Low wage capitalism – Newly added jobs are coming from lower paying sectors while productivity increases and profits filter to the top of the economic class. 3,500,000 high-wage jobs lost during recession and only 179,000 have been added so far.

- 3 Comment

One of the most troubling aspects of this “recovery†is how it is being achieved. We keep hearing about the wonderful Wall Street recovery yet a large portion of this is being created by extracting productivity from workers and stifling wages. Obviously if you scare the working and middle class and give them no job protection then many will retreat to their dark corner. Yet the reality is, these same companies are borrowing at subsidized rates from the Federal Reserve and using the taxpayer as a safety net. This economy is operating under a reverse Robin Hood effect where you steal from the poor and working class and redistribute the wealth to the top. The political class does not represent the people because as things stand, money buys power and many more Americans are losing their voice since they do not have funds to purchase lobbyists. The below chart is one of the more disturbing confirmations of our disappearing middle class.

The low wage recovery

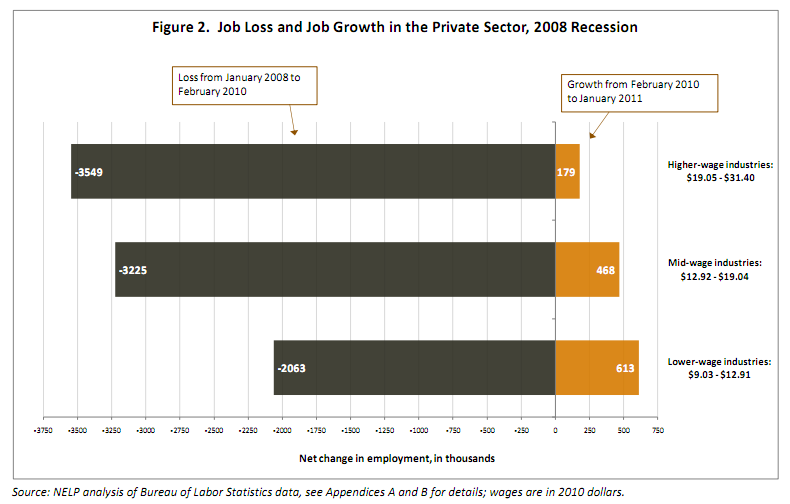

Source:Â NELP

This chart sums up our current recovery in one picture. We lost over 3,500,000+ higher-wage jobs during the recession and so far, we have added 179,000. The mid-wage sector has lost over 3,200,000+ jobs but has added 458,000. More troubling however, is that 2,000,000+ jobs were lost in the lower-wage fields and this is where the bulk of the current economic growth is occurring with 613,000 jobs being added in this sector:

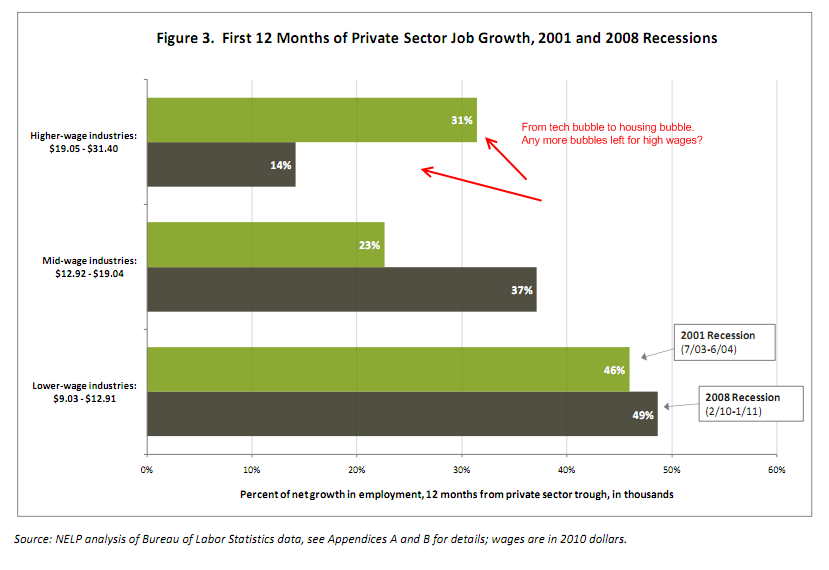

“(Huff Po) While the recovery of the labor market and the broader U.S. economy depend critically on job growth, equally important is the quality of those jobs. During the economic downturn, 40 percent of the jobs lost came from high-wage industries — yet high-wage industries accounted for only 14 percent of the new positions created in the first year of post-downturn job growth, according to a report released in February by the National Employment Law Project.â€

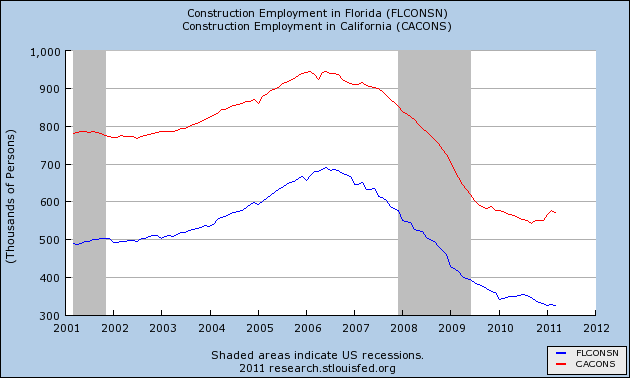

You don’t have to look far to see this playing out. Take a look at two states that had some of the biggest housing bubbles in the country:

