40 years of housing data – U.S. homes still too expensive for typical families. In 1970 the median home could be purchased with 657 ounces of gold. Today, it only requires 155 ounces. The erosion of the U.S. dollar

- 3 Comment

The last 40 years have seen the U.S. housing market transform into a market largely driven by incredible amounts of debt. The credit card companies understood the basic notion that the monthly payment drove most financial decisions. Even though people purchase a home with a 30 year mortgage, the implicit understanding was that in a few years the home would be sold again and yet another new mortgage would be taken out. Housing became like the national debt in that most realized we would never get around to paying it off. We would simply roll over the debt over and over apparently in an endless process. Yet this can only go on as long as average Americans have an increase in their standard of living and wages. The opposite has occurred. For that reason, housing is expensive in today’s market. The median sales price of an existing home is $184,000:

As the media reports that prices are going up, the underlying message is that somehow things are getting better. Yet the reasons for prices going up are largely due to government intervention into the market. The two main driving forces that have pushed prices up in the last few months are:

(-1)Â The new home buyer tax credit

(-2)Â Federal Reserve purchasing mortgage backed securities to force interest rates lower

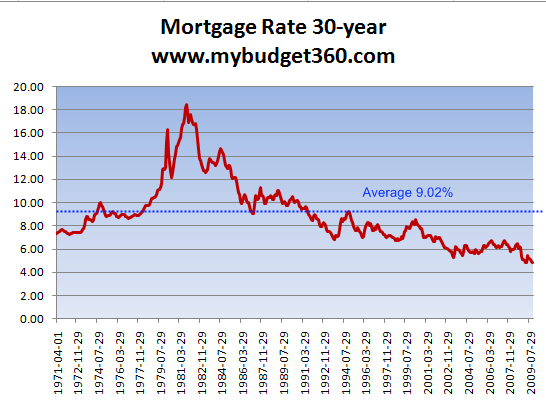

The outcome of this has pushed the existing sales price of homes up but Americans are not seeing improvements in their income. You can see that 30 year mortgage rates are at historical lows:

Let us go back to the first chart. Back in 1970 the median home price in the U.S. was $23,000. This means very little without context. Back in 1969 the median household income was $9,302. So it took 2.4 times the annual household income to purchase a home:

Median household income

1969:Â Â Â Â $9,302

2008:Â Â Â Â $57,000

Median home price

1970:Â Â Â Â $23,000

2010:Â Â Â Â $184,000

The ratio today is up to 3.2 so it is still more expensive to buy a home today than it was back in 1970 relative to income and home values. You also need to remember we have many more two income households today so we have more people working unable to purchase the same standard of living from four decades ago. This is an important distinction. We can even measure home values in terms of gold:

1970 gold price:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $35

1970 median home price: Â Â Â Â Â Â Â Â Â Â Â $23,000

Ounces of gold needed to buy a home:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 657 ounces

2010 gold price:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $1,181

2010 median home price:Â Â Â Â Â Â Â Â Â Â Â Â $184,000

Ounces of gold needed to buy a home:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 155 ounces

Regardless of your view on gold, it has gotten much more valuable in terms of home values over this time. You would need 4 times the amount of gold back in 1970 to purchase the median priced home.  Today, 155 ounces is enough to purchase the typical home. What has occurred over this time is the slow decline of the U.S. dollar. Average Americans haven’t paid much attention to this because access to debt has hidden the real erosion of purchasing power. It is also the case that cheaper imported goods have hidden the weakness of the currency. But those things are now coming to fruition and we are starting to realize how much the U.S. dollar has fallen.

If U.S. home values were increasing due to a healthy job market with steady income growth then we can say price increases were justified. Yet the gain is currently artificial. We need only look at the jump in homeownership rates brought on by exotic mortgage financing:

The homeownership rate is now back to levels not seen since the 1990s. Simply providing debt to someone without the means to sustain a long term payment is irresponsible. Yet the deeper problem stemmed from banks believing that home values would keep going up and up. In fact, some of the bigger banks saw this coming in 2005 and 2006 and started positioning their portfolio to take advantage of the coming collapse. There was no accident here but a deliberate funneling of debt to American consumers with housing as the main Trojan horse. Now that we know what has kept things propped up, do we want to continue down this road?  Having a high homeownership rate shouldn’t be a mandated policy. If we have higher homeownership rates in this country based on healthy economics then that is fine. But simply putting people into homes for the sake of doing it is bad policy. It is also the case that many of the bailouts were ushered in under the guise of helping “homeowners†but it was really a way to fix the bad bets of banks.

The chart above shows that there were times in our past when homeownership was actually in the minority camp. The massive increase in the late 1940s and 1950s was for the right reasons. It came because of big increases in household formation and a booming economy. The push in the 1990s and 2000s was largely due to bubbles.

