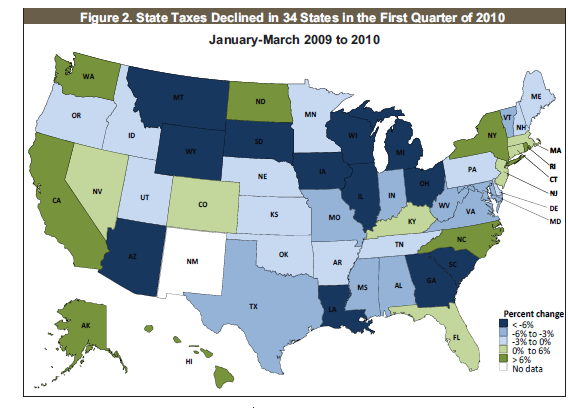

34 states saw tax collections decline in the first quarter of 2010. State budget deficits projected well into 2010 – Plunging tax revenues reflect a weaker economy dragged down by pervasive unemployment and underemployment. $112 billion in state budget gaps for fiscal 2011.

- 3 Comment

Big states with dismal budget short falls like California and New York have been making the news for the last couple of years. Yet the problems with state budget deficits go beyond the big and mighty. The banking system has been stabilized at a very high cost to average Americans but state budget deficits reflect a deeper underlying problem. States generate revenue through a variety of taxes; these show up through payroll taxes, sales taxes, property taxes, and other fees. As a metric for the economy, these are a good way of measuring the health of economic activity. Looking at current massive budget deficits states are mired in expenses with revenues falling. For the next fiscal year of 2011 states will face a combined $112 billion in budget short falls. California’s current budget deficit is $19 billion (current plus next fiscal year). But things can and may get worse.

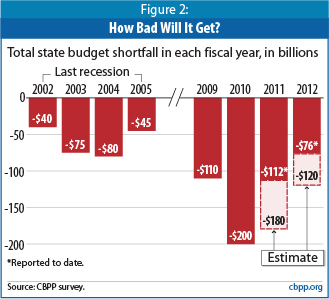

A recent survey compares this recession with the previous recession:

Source:Â CBPP

As of this year we are facing a deeply painful year for states. This will be the worst on record if 2011 doesn’t come in close contention. How is it that the rhetoric has shifted to recovery while states are facing deep and pervasive gaps in their funding? A large part of the so-called recovery has been directed to the banking sector. That is clear. Unemployment and underemployment is pervasively high and when we look at the top job sectors, 9 out of 10 are in low paying service sector jobs. Last month we added over 400,000 jobs but the vast majority were temporary Census positions. This is not a true recovery and state budgets reflect this.

Why is the above gap occurring? Take for example the collapse in housing prices. States adjusted revenue projections to assume higher assessments and thus believed that bubble level prices were the new norm. Take for example in California where property taxes can range from 1 to 1.5 percent of the assessed value of a home. We’ll use a $500,000 home as an example. Initially, this home would bring the state $5,000 per year at the low end in revenue. The bubble pops and that home now sells for $250,000. Only $2,500 comes into state coffers yet the state was expecting that funding to come in at a much higher level. That is one facet of the problem. Then you throw in pervasive unemployment that is taxing the system and you can see why state budget gaps are so wide and profound.

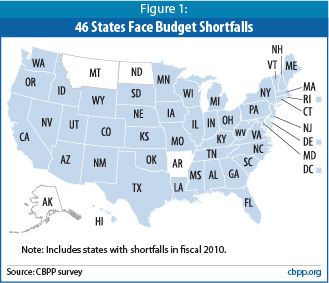

The state budget gaps are largely a reflection of a struggling working and middle class. Sales taxes have fallen in many states as people have cut back and started applying a level of austerity to their lives. Less spending obviously means less money coming in. To show how widespread this problem is, all but four states with small populations have budget gaps:

Now I know some will only see the gaps and talk about closing them at any cost. Yet some forget what this will mean to the overall economy and the so-called recovery. At this point, take for example the mortgage market, 95+ percent of all mortgages originated are government backed. The last month of employment gains were largely all (90+ percent) from government hiring. The current economy is largely supported by massive government spending. The problem is how we allocated the money. We have funneled too much money to the banking sector with little tangible results outside of Wall Street. As states cut deeper into their budgets, federal support is lagging and focusing more on helping out Wall Street. What this will mean is larger cuts and a drag on the overall economy going forward.

