Credit Consolidation Ideas: Using Prosper and Balance Transfers

- 1 Comment

Debt has a way of holding you down. It may start out with a very tiny amount, maybe a gift purchase or a vacation, but little by little that tiny debt has ballooned into an unmanageable amount of debt that is making it hard for you to save. I was watching Larry King last night and his guest was Suze Orman. She mentioned that the average credit card debt for Americans is $9,000 with an average interest rate of 17 percent. Just to put this into perspective, if you were able to get 17 percent on your investments you would be a millionaire in no time. So what are some steps in combating debt?

Get Motivated

First, you have to find the leverage in yourself to get out of debt. It isn’t enough to say you want to get out of debt for the sake of being debt free. If this is your only motivation, you will be in debt again finding your place at the starting point. You have to dig deep in your soul and understand that debt is hindering your ability to be financially free. High interest debt is a subtle (or not so subtle) way of telling you that you may be in fact living beyond your means. Take this as a challenge and an opportunity to change your life.

FICO

Your FICO score determines a lot of things including your interest rate. You can easily obtain your FICO score from www.myfico.com – scores range from 300 to 850 with the higher the better being the case. No need in getting all 3 scores from the 3 various reporting agencies. One will suffice. The score is derived from multiple sources including your debt ratios, payment history, and length of credit. One misconception is closing down credit cards helps your credit score. It does not because it increases your debt utilization. If you feel the score is too low, you can obtain a free credit report typically once a year at Annual Credit Repot.

If you have a high FICO score and are paying a high interest rate, make it a point to transfer your balances to lower interest credit cards. You may have two options here. Now with credit being tighter, you will find many of the 12 month zero interest offers gone. But there are many with a good credit score where you can get 4 to 5 percent fixed for a period of time until you pay off the balance. Make it a must to payoff that debt.

My Credit Is Bad

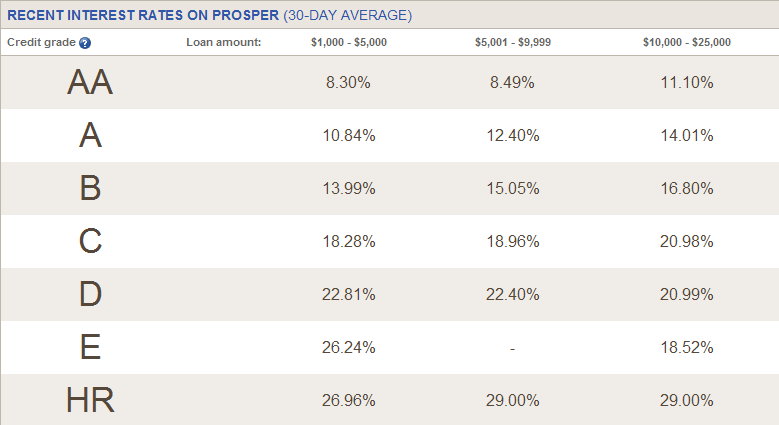

Okay, so you say that your FICO score isn’t so hot. Now what? Well there are a few places online that you can go and try to get a loan from a peer to peer loan network. One of these places is Prosper.com. These places allow potential lenders the ability to bid on personal cases and offer loans at competing rates. You put your loan up for bid auction style and after a week normally, if you had set a competitive rate, you will have your loan filled. Below are a few lender rates on Prosper:

The good thing about Prosper is the note is payable in 3 years completely amortized with simple interest. The benefit of this is that it forces you to pay off your debt quickly even if your rate is higher. Unlike a 24 percent loan with a credit card, a 24 percent loan on Prosper includes the principal and interest and usually you are paying a large piece toward the principal. Chances are that you will get a much lower rate however if you have okay to poor credit here compared to industry credit cards. Your payment is automatically taken from your checking account so there is no need to worry.

Getting out of debt should be a priority for the new year and there are many ways you can save money by getting rid of that albatross.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

1 Comments on this post

Trackbacks

-

Current account said:

T

Here have always been three ways of clearing debt:

1. repay it

2. inflate it away, or let the Government do it for you

3. defaultI once read as book on international debt which stated “1″ was by far the most common. White Russains and various African and American countries/states apparently used to be masters at this. Too much debt, time for a revolution.

Inflation used to be great but no more.

Default is now much easier with IVAs readily available on every high street and bankruptcy much less painful. With an IVA you can still stay in business and I know qualified accountants and solicitors who have gone this route and kept their practices running!! But it does not help your credit history.

But it you decide to repay then you only have two choices – earn more or spend less. But it can make a lot of differcne how you apply these policies and you may find it useful to visit this web site – it is a US site but I found it quite useful.

Mon

January 23rd, 2009 at 2:55 am