Federal Reserve openly aiming for inflation – The Fed looks for a sequel in punishing the U.S. dollar and hopes to inflate debt and the middle class away.

- 4 Comment

The Federal Reserve has painted itself into a very narrow and troubling corner for most of working and middle class America. The massive debt problems on hand have no realistic way of being paid off and the best path in the eyes of the Federal Reserve is to slowly inflate away the currency and debt. Yet that brings up some troubling dilemmas. Think of the cost of living adjustments (COLAs) that many on Social Security once received. Many of these people purchased homes pre-bubble days and many may have their home paid off. Yet because a large portion of the CPI is based on housing, the CPI has been falling for the last few years stunting growth in COLAs all the while food and other daily use items are surging in cost. The Federal Reserve has no allegiance to any country and is only concerned with the safety of the biggest banks. That is their main charter even though they claim to talk about a stable currency for a country. Let us see how well they are holding to that mission:

Source:Â Shadow Stats

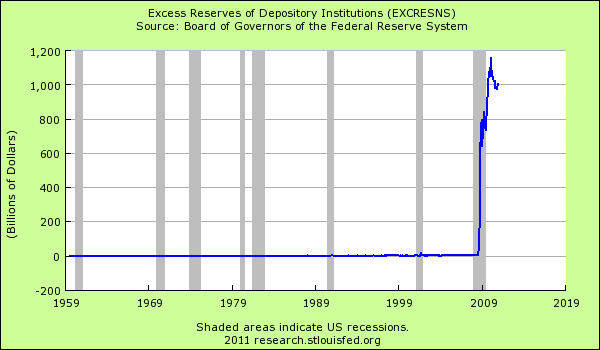

Does the above look like the Federal Reserve has done a good job in maintaining a stable currency?  Of course this is strategically planned and is deliberate. The purpose of debasing the currency is to make our exports more competitive abroad but remember who you are competing with here. We are going against places like China who artificially hold their currency low to expand their economy. Is this really the kind of global policy we are looking for here? Of course the Federal Reserve is allowing global banks to reap enormous profits all on the back of middle class Americans that allow the legal structure to stay in place and have stolen large amounts of money through bailouts. The banking industry is merely hoarding money and using most of it in stock market speculation:

Think about excess reserves and why they are so high currently. Banks knowing the full magnitude of their bad debts are holding on tightly to the money earning guaranteed low rates instead of putting the money to work into the economy. In other words they don’t believe the US economy recovery hype. Ask any small business owner how easy it is to borrow money from a big bank in the current economy. The money is extremely tight. But larger corporations are able to leverage their money globally and are largely outsourcing their workforce. It is a troubling dynamic. These large banks that are only permitted to survive because of US taxpayers are actually using the money to outsource the jobs that saved them from default. The Federal Reserve is merely lubricating the wheels of the full-fledged global debasement of our currency. First the currency is debased followed by the workforce.

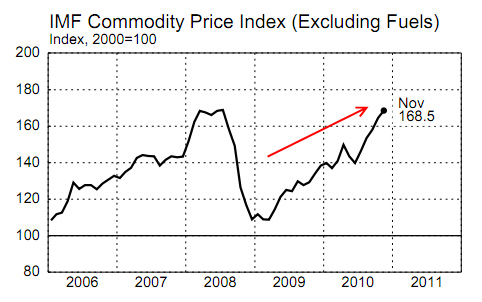

While inflation is supposedly non-existent, we are seeing the price of commodities bursting upwards:

The above understates the actual reality because it excludes fuel. As long as you don’t eat, go to school, need medical attention, or use gas then there is likely little inflation in your life. Otherwise you are living through the Federal Reserve experiment of debasing the US dollar.

