Fairytale economics – spending into poverty legend. How the allure and trappings of consumption led the middle class into a modern form of debt servitude.

- 10 Comment

Ludwig the II of Bavaria is rarely discussed in history class but most would recognize many of his castles especially the one that is replicated in Disneyland (Neuschwanstein Castle). Ludwig spent money he didn’t have to indulge in his eccentric desire to build opulent castles. Even wealthy royalty can put their balance sheet into jeopardy if they indulge every whim and wish. The banking sector for the last decade has allowed many Americans to satisfy nearly every consumer desire they had. Boats, cars, vacations, clothing, recliners, Jacuzzis, or anything else you can imagine. Some took this to the extreme and created a massive market that demanded bigger and more extravagant homes even though average Americans were not getting wealthier or earning more money. How this was accomplished was by allowing massive amounts of debt to accumulate until a crisis imploded the economy. The credit bubble bursting has forced many into a new life of austerity. No more Sleeping Beauty castles.

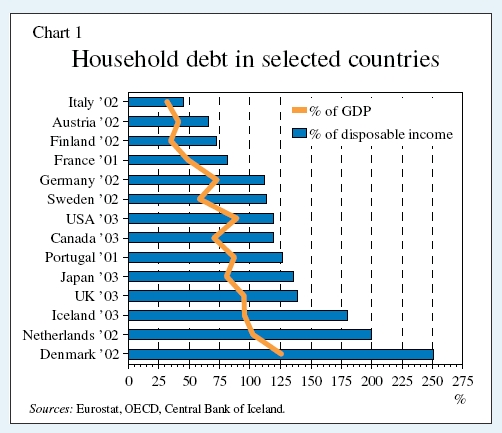

On a GDP percent basis the U.S. isn’t the worst offender but we are up there on the list. The above list spans out to 2003 (and it only got worse until 2007) and you can already see what big amounts of household debt will do. Take for example Iceland or Portugal that are now facing major headwinds ahead. A country cannot go into massive amounts of debt and expect to have a sustainable economy for years moving forward. It is a short term indulgence that masks deeper rooted problems. The middle class in America were allowed to think they were all dukes and countesses but when the crisis hit, the banks retreated to protecting only their kings on Wall Street. This was an economy built on a fairytale.

Part of this naïve belief was pushed by Wall Street and D.C. propaganda. For decades the idea was that you can spend more than you earn. This came all the way from the top so it shouldn’t be a surprise that many in the middle class took their signal from their leaders. What happened?

Source:Â Lew Rockwell

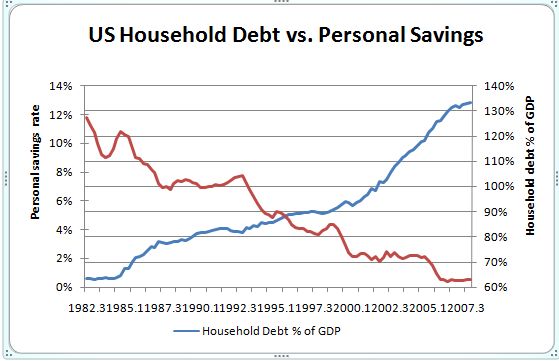

The personal savings rate went so low that it went from the double digits in the early 1980s and actually hit a negative percentage not too long ago. At the same time, the amount of household debt went off the charts. It is hard to remember that there was a time in our history when debt was actually something to be handled with caution. In the last decade, the careless risk taking banks did with debt created a massive housing bubble but also created bubbles in the auto industry, student loan market, and other areas that were financed induced. Industries where banks are heavily involved have somehow turned out to harm the working and middle class of the country.

Many financed their lifestyles through credit cards:

We have dropped from the peak of nearly $1 trillion in credit card debt down to approximately $850 billion in credit card debt. Yet this contraction didn’t happen because people started paying down debts. This has occurred through bank write-downs and many of the bailed out banks constricting access to credit cards to the American public. In a way, this is what should have been done decades ago. But what is troubling is that banks used this as an excuse and reason for receiving trillions of dollars in U.S. taxpayer money. The bailout funds were to keep lending going so people could use the funds to live in their debt fantasy. Well that fantasy has ended for the middle class but banks can continue on pretending and living in their fairytale world where taxpayer money and bailouts are somehow congruent with a free market. Retail spending has contracted because people no longer have access to the amount of debt that was available only a few years ago.

If you want to see the new royalty in America, just look at the below:

Source:Â Institute for Policy Studies

I’ve talked about the distribution of wealth in the U.S. in many articles but the above shows a solid plutocracy is already here. Wealth is the key issue. As many people are now finding out simply having a massive home with a jumbo mortgage and a leased foreign car is no sign of wealth. In fact, that can be taken from you quickly (and it is by the number of foreclosures and repossessions we are witnessing). But true wealth is actually owning the stock, or share of ownership in companies in the U.S.

“The above chart shows that half of all stock wealth is concentrated with the top 1 percent. In fact, over 90 percent of Americans in the lower rungs own roughly 9 percent of all the stock wealth. This is why the stock market is largely a game for the rich and jobs are largely a game for the rest of us.”

