The Giant American Banking Deception – $7.4 trillion in deposits backed by insolvent FDIC insurance fund. Bank of America and JP Morgan each have more than $2 trillion in assets each while 72 million Americans earn $25,000 a year or less.

- 3 Comment

The American banking industry is trying to convince the public that simply by hiding bad debts in the deep levels of corporate balance sheets that taking on leveraged risk is somehow safe. FDIC insured banks currently have $7.4 trillion in actual deposits, much of it covered by the Deposit Insurance Fund (DIF). Most Americans think that there is a “fund†similar to the “Social Security Trust Fund†to protect their hard earned savings but in reality the DIF is empty. The DIF is running on fumes and inspiration. Banks are trying to fool the public that somehow the Fed and FDIC backed institutions largely of the too big to fail variety, can simply print or hope money into existence like wishing mules would turn into magical unicorns. Most understand even at an instinctual level that something is wrong here. Even the king of the Ponzi scheme Bernard Madoff called the current structure the biggest of Ponzi schemes. He should know.

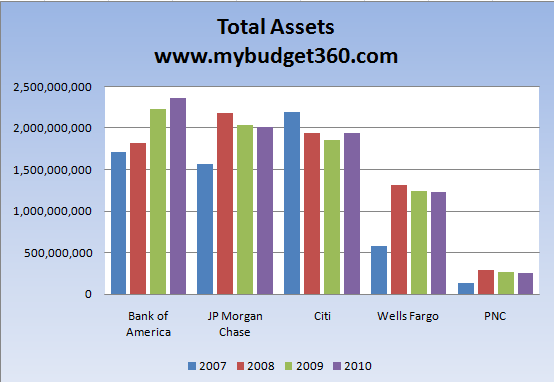

Too big to fail get bigger

Source:Â Individual 10-Ks

In September of 2008 when the financial sector was melting down like cheese on a microwavable quesadilla, the banking sector asked for $700 billion because many banks grew “too big to fail†and would cause systemic risk. In other words the financial system was screwed. There was no doubt that the reason for the Great Recession was too big to fail. So you would logically conclude that the solution would be to wind down these mega institutions so we wouldn’t have this problem down the road. Instead as the above chart demonstrates, the U.S. Treasury and Federal Reserve, largely staffed with former Wall Street bankers created even bigger firms. Too big to fail became too damn big to fail.

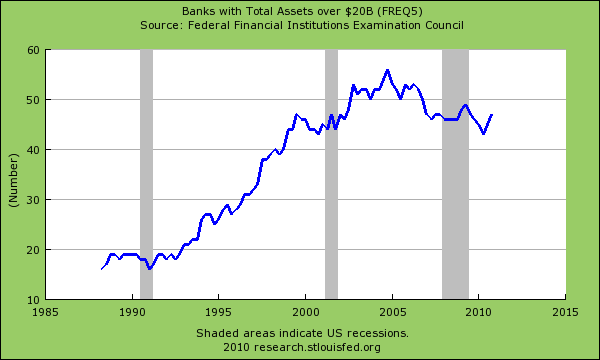

The growth of mega banks has been going on for three decades:

Mega banks peaked in 2005 but what the chart doesn’t show is that now we have fewer banks with more assets. These banks which hold many of your checking accounts, mortgages, savings accounts, and credit cards are largely leveraging the hard earned money of average Americans and speculating in global stock markets. Since Glass-Steagall was repealed in the late 1990s commercial and investment banking have been operating under one roof. This sinister wedding has allowed banks to use once boring and mundane investments (i.e., mortgages) and has allowed them to turn them into casino like instruments (i.e., mortgage backed securities). You can bet on mortgages just like you can bet on the next Manny Pacquio fight.

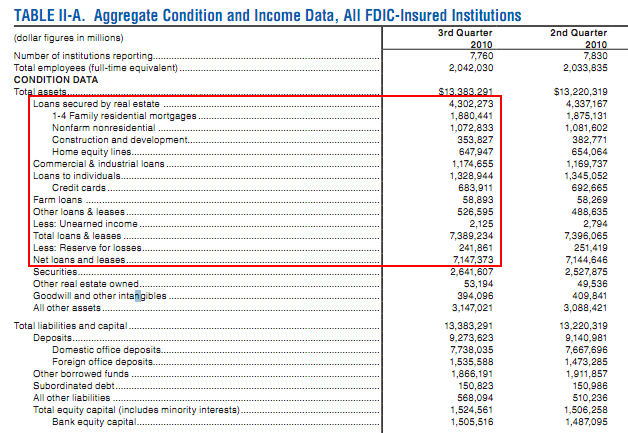

Banks overstating assets

Source:Â FDIC

U.S. banks have over $13.3 trillion in assets. This might sound impressive but just think of how many junk loans brought on by the housing crisis are still sitting on bank balance sheet as assets at over inflated levels. Banks still claim over $3 trillion in commercial real estate loans at incredibly inflated levels including empty dusty shopping centers, hotels with no customers, and parking lots that serve only one customer of the tumbleweed variety. This is what a bank can claim as an asset. Remember, bank deposits in cold hard cash are actual liabilities. They have to pay this back obviously. Yet the $7.4 trillion in actual deposits allows banks to leverage this money because of fractional reserve requirements and speculate in global stock markets like hitting the roulette wheel. That is why investment banks like Bear Stearns and Lehman Brothers even with no customer deposits were able to leverage their institutions 30-to-1. A small 3 to 5 percent decline was enough to collapse both institutions and it did.