Going forward we know that there are only two ways to balance the gaps. More cuts or higher taxes and both hurt the economy. The issue so far is that states have gone after low hanging fruit. There are hundreds of state workers making high six-figures with fantastic pension plans and lifelong employment with little economic yield and these are not the people losing their jobs. They are going after janitors, repair workers, young teachers, and other easy targets that do little to balance the bigger line items. Penny wise but absolutely pound foolish. Below is from the CBPP:

“Expenditure cuts are problematic policies during an economic downturn because they reduce overall demand and can make the downturn deeper. When states cut spending, they lay off employees, cancel contracts with vendors, eliminate or lower payments to businesses and nonprofit organizations that provide direct services, and cut benefit payments to individuals. In all of these circumstances, the companies and organizations that would have received government payments have less money to spend on salaries and supplies, and individuals who would have received salaries or benefits have less money for consumption. This directly removes demand from the economy.

Tax increases also remove demand from the economy by reducing the amount of money people have to spend — though to the extent these increases are on upper-income residents, that effect is minimized because much of the money comes from savings and so does not diminish economic activity. At the state level, a balanced approach to closing deficits — raising taxes along with enacting budget cuts — is needed to close state budget gaps in order to maintain important services while minimizing harmful effects on the economy.â€

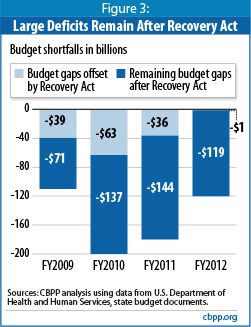

Even after the Recovery Act, large budget deficits will remain:

So combining budget gaps for 2011 and 2012 will result in budget shortfalls of $260 billion combined. This is an incredible amount of money. Even a modest recovery will have a hard time making that up and we have yet to see a recovery for working and middle class Americans. The recovery to many is largely lost in the trillions of dollars funneled to a banking sector that is merely concerned about shoring up their balance sheets.

If we look at a map of state tax collections, 34 states saw declines in the first quarter of 2010:

Source:Â Rockefeller Institute of Government

What this means is there are two recoveries going on. A real one for Wall Street and the investment banks and a phantom one for working and middle class Americans. I wouldn’t even call it a recovery for the investment banks since they are simply stealing taxpayer money and calling it turning a profit. State budget gaps are merely a reflection of what we already know and that is the economy has yet to actually recover.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!3 Comments on this post

Trackbacks

-

j r said:

I guess encouraging companies to ship good jobs overseas so rich execs could stuff more money into their pockets wasn’t such a good idea after all.

Time to replace all the criminals in Congress (and that’s all of them) with regular people. Time to outlaw the legal bribery called ‘contributions.’

June 27th, 2010 at 11:57 am -

Micah Stringham said:

I HATE THE GOVERNMENT!! We need to consolidate and take money out of politics. No one wants to impose harder taxes even though if we don’t we are sure to plunge in to a bleak future. They won’t do whats right, because whats right is unpopular in the voting world.

~Micahangelo

June 27th, 2010 at 6:04 pm -

Paul F said:

I love reading your posts – they are clear and to the point – they are the “bitter-pill” that all America should have to take and digest. IF they did, our ruinous elected officials would have never gotten so far in reckless spending.

June 28th, 2010 at 4:38 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market! Follow us on Twitter!

Follow us on Twitter!