The minimum wage economic recovery – 44 percent of jobs added since recession ended come from low-wage industries paying $10 an hour or less.

- 2 Comment

This has been a disjointed economic recovery. Most Americans are hearing about this Wall Street party yet look at their paychecks and wonder when the party is going arrive in their neighborhood. Looking back at the 2001 recession, the recovery during that time came largely by adding higher paying employment. That is not the case with the Great Recession. The largest segment of jobs being added are coming from lower-wage industries. What does that mean? It means the bulk of jobs being found by Americans are paying $10 an hour or less with Spartan benefits. Given that inflation is hitting and wages are stagnant, more money is being taken away once that net income hits your bank account. Lower gas prices are a drop in the bucket when you look at the rise in home prices and rents driven by Wall Street buying. Shelter is the biggest expense for Americans. With this moving up and incomes stagnant, more money is flowing into the pockets of banks while working class Americans (a growing group) are largely living paycheck to paycheck. Let us take a look at where the jobs are being added in the aftermath of the Great Recession.

The low wage recovery

One data point that should give you a perspective on our current economy is that we have more people working in the food services industry than we do in the manufacturing sector. Working in the food sector comes with little benefits, low wages, and minimal job security. The recent recovery in the stock market has been driven by easy credit, companies cutting wages, and firms pushing on retirement and healthcare costs down to workers. This is great for profits, not so much for workers.

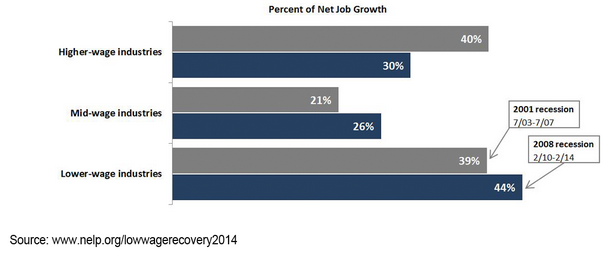

This recovery has largely been driven by lower-wage industries. Take a look at the percentage of jobs being added based on wages:

Source:Â NELP

44 percent of the jobs being added post-Great Recession are coming in the low wage sector.

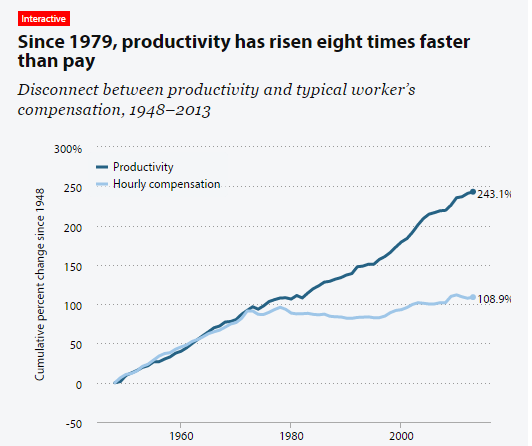

And don’t believe the narrative that somehow Americans are less productive and deserve what is happening. This is the push coming from the financial sector. If we look at productivity, we actually find that Americans are very productive but the compensation just isn’t being shared:

Keep in mind the above only looks at wages. This does not factor in the disappearing pension, rising healthcare costs, and inflation eating away at wages. This is the reality of a shrinking middle class. Wall Street is still near a peak with a 200 percent increase from the lows in 2009. Do people feel that things have gotten that much better? What does the stock market reflect? It reflects companies turning a profit at any costs even if it means slamming wages lower.

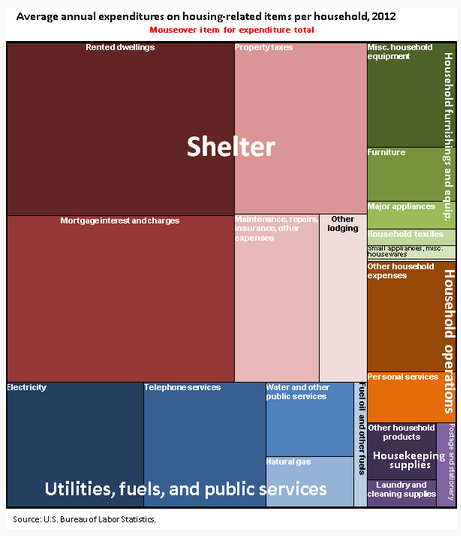

It is amazing how much attention is given to the oil crash story and how this will help Americans. Sure, it will help a bit. But just look at where people spend their money:

Source:Â BLS

Shelter consumes a massive portion of your net take home pay whether you rent or own. Yet there hasn’t been much talked about how investor buying has made it tough for those new workers landing low wage jobs. Those working in jobs making $10 an hour or less are simply getting by. And this impacts both young and old. Many older Americans are now working these low wage jobs trying to supplement their Social Security income.

This has been a low wage recovery. Jobs in food services, retail, and other lower paid industries are driving the employment numbers up. But in the end, many Americans are not enjoying the fruits of their labor. There has been scant talk in D.C. or Wall Street about protecting the middle class. This last election did little to quell that issue.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!2 Comments on this post

Trackbacks

-

Ame said:

Is there a correlation between going off the gold standard in the 1970’s and the diverging lines in the graph on productivity and wages?

January 17th, 2015 at 12:39 pm -

Jim said:

To be fair, some of the productivity gains are due to advances in automation and employment of robots for some repetitive manufacturing and packaging tasks.

However, it is clear that wages for most workers in the U.S. have not kept up with real rising costs of living (including rising taxes of all sorts) since around 1977.

January 20th, 2015 at 5:40 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!Â