The calm before the student loan bubble bursts – For-profits make up 9 percent of student enrollment yet produce 27 percent of all private loans. The inevitable pop of the student loan bubble.

- 1 Comment

The worth of a college degree has now come into question because of the massive student loan bubble. An education is vital yet the monopoly on knowledge has been turned upside down with readily accessible information through technological changes. What is odd however is during a time of knowledge access ubiquity you have a field sprouting up of institutions that simply target the unknowing with promises of degrees that yield worthless marketable prospects. Many for-profit colleges fit in perfectly with the financialization of our nation. The main goal is to draw in a large unsuspecting audience and saddling millions with unsustainable amounts of debt for a piece of paper that has little worth in regards to career aspirations. Like the subprime mortgages pushed by lower levels of the financial industry only for quick profits, many of the for-profit colleges have done very similar things to the prestige of a college diploma. When a list of cats and dogs with college degrees is listed on Wikipedia we know there are serious issues in how some for-profits operate.

The for-profit college model

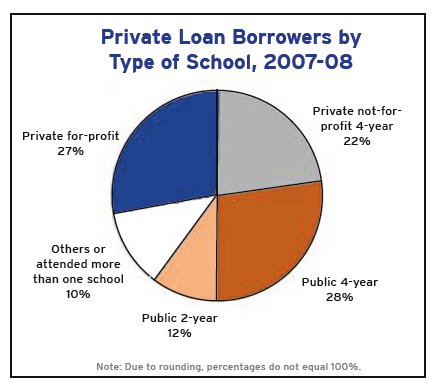

Although for-profit institutions make up a small segment of the college going population, they make up a large portion of the private loan market:

Source:Â Project on Student Debt

“Students attending for-profit schools composed about 9% of all undergraduates, but 27% of those with private loans.â€

A big reason for this is the lack of transparency in the financial aid process and stems from these schools lack of concern for the students. This is why pushes for legislation for career metrics have been stifled over and over in Congress by for-profit lobbyists. It is rather clear why this has occurred because these institutions are largely creating a debt collective of millions:

Source:Â Senator Harkin

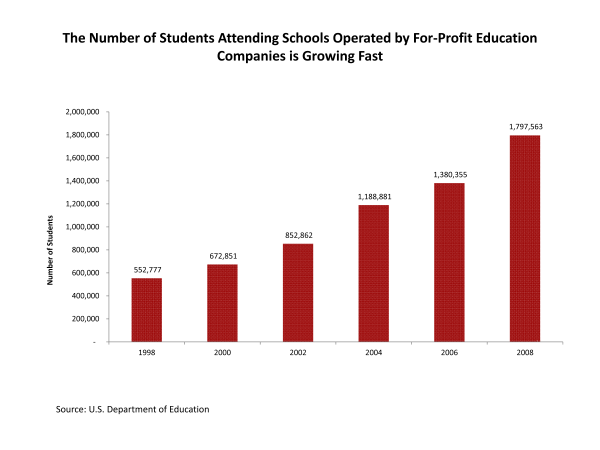

Enrollments at for-profits now nears a total of 2,000,000. And student debt overall continues to expand:

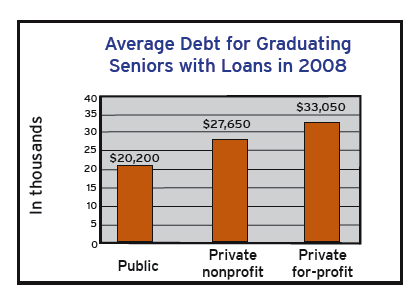

It should come as no surprise that for-profits carry the largest debt load although attract some of the lowest income students. This is why over the last decade, coupled with the financial destruction created by the banking sector, the typical earnings of a college graduate have fallen overall:

Source:Â BusinessWeek

This is extremely troubling. The cost and debt of those pursuing higher education is far outstripping the base rate of inflation. Many of the for-profits have student default rates that would range in the 40 to 50 percent level if only measured correctly. You can thank the financial sector and government for working closely to keep these figures distorted. Make no mistake, there is a bubble in higher education and the for-profits are simply trying to squeeze every dollar out of this turnip before a bailout is required by the American taxpayer. Yet like the subprime market, it was only the tip of the iceberg before the entire housing market collapsed. The same goes for a college education. Not that college will go away of course but a price shock will ripple through the industry just like it did with housing.

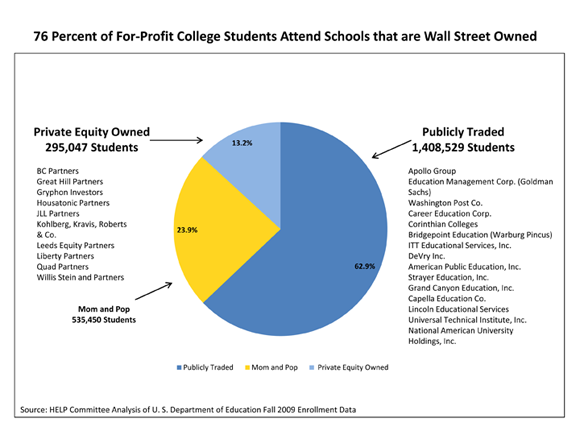

Some schools are now getting close to charging $60,000 with fees, tuition, and housing per year. How is this even sane when the median household income is barely $50,000 a year?  The only reason this is occurring is because instead of looking at the system carefully, the banks in conjunction with the government simply keep stating that the problem is access to student loans. No shocker that many of these are publicly traded:

So of course these for-profits which also trade on Wall Street increase costs and try to take as much as they can. Many of the for-profits take in 85 to nearly 95 percent of their “revenues†from government aid and loans.

The lack of vigilance in college degrees

There are big penalties if you claimed to be a doctor, lawyer, or even an accountant without really being one. Yet the ability to get a college degree is so easy that there is a Wikipedia page dedicated to pets who have earned this prestigious honor:

“(Wikipedia) Colby Nolan is a housecat who was awarded an MBA degree in 2004 by Trinity Southern University, a Dallas, Texas-based diploma mill, sparking a fraud lawsuit by the Pennsylvania attorney general’s office.â€

We will reach the $1 trillion mark in student loan debt in 2012. How is this good for a nation already saddled with $15 trillion in debt? At a certain point we need to start asking how is it possible to go from $200 billion in 2000 for student loan debt to over $1 trillion in 2012 with no measurable increase in quality for a degree. Plus, you have a large part of the industry now simply operating like subprime lenders trying to acquire students with fancy brochures and telemarketers to get students to sign on the dotted line.

Economic bubbles are defined as high volume action that has prices that are beyond the intrinsic value of the item. When you are paying $20,000 a year for basically an online diploma and going into massive student debt for this, we are likely facing a bubble. You don’t need a college degree to understand that key point.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!1 Comments on this post

Trackbacks

-

expatriot said:

What a joke and sham any college is. For profits are the worst because businesses laugh at a university of phoenix degree. Wall street and the colleges are just exploiting Americas biggest weakness which is a dumbed down citizenery. The sheeple are guillable and easily distracted and manipulated. I don’t think the cost to go to college will go down like housing did. Students can never file bankruptcy on their student loan debt. It will be with them no matter what happens for the rest of their life. So they will make payments. People just walked away from their homes. Another reason college costs won’t go down is because every generation coming up has had it beat into their head, “you want a better life? Go to college.” Also when a kid turns 18, his or her parents might want them out of the house and the kid wants out. College is suffice for both, the parents may think the more it costs the better the education. Enough rambling from me, good article this issue needs more play. Google chrome is telling me I have misspelled words sorry.

December 23rd, 2011 at 10:58 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!