Middle class retirement now largely a postcard fantasy – How Wall Street fabricated a buy and hold fairytale and jumped ship with taxpayer golden parachutes. Did baby boomers think about who they would be selling those 401k and pension stocks to?

- 5 Comment

The days of dreaming about long days playing golf on a green course and taking luxurious cruises around the world are appearing more and more like a foggy memory for those in the middle class planning for retirement. As Wall Street bankers and hedge fund managers rob the public blind, the mission statement sold to baby boomers is starting to become a large bait and switch catchy enough to make it on a Hallmark card. For decades Wall Street begged and lured the public in either directly or through pension funds into their web of easy money. Save $100 a month and you’ll retire a millionaire! As it turns out, the golden parachute was only available to a tiny fraction of the population while the oligarchy in the financial sector offloads their toxic bets onto the taxpayers struggling balance sheet. The end game? No retirement. At least no retirement like those plastered on glossy mutual fund brochures. What the Wall Street banking charlatans failed to tell you is that you eventually need to sell those stocks to use the money for real world spending. What they also failed to mention is that the baby boomer generation is now going to sell into unrelenting headwinds of demographics bringing on a younger and poorer generation to purchase their stocks. Of course Social Security is in the crosshairs of the financial elite since they already secured their financial piece of the pie. You know things are bad when the Federal Reserve is stating that stocks are not exactly a winners bet in the years going forward.

Retirement becoming more of a postcard fantasy

The middle class has been pillaged and ransacked by financial thievery for decades. The debt bubble and mass delusion is now imploding. The graft and con games taking place in the financial sector would be comical if they weren’t so real and economically tragic. The Federal Reserve has given covert loans to big banks while big banks publicly stating all was well. The Federal Reserve has grown their balance sheet to a stunning $2.8+ trillion of questionable assets and other junk with little redeemable market value. It would have a hard time selling these items on eBay let alone the natural marketplace. There is no easier way to make a profit than stealing from the taxpayer. Of course the problems in the system are coming at the expense of the working and middle class. For those who bought into the Wall Street mantra of buy and hold, making a profit has gotten much harder:

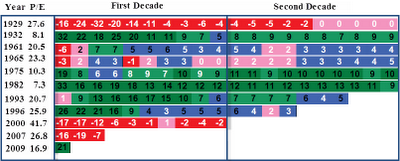

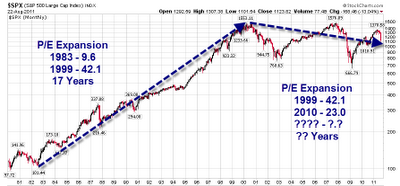

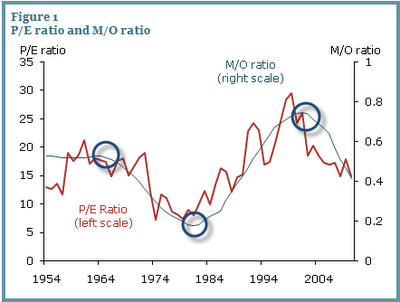

This is fascinating data to look at. This decade has been horrible for stocks. The S&P 500 stands today where it did in 1998. The massive stock volatility is simply a reflection of the problems deep in our financial system. The above chart examines P/E ratios over time. Really fascinating information but the Fed study finds that P/E ratios are likely to go lower because of demographic shifts and also the reality that we have a lower wage employment force dominating our economy. The latest decade is a reflection of the bubble era machinery that has hoisted up the financial sector into an untouchable corner yet middle class Americans have taken it squarely in their stock portfolios. Why? Because Wall Street has been preaching buy and hold as if it were some patriotic mission but many of these hedge funds and banking managers have placed bets that openly aim against American middle class success. In fact, some have made bets on flat out American failure and have made billions of dollars with lower tax rates that are given to hedge funds.

The stock market casino

The stock market has been on a wild ride for well over a decade:

Source:Â Mish Global Economic Analysis Blog

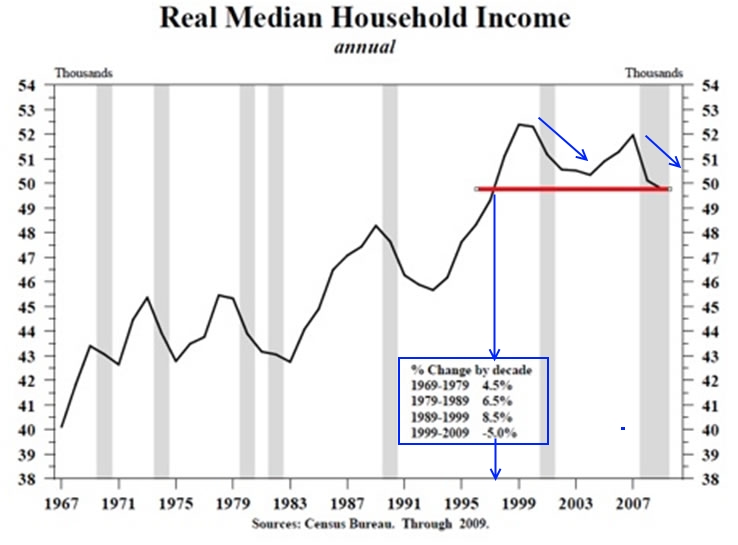

You have a crazy expansion in the 1980s and 1990s with the peak productive years of baby boomers but also the carefree attitude with the debt bubble and the “deficits don’t matter†mentality that has harmed this nation and is leaving the Eurozone in tatters. Of course all of that has come to a crashing halt first with the tech bubble bursting and then the real estate bubble imploding. So you have to ask, when these baby boomers sell out of their 401ks and pension plans who will buy the stocks? The 46,000,000 Americans on food stamps? Or what above the average per capita worker making $25,000 a year? Household incomes have been stagnant for well over a decade:

To use an often quoted cliché, this is the perfect financial storm. For the financially and politically connected the free market rules do not apply. For the working and middle class they do. This massive contraction is happening when millions are entering the retirement pipeline. Now it would be one thing if people had vibrant retirement accounts. 1 out of 3 Americans have no savings account. But for those with a retirement account they likely do not have funds to support their life as they age and this is seen in a Transamerica retirement study:

“Workers estimate their retirement savings needs at $600,000 (median), but in comparison, fewer than one-third (30 percent) have currently saved more than $100,000 in all household retirement accounts.â€

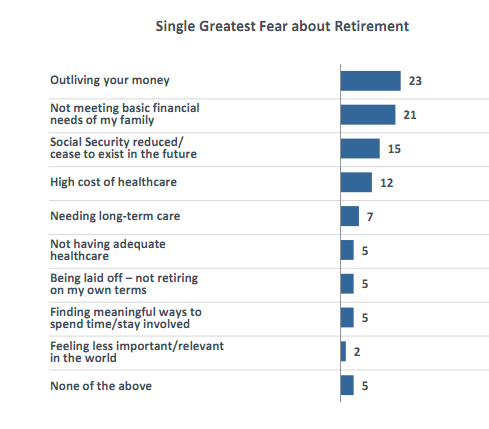

And the fears most have are based on real life issues:

Source:Â Transamerica

These aren’t fears about not having enough yachts or trips to Paris but whether they will eat decent food or Alpo. Workers are accurate in how much they need but less than one third have even saved $100,000 or more for retirement. For a median household income pulling in $50,000 a year in working years, the funds would likely last 3 or 4 years. The biggest fear is outliving the money while coming in at a close second is simply not meeting basic family needs. The next fear is cuts to Social Security because of course, the bankers and investment banks had to get their bailouts first before setting the U.S. economy on fire.

The Federal Reserve study found that P/E ratios are likely to become compressed as time goes on:

“Between 1981 and 2000, as baby boomers reached their peak working and saving ages, the M/O ratio increased from about 0.18 to about 0.74. During the same period, the P/E ratio tripled from about 8 to 24. In the 2000s, as the baby boom generation started aging and the baby bust generation started to reach prime working and saving ages, the M/O and P/E ratios both declined substantially. Statistical analysis confirms this correlation. In our model, we obtain a statistically and economically significant estimate of the relationship between the P/E and M/O ratios. We estimate that the M/O ratio explains about 61% of the movements in the P/E ratio during the sample period. In other words, the M/O ratio predicts long-run trends in the P/E ratio well.â€

In other words, lots of money chasing the Wall Street illusion yet there will be fewer (poorer) buyers ahead. The P/E ratios surged when baby boomers entered their peak earnings years. Given the massive problems in our economy the fact that P/E will take it on the chin is no surprise. What is more stunning is the fact that no real financial reform has taken place and that the political system is so utterly broken. Money has infiltrated politics to a degree never before seen. We have career politicians in the SEC basically training for plush gigs at Goldman Sachs or Morgan Stanley. A revolving door out of D.C. and into big investment banks and back to D.C. No wonder why there has been no true enforcement of the investment banks when many are simply using it as a training ground for future jobs! If the working and middle class actually saw what went on trading floors they would never even think about playing the stock market. The fact that we have millions now needing to dump stocks into the open market is simply another issue we will be facing. These are people that have to sell (you can’t eat your stocks or pay for a medical bill with a stock). Many are now realizing after a lifetime of work that retirement only meant more work with fewer benefits to compensate for the big banking bailouts.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!5 Comments on this post

Trackbacks

-

MarkD said:

I agree. Also I am amazed at how many folks nearing retirement age have used their homes as an ATM machine for the past decade so now rather than having a roof over their head that is paid for, instead they have to come up with a mortgage payment.

Crazy.August 24th, 2011 at 6:45 pm -

Rachel said:

I know a few & feel badly for those who still believe that having anything less than at least 1 million dollars (after taxes) available for retirement. This will provide many Americans with about $33K annually which is enough to live decently in many parts of the country. Of course, it is so difficult to obtain for 85% of us, but those who actually believe that they can survive 10, 20, 30, or 40 years of retirement on six figures or less may find themselves eating Alpo.

August 25th, 2011 at 9:00 am -

Ian Mathers said:

Ironically, I raised the same question 2 decades ago while discussing retirement plans with my father and brother. They couldn’t acknowledge the boomer bump heading to retirement with all those higher risk investments (equities) to ultimately find buyers for. I chose to put my faith in gold and silver and have spent the better part of my working life hoarding both. I know I’ll be vindicated, and may be the only one of all my three siblings who will be able to retire.

August 25th, 2011 at 1:18 pm -

ted Kramedas said:

It is sad to see that so many baby boomers did not save enough

money and did not invest that money wisely through diversification.

Hopefully, this will be a wake-up call for future generations to save

more and pay more attention to their investments, not depending on

past performances of equity markets and historical data which is highly

skewed by financial bubbles. The wanting it now and paying for it later

philosophy leads to a painful realization that retirement is no longer a

practical option.August 25th, 2011 at 4:08 pm -

truthbetold said:

GOT GOLD?

August 25th, 2011 at 11:33 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!