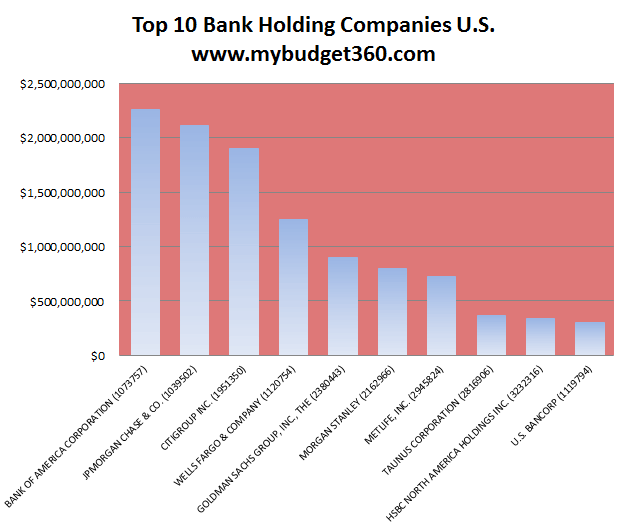

Most of the assets concentrated in a few hands

Even though there are over 7,500 banks backed by the FDIC the large concentration of the $13 trillion in assets is centered with the top 10 banks. Bank of America and JP Morgan Chase alone each hold more than $2 trillion in assets each. Bank of America just announced it would be splitting $1 trillion in “legacy loans†into a bad bank model. This is like you splitting your household in two and putting all the bad loans you have into a bad bank and simply ignoring it when it comes to figuring out your net worth. The too big to fail banks still dominate the market. Keep in mind that all the deposits at these banks are backed by the FDIC DIF that is completely insolvent. No money is there. The system is being held up purely on faith and the Fed is trying to digitally print money to devalue the U.S. dollar so our debts can become cheaper. Of course most Americans don’t have the debt that many of these financial institutions have. In many cases if you can’t pay your debts you lose your home through foreclosure or have to file for bankruptcy. Banks can reach into the taxpayer wallet and take money while pushing the cost to later generations. This is how the current system is structured. Take money now to pay out current debts (i.e., a Ponzi scheme).

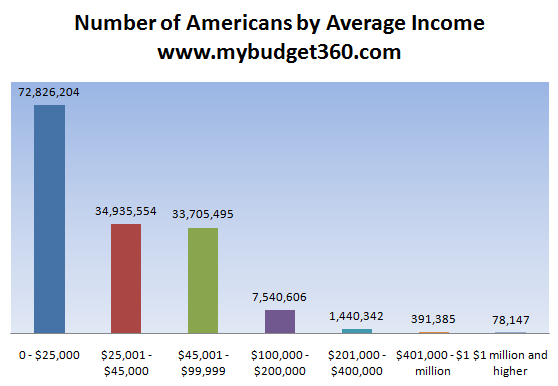

In the meantime the average income of individual Americans is lower than you think:

Source:Â Social Security

72,000,000+ Americans (over half) earn $25,000 or less a year. Another 34,000,000+ earn between $25,000 and $45,000. The notion that everyone is feeling the pain of this recession equally is completely deceptive. Working and middle class Americans are feeling the brunt of this recession. You would think that after the worst crisis since the Great Depression things would be different today in Q1 of 2011. Yet nothing has changed and in fact, we have invigorated the too big to fail with our current government policies. This is a government built by Wall Street banks and for Wall Street banks. Don’t be surprised when the next crisis hits because nothing has changed.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!3 Comments on this post

Trackbacks

-

peter said:

We are on the road to bankruptcy their is no turning back. I wonder how the Govt. will use the coming tragedy to create a new currency and possibly a new govt. and who will they blame. The country is very sick and getting sicker at an excellerating rate. If only we had leaders who would face the truth as to why this all is happening.

Major causes:

The Govt. passing a bill allowing the Fed. Reserve to take over our currency.

Company and Private organizations Lobbyist that have bought our govt. leader for favors.

The extreme downfall all started in 1913 Woodrow Wilson a man that will go down in infamy. He sold out our country. The following is a list

that was originated under his presidency.

1-The Fed. Reserve 2-Lobbyist 3-Progressive income tax 4-The start and concept of the United Nations. Beware of the new reserve the SDR’s and the IMF.March 13th, 2011 at 7:06 am -

CLARENCE SWINNEY said:

iN 2008 Bush promised 8500 Billion in all Bailouts such as FDIC FHA etc.

No one would tell the people that 700 was Big banks and omit 8000B??What gives? Free Press–WSA owned Press?

clarence swinneyMarch 13th, 2011 at 8:44 am -

Rick said:

Come to Calif. and become a government worker. Calif. has over 5,000 people who make a RETIREMENT benefit of $100,000. a year, or more, with free medical insurance on top of that.

Average teacher can retire at 55, at $45,000. a year.And of course, free medical on top of that.March 13th, 2011 at 12:29 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!