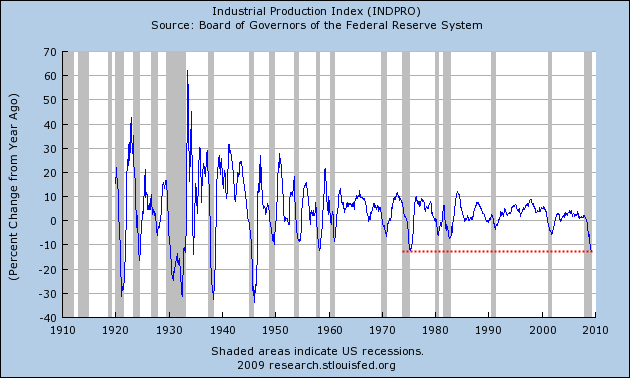

Since we floated the dollar, the trade balance has grown bigger and bigger since the early 1970s. During the prosperous 1990s, the trade balance exploded even though many would look upon this era as a time when our economy was shining. Our current system took three decades to build and most of it was on debt. After the collapse of manufacturing, we jumped into the tech bubble only to follow it up by the real estate bubble. As you can see from the trade balance chart above, the actual amount we owe has decreased. This is good. Yet the reasons for the decrease are not. Imports and exports have both collapsed. It would be one thing if we were exporting more goods thus bringing in more revenue but that is not the case. Let us look at the collapse of industrial production:

The last time industrial production collapsed this quickly on a year over year basis was in the early 1970s. Much of that of course was brought on by the outsourcing of our manufacturing base:

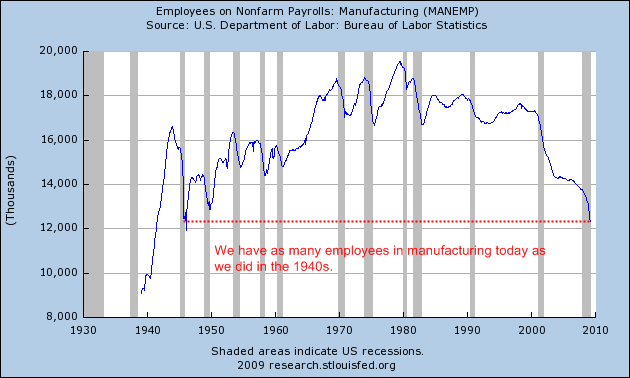

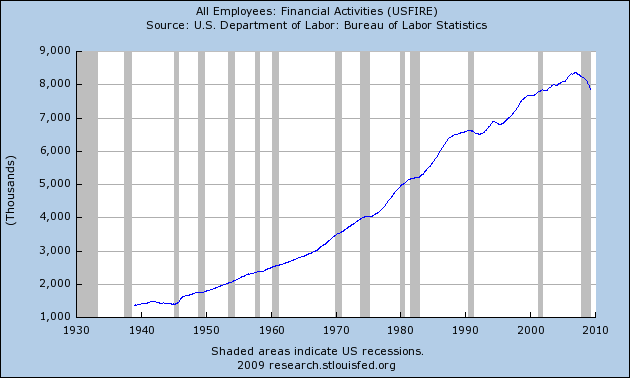

In fact, we currently have as many employees working in the manufacturing sector as we did in the 1940s. Where did most of these people go? Look no further than the financial sector:

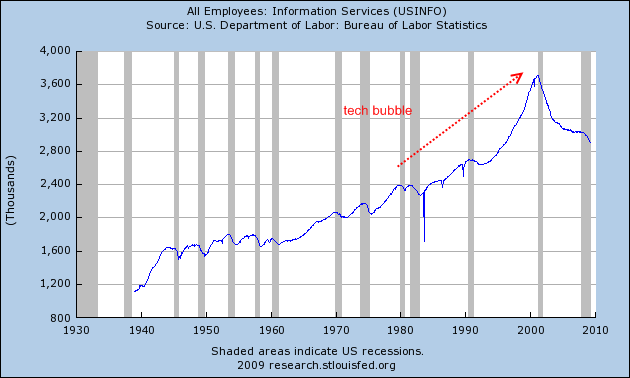

Now given how bad this sector has ruined the economy, where do you think many of these people are going to find work. This is the first time in a long time that people are going to have to take major wage cuts on an aggregate. Why? Think of it this way. When manufacturing started faltering, people had the option to retrain and start careers in technology fields that paid more than manufacturing:

Once that bubble burst, we had the financial sector ready to pick these people up and pay them even more. So you had three decades of people having the opportunity to hop into higher paying fields in bubble sectors. Now you tell me what other large bubble field do we have? Green technologies? I’m not sure that’ll eat up the slack and those jobs don’t come close to matching the casino profits of hedge funds and those on Wall Street. So even if the jobs are there, the pay is not.

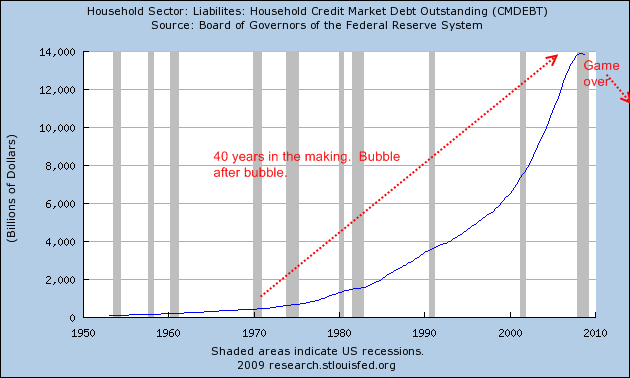

So this economic crisis was 40 years in the making. To think we can create another bubble and go forward is absurd. Just look at household debt over this time:

With record foreclosures, rising bankruptcies, and declining access to debt this is money destruction in action. By definition someone that can’t afford to pay something will default. That is, there is no other out. It will be a forced correction of decades of excessive spending.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!6 Comments on this post

Trackbacks

-

Frank N. Stein said:

Thanks for putting this into an everyman’s context. But Sobama and the talking heads on the sewer box said it’s all over and happy days are ahead? No thanks I’ll take the reality instead.

April 17th, 2009 at 1:04 pm -

DavidB said:

what about the gold bubble? We have yet to create and pop that one yet

April 18th, 2009 at 6:40 am -

Moron said:

what about the “stupid” bubble? We still have to pop that bubble…

April 19th, 2009 at 2:55 am -

green span said:

see web on last bubbles

April 19th, 2009 at 5:19 pm -

a. grease. pan said:

1 more bubble,

says Onion, and fiend bear editor. What’s that 1 more bubble?

Government bonds, cash? what do sellers of assets,

e.g. metals, invest in, modern paintings, cognac?May 12th, 2009 at 5:59 pm -

Ed said:

The “bubble” game will destroy the American financial empire for sure. Looks like the Fed and Treasury have joined the corporations in looting the American public.

November 27th, 2009 at 9:55 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!