Revisiting the Last California Housing Slump: How bad are Things Currently for California Housing?

- 1 Comment

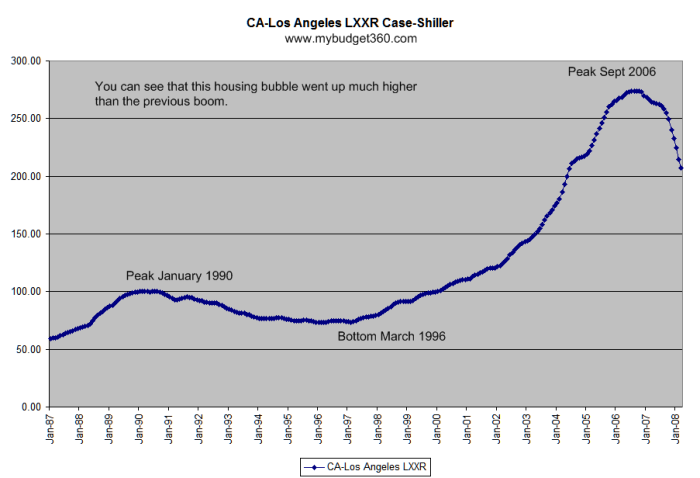

Sometimes the best way to measure one current downturn with one from a distant past is to look at the headlines. Many will recall that California in particular Southern California faced a boom and bust cycle; in the late 80s prices went up only to bust during the early 90s. Much was to blame including a recession and also local factors including the shrinking of the aerospace and defense industries. Yet as is currently happening, there is always a multitude of reasons why housing is declining. The actual forces have been here for sometime including dropping sales and increases in distressed properties.

Let us look at the previous Southern California bubble which peaked around late 1989 / early 1990 and hit a trough from late 1995 / early 1996. Take a look at this article from June of 1995:

“(DQ News) La Jolla, CA.- Fewer California homes are being sold for less than they were bought for, indicating that many potential sellers have decided to stay where they are, a real estate information service reported.

In 30.7 percent of all May home sales, sellers ended up getting less for the home than what they had purchased it for. That loss percentage was down from 32.4 in April and down from 35.4 in May last year, DataQuick Information Systems reported.

Loss sales accounted for a steadily increasing portion of the market from early 1991 until a peak of 42.7 percent was reached in September 1993.

Large newly-built homes that were bought during the 1989 to 1991 sales surge have been particularly exposed, but the problem has spread into other categories as well, said Donald L. Cohn, DataQuick CEO.”

We also know from the data provided that from March through May, for Southern California 40,144 homes sold for the 1995 year. Let us now look at the same sales data for 2008:

Southern California Home Sales:

March: 12,808

April: 15,615

May: 16,917

Total 3 Months: 45,340

So given that over 13 years and a natural growth in the population, home sales are nearly as bad as the absolute trough that was reached in the previous bursting of the bubble. Keep in mind that if we are to say the peak was 1989 and the bottom was 1995, it took at least 6 years to reach bottom. Currently, the peak for Los Angeles County was reached in the winter of 2006 so we are not even two years into this correction. The peak of loss sales was in 1993 where 42.7 percent of homes were selling for lower price. Now let us take a look at last month’s stats:

“(DQ News) Among all Southland resales in May, about 42 percent of homes sold for less than their prior sale price – about 34 percent less, on average, based on an analysis of sales where a full May 2008 and prior sale price were in the public record. Most of the prior sales occurred between early 2004 and mid 2006.”

So already we are quickly approaching the peak that was reached in the last housing bubble. Given that from the price loss peak in 1993 to the trough took an additional 2 to 3 years, we can expect that we will see at least a close nominal bottom in 2010 or 2011 if things follow the same trajectory from the last bubble.

My first observation is that it will be much more prolonged given the multitude of mortgage products still lingering and this recession will not be based on a few industries but an overall contraction. Plus, we are still seeing worse and worse price declines and still have not seen that bottom. It may be the case that prices continue to fall for an additional year. Southern California is already down by a stunning 27 percent on a year over year basis.

You also need to remember that this bubble went up much higher than the previous bubble. Bottom line is we are already at the level of distress from the previous bust and we are less than two years into this correction. Only time will tell how much we will correct but looking at the past gives us a good reference that housing has and will burst in bubbles.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!1 Comments on this post

Trackbacks

-

Caren said:

Hi,

My name is Caren.

I have a very good credit card website that takes its place in the Google top 10 credit card sites.

I would like to buy links at pages of your site http://www.mybudget360.com

Please let me know if you are interested and how much you charge via email.

Thank you for your time,

Regards,

Caren.June 25th, 2008 at 3:03 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!