China ghost cities and real estate correction: China’s GDP and individual household wealth is heavily tied to real estate. What happens when a correction hits?

- 2 Comment

China has had one of the wildest real estate sectors of any large global economy. Chinese real estate values have appreciated dramatically largely shutting out regular workers in the country. It is an interesting situation. You hear countless stories of young males trying to find a potential mate and given the restrictive one child policy, many eligible bachelorettes are looking out for those that actually own property. Nothing wrong with that but it adds fuel to the real estate flames in China. The flames are now cooling down. China’s real estate market has started to cool for the first time in many years. This will be challenging for the economy because a massive part of Chinese GDP is tied directly to real estate. We have many examples of ghost cities and ghost apartments sitting virtually empty but somehow, added to the GDP figures. It is also important to note that in China, a large portion of household wealth is tied up in one asset, real estate. Chinese stock exchanges do not reflect the massive growth of the country, fudge factors aside. So what actually happens when real estate contracts in China?

Too much wealth in real estate

We saw the dramatic impact of a housing correction in the US and what it can do to an economy. In China, real estate is a gigantic portion of GDP but also of household wealth. Real estate in China accounts for roughly 13 percent of total GDP. That is a big sector and doesn’t account for all the supplementary business segments that are reliant on a healthy real estate sector.

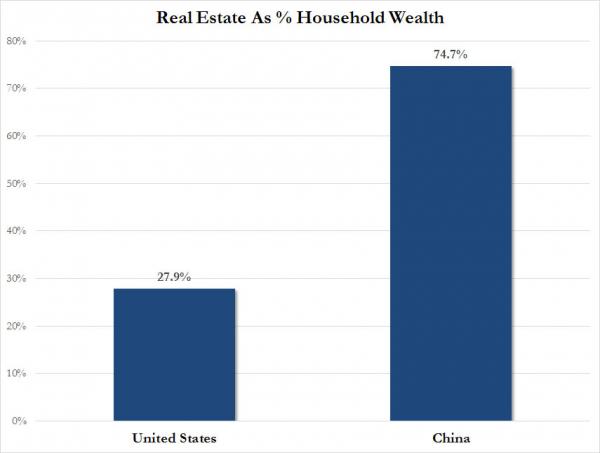

It might be useful to compare household wealth between China and the US when it comes to real estate:

In the US real estate makes up 27.9 percent of total household wealth. In China this number is a whopping 74.7 percent. I should note that most of the wealth in the US is in financial instruments but most of this is aggregated in few hands. The same case occurs in China except that most of the wealthy have decide that real estate is the way to go. This lack of diversification is troublesome should a correction occur in the real estate sector. The correction looks like it is already here:

“(NPR) After years of stunning growth, China’s go-go real estate market is now in retreat.

Prices fell last month in 79 out of 100 cities, according to the China Real Estate Index run by SouFun Holdings, a real estate website. Land sales dropped nearly 30 percent this spring from a year earlier.

Real estate has been one of the engines driving the world’s second-largest economy, which is why economists in China and around the world are watching the market closely these days.

Among the harder-hit cities are midsized provincial ones like Wuxi, in eastern China’s Jiangsu province, about an hour by bullet train from Shanghai. Drive into town at night and you’ll pass rows of 25- to 30-story apartment blocks with just a handful of the apartments illuminated.

“There’s nothing you can do,” says Huang Jiqiang, an agent with Central Plains Real Estate here. He says supply and demand are completely out of whack.â€

Since China building projects are designed for massive numbers of potential residents, apartment living is the typical building structure. This makes it interesting because you can visually see how empty some of the projects are during the night. A quick glance will show that many new developments are flat out empty. Given the transition from rural to urban living is a slow one, it is hard to envision working Chinese residents suddenly being able to afford swank apartment buildings, certainly not at current prices.

Take a look at Ordos, one of the bigger ghost cities in China:

“(Gizmodo) Built for over a million people, the city of Ordos was designed to be the crowning glory of Inner Mongolia. Doomed to incompletion however, this futuristic metropolis now rises empty out of the deserts of northern China. Only 2% of its buildings were ever filled; the rest has largely been left to decay, abandoned mid-construction, earning Ordos the title of China’s Ghost City.

Last year I travelled to Inner Mongolia for myself, to get a closer look at the bizarre, ghost metropolis of Ordos… and the experience, as I would discover, was far stranger than anything I could have prepared for.â€

A city built for more than one million people yet only 2 percent of buildings being filled. The government is pushing for real estate and has mentioned trying to cool down the sector but similar to our Federal Reserve, actions are speaking louder to keeping the gig going. There is no doubt that some of this real estate inflation is being caused by the obsessive focus on real estate especially in an economy where so much wealth is stored up in real estate.

If the correction continues, it is likely to shave off 3 to 4 percent of GDP but this is likely going to happen over a few years. This does beg the question as to how much poor investment has been occurring and how much of this is incorporated into the GDP bottom line. It does make you wonder but it is rather clear that a correction will be occurring in Chinese real estate. The only question that remains is how deep will it be?

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!2 Comments on this post

Trackbacks

-

roddy6667 said:

August 1st, 2014 at 5:08 am

-

Dmitri said:

I’ve seen quite a few of these ghost areas and they are a stunning waste. There is one point I would make though: go to Hong Kong. You will realize after a while that there are 10,000s of units kept off the market intentionally. Visit London or Boston and discover much the same: Chinese who bought luxury houses and condos with cash are not using them at all. Chinese seem to have a very different concept of real estate than western society. I’ve met people with multi-million dollar units in HK that will not even try to sell or rent their empty unit for years because they can afford to hold on to it and wait for an even greater jackpot. I was told that many luxury units in Hangzhou are in this category. There’s no question that ghost cities make sense and that most represent waste, but I am not so certain the situation is as dire as represented in the west. Further… Chinese banks, like ours, don’t go bankrupt… they are forced to keep extending credit (unlike ours).

August 7th, 2014 at 5:25 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!Â