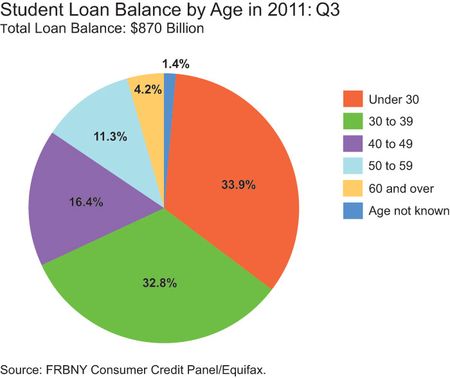

A costly lesson in student debt for young Americans – 34 percent of all student debt saddled to those under the age of 30. 47 percent of student loan borrowers appear to be in deferral or forbearance.

- 4 Comment

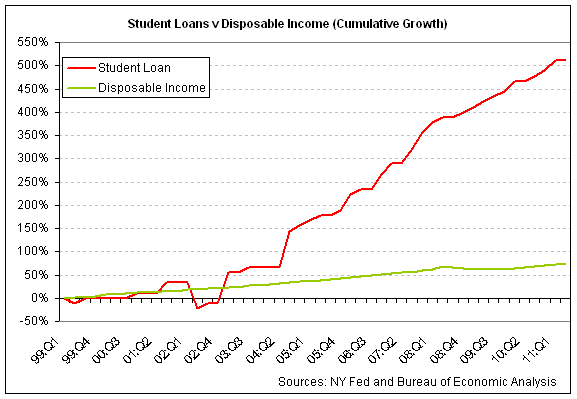

The student loan market has expanded like a financial virus in the last decade. Even during the financial meltdown where credit was being restricted across all sectors of the economy, student debt kept on growing at a feverish pitch. It would be one thing if the quality of education had increased or wages were going up for college graduates but the opposite occurred. The quality of education especially at many of the for-profits is suspect at best and borders on thievery. This is where a massive expansion has occurred thanks to the financialization of our entire economy. Student debt has grown from $97 billion in 1997 to a stunning $870 billion according to conservative Fed reports to inching closer to $1 trillion this year by other measures. Higher education is definitely in a bubble and younger Americans are dealing with the brunt of this new predatory financial epidemic.

The young carry the brunt of the growth in student debt

As we previously mentioned, total student debt in 1997 was roughly $97 billion. Since that time, it has expanded by a factor of 10 all the while incomes have actually fallen. The data is disturbing because it shows that over 90 percent of all outstanding student debt came after 1997. The breakdown of the data shows this:

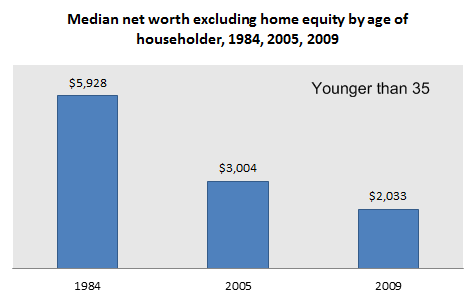

The above is a conservative estimate of total outstanding debt. You’ll notice that roughly 34 percent of all outstanding debt is carried by those under 30. If we add in those under 40, we encapsulate over 66 percent of the entire debt market. This is disproportionately a problem of the young. What is troubling is that most of this debt is being taken on by younger Americans who have actually seen their net worth fall while student debt markets expand:

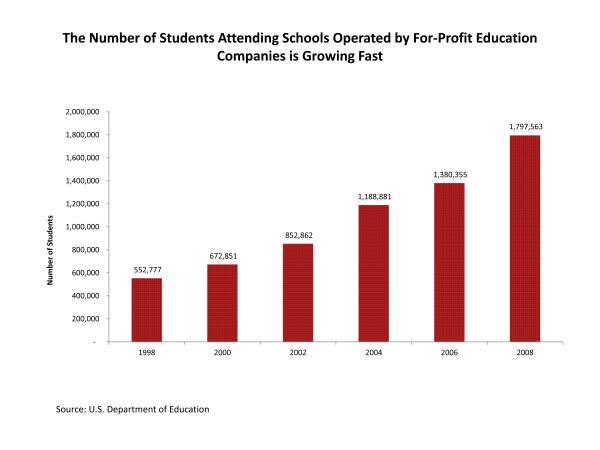

Wages have also fallen for recent graduates. This can be attributed to the weak bubble based economy but also the dilution of the quality of education many are getting. The fastest rising sector in higher education is the for-profit sector:

Source:Â Senator Harkin

Many of these institutions are essentially degree printing factories that rely almost 100 percent on government backed loans to lure in prospective students. This is more low-hanging fruit of course and can easily be solved by shutting down their funding source. Many students are going to colleges and getting a good education but the market for jobs is simply not there yet the cost of college has outpaced income growth:

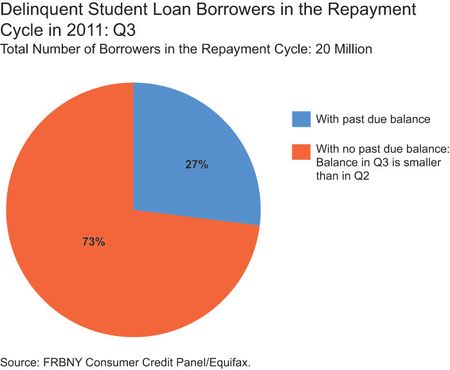

The problems in the student debt markets are starting to catch up now that a stunning 27 percent of all borrowers have a past due balance. When we break out the figures we realize that many are unable to support their college debt payments:

Since college debt is not dischargeable in bankruptcy we are setting up a generation of young Americans that will be forever saddled with overpriced degrees and back breaking debt. This leads to an even more insidious side of student debt.  Some balances with fees and other gimmicks actually increase the initial balance on those least likely to pay.