“Construction and finance, sectors which boast a median hourly wage of roughly $20, were among the hardest hit during the downturn. By contrast, about a fifth of all new jobs are being generated in the administrative/support, waste management, and remediation services industries and they offer a median hourly wage of $12.91. And many of those jobs are temporary positions.â€

These jobs that pay $20 or more are now being replaced by jobs that pay $9 to $12 an hour. So even though we are adding jobs the quality and pay of those jobs is not exactly helping grow the middle class. This is likely only to be shocking news for the top 1 percent who has no connection to the working and middle class. Half of all workers make $25,000 a year or less. This isn’t a new development but a trend that has been going on for well over a decade. Many are getting a hard taste of this new forced austerity:

“Since 2008, Goscewski has altered the way she lives in the city, cutting back on her subscriptions to cultural institutions in New York and other luxury items. Her perception of herself has also changed, she said, as her hours with the support group have put her in close contact with “a whole new group of people.”

“It’s really seeing things from the street, as opposed to from the 21st floor of a skyscraper. And I find I’m not entirely opposed to it, because I find the street–” Goscewski paused. “I think I’m shifting values over time.”

There is no longer any other bubble to make up for the lost wages here. In fact, the last two decades benefitted from the technology and real estate bubbles. Yet current job growth shows no high-wage job growth (aside from CEOs earning 840+ times the annual household income for bankrupting and foreclosing on Americans):

Source:Â NELP

The fact of the matter is we have very little protection for working and middle class Americans. The wealthy and financial class has access to near zero percent loans from the Federal Reserve and VIP programs that cater to this small group. The wealth inequality is happening not because all ships are rising because of a financially positive tide, but because companies and financial institutions are squeezing out productivity and pennies from the majority of Americans to bolster their bottom lines. Americans are being held as financial hostages:

“The reality is that a number of people are experiencing downward mobility,” said van Horn, the Rutgers labor economist. “Depending on where they started on the economic ladder, that downward mobility can be somewhere from inconvenient to actually pushing them into poverty.”

“Our economy was in trouble before the recession — we were sitting at the end of 30 years of growing inequality,” Bernhardt said. “So we were already at a point where there was a real challenge for many workers in the U.S. in terms of finding living-wage jobs and sustainable careers. The Great Recession clearly did not reverse that trend. If anything, it’s accelerated it.”

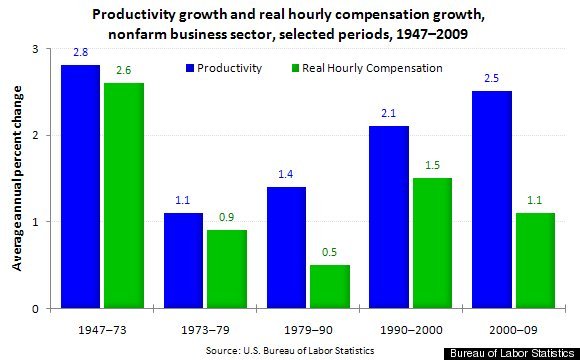

This is demonstrated by looking at productivity gains:

Source:Â BLS

What you see is for the last three decades really, starting in the 1980s that productivity has been going up yet real wage compensation has been going down. So as you hear about all those great profits from banks remember that it is happening on the backs of the working class:

“It’s depressing. It is extremely depressing. Especially when you leave interviews, and you just know you’ve got this one. And then you don’t, again,” Island said. “You definitely take a look at all the extras that you have in your life. You start finding that instead of needing 150 cable channels, you only need the package that gives the basic. You don’t drive as much. You clip coupons. You worry.”

The financial elite have lobbyists, bought out politicians, and the central bank in the Federal Reserve for crying out loud. What does the working and middle class have? Until they stop believing they are temporarily embarrassed millionaires people will remain comfortable and keep changing the captains of the Titanic.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!3 Comments on this post

Trackbacks

-

CLARENCE SWINNEY said:

PLEASE STOP GIVING ME HARD NUMBERS TO ADD 1 + 1 MY CUP OF TEA

ONCE AGAIN YOUR ARTICLE IS SUPERBTHANKS VERY MUCH

April 22nd, 2011 at 6:53 am -

j o t o p said:

gt site.

1. Western corps oft invest in A sia, creading jobs THERE.

2. comment on new regs on o’seas fin accounts.

What about houses, antiques, etc held directly

o seas not thru / in fin accounts?April 22nd, 2011 at 12:28 pm -

Bodmas Oblomov said:

Important caveat – those construction jobs from the early part of the decade, they weren’t real, value-add jobs. They were beneficiaries of a construction bubble.

New construction does NOT add to national wealth.April 22nd, 2011 at 6:02 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!