No debt ceiling for the Federal Reserve and too big to fail banks – The double standard of American banking and opaque Federal Reserve policy.

- 3 Comment

While the American public is staring at a government that is more like an improv act in Chicago, the banking system continues to hide toxic assets from the view of the public. An odd economic dance is taking place.  While the public is being beaten over the head about spending within its limits we have a shadow banking system that seems to have no debt limits at all. While many Americans are losing their homes to foreclosure, are filing bankruptcy because of credit card debt, or face having to deal with massive amounts of student loans you have the Federal Reserve expanding its balance sheet all with complete media silence. Why is there no spectacle here? Where is the scrutiny for the banks? The problem of course is that the Fed is mainly concerned with protecting the wealth of the small financial elites. After all, we have the grand J.P. Morgan as one of the masterminds behind this hub of banking power. As we continue down this circus, the even bigger absurdity of the Federal Reserve practices continues unquestioned in popular media.

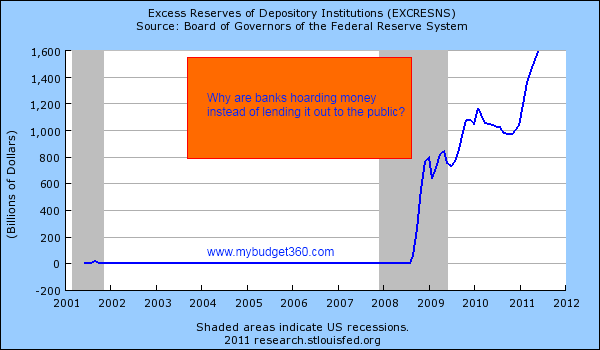

Growing those excess reserves

While we continue to hear about how we are running out of money, it would appear that banks in the United States are flush with funds. These excess reserves are ready for lending to the American public and can go into small businesses to revive the economy. The issue of course is that banks understand how toxic their balance sheets have become and they would rather keep this money under lock and key. Plus, these banks earn interest at the Federal Reserve for an absolute risk free bet. Did we also mention this only occurred because of the bailouts that were funded by taxpayers? So you see, taxpayers are essentially allowing the too big to fail to have absolutely no debt ceiling yet somehow our politicians are trying to convince the public that they now need to tighten their belts. This is the twisted world we now live in.

Aside from this, we already know that many working and middle class Americans have smaller household incomes. Now that banks are using some due diligence they realize that they are unable to make too many loans without risking future damage yet again. What I would argue is that banks knew this all along but the trillion dollar bailouts were predicated on the assumption that credit would dry up and banks needed this money to continue making loans. The opposite occurred. Banks are hoarding the money, taking on a taxpayer risk free bet, and are now lambasting the public for not being fiscally responsible. There is no bigger double standard than the current American banking system.

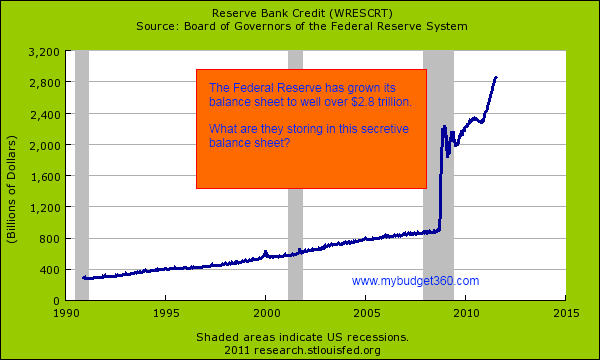

The Federal Reserve has no debt ceiling

While you were sleeping the Federal Reserve has grown its balance sheet to well over $2.84 trillion. No public scrutiny, no media investigations, no deeper analysis, yet this has all occurred in the matter of a few years. Keep in mind the Fed has taken on mortgage backed securities, luxury hotel loans, strip mall loans, and other dubious debt that is hidden from public analysis. So while you and I need to operate within the fiscal laws of reality and not spend more than we earn, the Fed in conjunction with the U.S. Treasury can digitally print up as much money as is needed to protect the too big to fail banks. Where does the average American have the option to dump onerous student loans or insane credit card debt? There is no mechanism for this outside of bankruptcy (and student loans are still with you even after that). Many of the too big to fail banks have simply shifted toxic assets to the Federal Reserve. And then people wonder why the U.S. dollar is plunging.

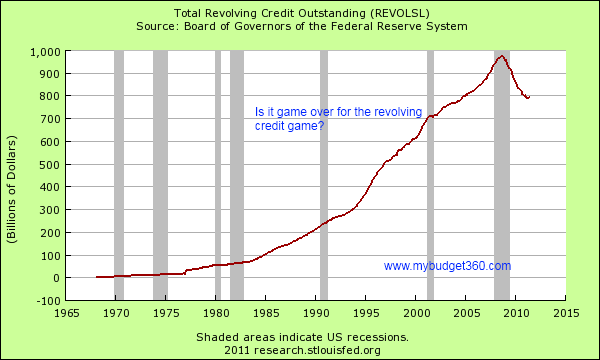

Peak credit?

The credit card is a fascinating device. People are able to spend today with the promise of paying tomorrow. This peaked in 2007 where we were quickly approaching $1 trillion in revolving debt in the American public. As the chart shows, since 1965 credit card debt has only grown. Through every recession and dip this movement never changed. That is until this crisis hit. Credit card debt has now fallen into the $700 billion range and has been surpassed by student loan debt that is quickly approaching $1 trillion itself.

It is clear that the American public does have a debt ceiling. We have reached it for credit card debt, mortgage debt, and other forms of loans. Ultimately incomes need to service this debt and with the economy losing steam this is harder to sustain. The Federal government finds itself in a similar situation and needs to cut back as well. Yet it is amazing that the first things on the table are programs that directly hit the working and middle class.

“Why not have the Fed charge banks for keeping funds in excess reserves so more money is used to start businesses even if they are small and local? Why don’t we actually audit the Fed and see what is really going on? Why not have hedge fund managers pay taxes just like every other middle class American? Instead of these measures we get fear and mind games trying to stiff an old retiree with a $1,000 a month Social Security check. The politicians want to game the CPI system to chop down COLAs and other forms of keeping up. People need to wake up before the middle class is completely gone.”

There is no debt ceiling with the Fed or the too big to fail banks yet the public is being blamed for all of this. Why not use those trillions of dollars to actually pay down our debt? How about banks face the music and realize many of their hyper-inflated loans are actually worth less? Of course that would be problematic for the financial banking elite so you will rarely hear about that in the press. Remember this, debt ceiling for you, yes, debt ceiling for too big to fail banks, no.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!3 Comments on this post

Trackbacks

-

Don Levit said:

This post tells a lot of the story.

If you’re not in the top 10% of households, you’re worthless.

The game is tilted toward the elites, with virtually no chance of losing.

Two sayings come to mind:

Capitalism without failure is like sin without religion.

The opposite of pro is con.

That’s why we have progress and Congress.

Don LevitJuly 29th, 2011 at 8:13 am -

hairy reed said:

gd site! re: no data on searching for ‘other debt-ceilings” found!!

re debt-ceiling: do other nations UK etc have this farce,

vote on debt-ceilings??July 31st, 2011 at 12:37 pm -

Matthew Mitchell said:

Having banks lend those excess reserves to businesses would not be good, it would be terrible (Hyperinflation, over-leveraging and malinvestments). The whole banking system is corrupt and fascist. We need free market banking and free money where no banks can take privileges from government and have a monopoly over money.

August 30th, 2011 at 1:33 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!