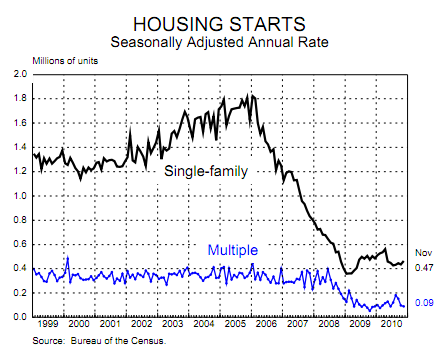

Remember how all the bailouts where about saving the US housing industry? After all, trillions of dollars in bailouts and backstops were given to banks all under this premise. Let us see how things are going:

So much for that recovery and prices are near their trough and recent data shows prices heading lower yet again. And of course prices are moving lower! Home prices were solidly in a bubble. Homeowners had no way of buying homes at bubble prices without the help of exotic financing from the banks. Yet right now the banks have been bailed out completely while homeowners who are also taxpayers are left cleaning up the entire mess. Banks are merely using the bailout funds that were supposed to help the flailing housing market and are betting in foreign markets like Latin America and Asia. Do you remember that being told to the American public in the dark days of 2008?

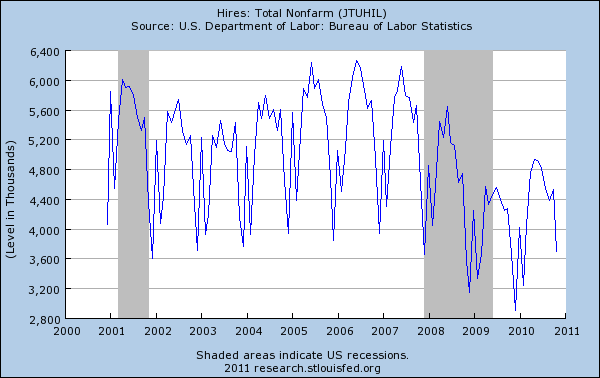

Hiring hasn’t improved much in the US with the Federal Reserve going with the quantitative easing machine:

It is an interesting issue. The banks should have failed for their bad bets. Yet now we have this slow methodical outsourcing of the US middle class all the while the top 1 percent gets richer and richer. Adam Smith cautioned nations against this form of predatory corruption brought on by capitalism gone haywire. This is no longer capitalism but a controlled form of plutocracy protecting the elite via exporting the gains of the masses. That is the reality. The debasement of the US dollar hurts most workers who are paid in US currency but the wealthy don’t care since they have accounts denominated in foreign currencies. What do they care? Yet quality of life issues are hitting most working and middle class Americans.

The Federal Reserve is concerned about the banks. That is the bottom line. They do not care about a stable currency and the proof is in the pudding as they say. The US dollar has taken a beating over the last few decades. The Fed is not a government agency yet has the power without Congressional oversight to basically destroy the purchasing power of millions of Americans. How is that even possible? Keep in mind that the Fed during this economic downturn has taken on much more than their original charter had mandated. Is this the kind of world we want where the banks can use the taxpayer as a piggybank with no accountability? Keep in mind the housing bubble was largely brought on by the Fed thanks to super genius Alan Greenspan who dropped rates to the floor for too long and did no policing of the banking industry which was under the Fed’s jurisdiction. The banks will continue to go on this road because it is profitable. The government is largely co-opted and is now designed to protect the established power. If you like what has been going on for the last decade then you’ll love what we have ahead of us unless something drastically changes in our economic policies.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!4 Comments on this post

Trackbacks

-

peter troncale said:

It is quite obvious that he Govt. is behind this corruption. Our leaders and govt. officials are just ignorant of what is going on or they are corrupt. We are witnessing the end of America as we have known it.

God if the founding fathers saw what was happening they would be greatly disappointed.

January 28th, 2011 at 7:20 am -

stephen verchinski said:

Class warfare stolen by the top 2% and David Kay Johnson was very right, true and mindboggling.

What would happen if we dramatically raised the high level income cap for Social Security and just for grins doubled the minimum wages in the USA? As long as there is going to be inflation, inflate the bottom end for a change?

January 28th, 2011 at 8:39 pm -

geo. wash. ing. ton said:

whats dollar collapse any way?

ps. 1.11 Jess former Minn gov. Ven-

. tura sues that grouper gp. Tee (ess and or

A. y dont you, a c l u sue groupers also?January 30th, 2011 at 2:40 pm -

mm said:

What’s the definition of “Public Enemy”?

Doe Fed fit in this definition by stealing from all Americans who sweat to ear Dollars? By throwing the poor poorer thru harsh inflation?

By making retirees work 5 or 10 more years?January 31st, 2011 at 4:32 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!