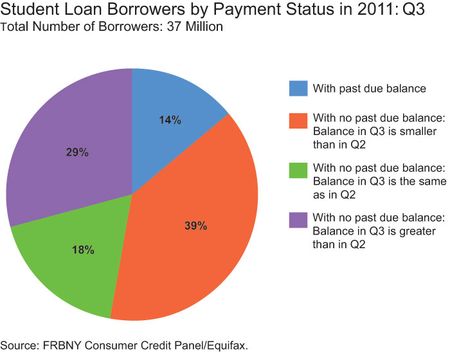

When we look at the data we see a large portion of those in student debt actually having a growing balance:

29 percent of all student loan borrowers had a higher loan balance in Q3 of 2011 than they did in Q2 of 2011. Here is a troubling account from a moderately priced state school:

“Q: How does the American middle class dream of affordable higher education become a nightmare?

A: Default a student loan.

Original loans=$26,000

Amount paid to date = $24,000

Current amount owing = $70,000

Synopsis:

Multiple loans as a graduate student attending Cal State Northridge. Full-time through 1993 in graduate school, no problems, just sailing along. I lost my dwelling in the ’94 Earthquake, and dropped down to less than 1/2 time. I was put into default by Sallie Mae. Wrote numerous letters to CSAC & loan Co. (AFSA) that due to hardship, I’d be dropping below full-time. To no avail. Returned full-time in Fall ’94 thru Sp.’95 full time, sent numerous letters (all certified mail), “sorry, but can’t help.” I’ve been fighting this since then. Have all documentation, but it’s useless. Every year (thru 1997), I would ask for a dispute hearing, and was answered with either a garnishment or judgment [sp]. I Finally gave up.â€

So the original loan balance was $26,000 and is now up to $70,000. Given that student debt hangs around like a financial albatross for life, if you do end up like one of the many millions unable to pay student debt the story can become rather dark:

“Original loans $26,000, now over 70,000. Paid over 22,000 in garnish $ tax intercept, lost my scholarships (PhD), loan forgiveness programs, and chance at a fellowship. This hurts me particularly since I taught at an inner city school in Los Angeles for 5 years in the expectation that my loans would be forgiven.

I’ve completed 2 master’s degrees since this nightmare, and work at a college (JC) as a professor/counselor. Made the mistake of contacting Scott Williams & EdFund. I offered a settlement, also, but no bite. Instead, Edfund has increased the amount of my wage garnishment, and raised my interest up to nearly 20%

I left off of the synopsis all the anguish, the embarrassment [sp], credit problems, anxiety, etc.( need I go on?)

All I want to do is pay my loans at a reasonable amount, and get back to my life.â€

This is one of the many stories I’m sure we will be hearing about for years to come. It also highlights how absurd the system is when it comes to student debt. Even with housing if you are unable to pay (a very common story today) you lose your house through foreclosure but you can leave and move on. You take a hit to your credit report and the bank takes the house. You can rebuild, rent, and start again with very little lingering pain aside from a lower credit score. With student debt they can garnish wages, chase you down like a bookie, and basically own your financial life like the story above which goes back to the early 1990s and continues today.

The irony is those that can’t pay actually see their balances grow which is like sticking people into debtor’s prison and then expecting them to pay off their balance. The student debt market is simply a symptom of an out of control and gambling banking sector that has bought out our politicians.

“We truly have the best government money can buy. From 2004 to 2010 members of Congress increased their median net worth by 15 percent while the average American saw it fall by 8 percent. Yet this fall in net worth does little justice to the rising cost of food, energy, healthcare, and college expenses that have eaten away any iota of progress families try to achieve in a prosperous nation.â€

These loans are made on the backs of the American taxpayers to serve as a laundering system for the big banks. Isn’t it amazing that since the late 1990s with the deregulation of the financial sector that we have had the biggest bubbles in real estate, oil, and now with student loans? Wages have gone down for most American, the cost of living is up, so who really won here? You don’t need a college degree to figure that one out and it certainly doesn’t require you to get an absurd student loan.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!4 Comments on this post

Trackbacks

-

surfaddict said:

I’d like to see data on disciplines studied and student debt corellation. Just a guess, but I bet finance, ethics, and science students are lsess likely debt-saddled. No excuse for being a deadbeat, asking for forgivness is futile, only God forgives, but the bank wont!

March 22nd, 2012 at 10:12 am -

expatriot said:

Health care costs are raping Americans and so is student loan debt. The health care ones more important to me because people can’t choose to get sick. These college guys knew what they were getting into. It’s no one’s fault they didn’t realize college was a scam. They should have done their homework and stopped with that b.s. mantra of “I’m going to college to make something of myself and have a better life.” That worked in the seventies but what they should tell themselves today is, I’m going to college and if I’m lucky I’ll be flipping burgers to pay off forty or eighty grand in debt. And if I’m really lucky I can live with my mom.

March 22nd, 2012 at 9:36 pm -

jimbo said:

Why don’t students ban together and refuse to pay? I’d work under the table.

March 22nd, 2012 at 11:21 pm -

fresno dan said:

I find this one of the most consistently insightful and informative websites that I frequent (and I read A LOT of economic websites)

I very much appreciate your analysis and perspective. I truly learn a great deal every time I read one of your postings!!!

Great job!!!

March 23rd, 2012 at 6:12 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!