We are at a major crossroads for the U.S. If action isn’t taken soon this massive inequality will dig deeper and the middle class will lose more and more people as the economy knocks people off the treadmill. If we follow the money, our government, Democrat or Republican is largely bought out by the Wall Street cause. Money is shifted to the least productive sector of finance at the expense of building real tangible assets that help the majority. The real fairytale going on today is believing that our government and Wall Street are looking out for the economic good of the entire country. Ask the 40 million people on food assistance how things are going. Ask the over 15 million Americans with no job how the economy is progressing. Let us ask the millions that are being foreclosed on how solid growth is. For big banks, all is well and this is reflected by their billion dollar profits since they are stealing from taxpayers and gambling on Wall Street. Not even a Disney fantasy is this outlandish.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!10 Comments on this post

Trackbacks

-

hal said:

90% of the stock wealth is owned by 10% of the people – who cares. I’ve seen so many poor people who have a 40 inch flatscreens, an xbox, and a wii. They could’ve bought stock instead, but they prefer the petty consumer items at the store. The imaginary plutocracy did not force them to lead lives of waste. It’s their freedom to choose. I left that class of people for a better one through extreme thrift and austerity over a period of 2 decades. Don’t call me part of some plutocracy who is plundering the poor.

July 19th, 2010 at 9:43 am -

Don Levit said:

The distribution of wealth provides a startling statistic.

But I have never heard of Political Party Pooper.

Don’t you have a governmental source you can cite?

Don LevitJuly 19th, 2010 at 12:03 pm -

steve said:

well this is depressing. and i’m in the group of idiots, with $50,000 of credit card debt and $70,000 left on my mortgage of a house I won’t be able to sell for a while because it’s in a depressed part of New York, the effed up state who’s legislators continue to spend it’s taxpayers into the red, people are moving out, not moving in, and they can buy a new house for a better deal than my used house, so eff the concept of “your house is your biggest asset”. my b2b business is failing hard because the businesses I sell to are having really bad times and don’t want to spend any money on any thing, even the necessities. this is a scary time.

July 20th, 2010 at 5:29 am -

BigSkyBear said:

Congrats Hal, but don’t shoot the messenger because he touched a nerve. Spot on article.

July 20th, 2010 at 5:39 am -

Black Swan said:

@Hal, you are getting a little defensive. Where in this article does he say that the 90% is plundering the poor.

He writes, “In fact, over 90 percent of Americans in the lower rungs own roughly 9 percent of all the stock wealth. This is why the stock market is largely a game for the rich and jobs are largely a game for the rest of us.”

July 20th, 2010 at 7:42 am -

Benjamin said:

The plutocracy is not imaginary, and the reason debt is going up and savings going down is not “people buying flat screen tvs.”

The reason is that the jobs have all been shipped off to China for the benefit of the plutocracy and stock holders, and this (American capital moving abroad) is called “free trade” by the plutocracy. People have compensated for flat wages for 30+ years by going into debt so that they could have a rising standard of living, just like every generation of Americans since Plymouth Rock- if the debt option wasn’t available we’d have had a revolution twenty years ago.

Now the debt option is being taken away, and Americans will either smash the “Free trade” and “Free markets” which have off-shored the jobs and kept the wages flat, or the “Free trade” and “Free markets” are going to smash them into neo-feudal lifetime debt serfs.

July 20th, 2010 at 7:40 pm -

CLW said:

Hal: You say a plutocracy is imaginary, but you admit you moved yourself out of one class of people to a better one. You simply cannot have it both ways. Sorry.

July 21st, 2010 at 5:50 am -

George Bush said:

Yea the poor people could have bought stocks and really lost their a$$e$ that would be brilliant!!

July 21st, 2010 at 11:36 am -

Jay said:

Hal, you are right to say that poor people are buying flat screen TV’s and other luxury items. And they are doing it on credit. However, you and the author are both living in a fairyland if you think investing in the stock market makes you wealthy. During the crash of the first great depression, some of the wealthiest stockholders in the world could be seen in mid-air as they jumped from tall buildings after the stock market crashed. When the working class of people,(if they really work that is) can no longer hold a job, then they can no longer buy the flat screen TV’s and ipods that are built by the large companies who’s stock you have invested in. So both of you are living on credit and borrowed time. My advice? First of all, don’t go into debt for anything. Second, only buy what you can afford considering all other expenses and future financial reversals and disasters. Third, get ready for economic armageddon and expect the unexpected in every way.

July 21st, 2010 at 11:47 am -

Nate said:

Good summary. One important thing you pressed on is the changes in the job market. Industrial labor jobs are becoming a thing of the past. In a market economy, jobs will change, and people need to move with the market, or get left out.

As low skilled jobs move out of the country or are replaced by technology, people will need to re-educate themselves. This country competes with the world labor market and the only way to have growth is to maintain high education and skill set levels. Gone are the days when a laborer can be in their job for 30 years and get a pension. We need a country where 70% of the people have 2+ years of secondary education. Even 4 year degrees are feeling pressure.I see a lack of ambition by lower skilled workers to drive themselves to better education as a whole. There are so many programs out there that a resourceful person (like I did) can get education with no upfront costs and maybe little post degree cost. All I see is a stubbornness not to change jobs and expectation that they should get their same job back. At least 5 million of those 7 million jobs are gone for good. People need to accept that things change.

As lower skilled jobs are going overseas, the management and IT job are booming for the same companies. When a company can produce a product for 30% cheaper overseas, it means they could be selling more of their product, requiring more management and administrative resources over here.

The problem is now it’s almost too late. People are stuck underwater in homes, so cannot move where the jobs are. And government is throwing in every possible method to prop the past market up, only delaying reality. And even worse, giving hope that people will not have to change.

July 28th, 2010 at 12:59 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!