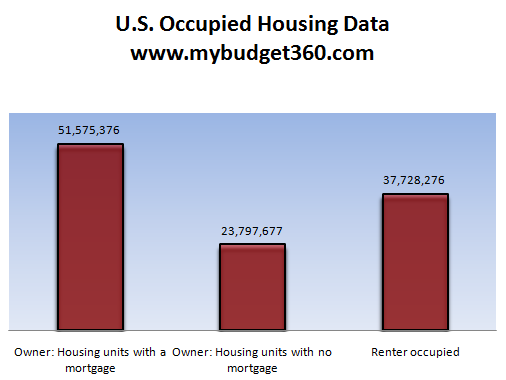

You wouldn’t know it from reading the mainstream press but a large part of our country actually rents:

Source:Â Census

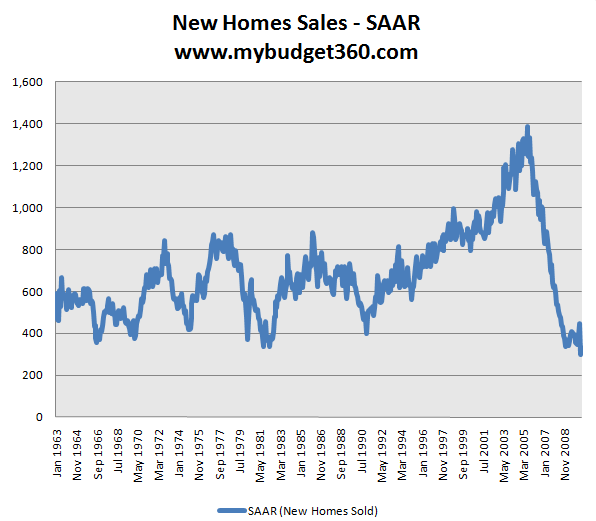

37 million households in the U.S. rent. This works out to 1 out of 3 households. Yet government policy through tax incentives punishes those for renting. So it was no surprise that easy lending from banks and stated government policy created the perfect storm for the largest housing bubble the world has ever witnessed. Those that think the correction is over are wrong. Let us look at new home sales data:

People aren’t buying new homes in large numbers because they don’t have the money to do so. When you have 40 million Americans on food assistance, purchasing a new home doesn’t exactly show up on the radar. For those with work, you have 4 out of 10 Americans workers employed in the lower paying service sector. Who will buy the more expensive newer homes? That is why most of the recent action has come in the existing home market. What constitutes an existing home sale? This would be a foreclosure resale or a pre-owned home being resold. In fact, in June only 30,000 new homes were sold in the entire country while 564,000 existing homes were sold. The gap is always big but this is near historical levels.

40 years of housing was built on more and more debt. Households even today are required to go massively into debt to purchase a home. The metrics are still off. It is still too expensive to buy given the current economic conditions of our market. Money is only as valuable as what you can buy with it. Would you rather have those 657 ounces of gold from 1970 or the median home from back then? That median priced home is now worth $184,000 while the 657 ounces of gold would be worth $775,917. The purchasing power of the dollar has gotten weaker but some fail to see it because of the large amounts of debt that mask the longer term problems. The housing market is in for a harrowing few years. Proceed with caution.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!3 Comments on this post

Trackbacks

-

Chundini said:

Your premise is sound but your example is fallacious as prior to 1971 gold was pegged at 35.00 a troy ounce since world war II and did not reflect any market place with the Bretton Woods system pegged the United States dollar to gold at a rate of US$35 per troy ounce. Today the price of gold is controlled by paper fiat gold that could not come close to supplying real gold to anywhere close to 10% of the holders of paper fiat gold if they confiscated all the real gold on the entire planet. The only real gold wealth you have is the gold that you drilled through for tungsten and having found none burried it in your GPS safe place.

August 1st, 2010 at 7:56 am -

Don Levit said:

Great article.

The median househild income looks pretty accurate.

From where did you get the median price of homes?

Is that for new, used, or all homes?

Not only do we have twice as many wage earners than 30 years ago.

We also have about half the kids to support.

The numbers have not worked out for the typical household for the last 30 years.

Women’s median wages have doubled, while men’s median wages have dropped. I can provide the statistical links, if any one is interested.

Don LevitAugust 1st, 2010 at 4:25 pm -

We Buy Houses said:

Great article and great site. I’ve been long annoyed at the media for trumpeting an increase in home values as if it was a good thing. Home values in many areas are still absurdly expensive, so why is it good if they become even more expensive? With a crappy economy and job market, people can’t afford homes at even the current price levels. On top of that, the price-to-rent ratio is still completely out of whack in many areas of California, particularly Orange County. If it’s far cheaper to rent, people are going to do so.

As painful as it will be, we NEED a housing correction, not another bubble. We shouldn’t even bother wasting untold billions trying to reinflate the housing bubble because the market will just pull it back into equilibrium at some point in the future anyway. We should just embrace the correction. The sooner housing corrects, the sooner we can clear the bad debts and get people buying again.

Thanks for letting me post!

August 4th, 2010 at 4:36 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!