Sin City and Nevada suffer brunt of recession – 25 percent underemployment rate for Nevada reflecting depression like stats. Foreclosure data on home that was picked up for $120,000 but had a second mortgage of $1.2 million.

- 5 Comment

The great recession has touched every state across the United States with a reverse Midas touch. Every average American has felt this recession to one degree or another. Yet few states have felt the economic implosion like Nevada. Here we have a state that highlights the heavy reliance on the housing bubble, conspicuous consumer spending, and ultimately the pop of the debt bubble. The data coming out on Nevada is not encouraging and overall trends show deep problems for states in the Southwest. Yet now that the curtain is being pulled back, we start getting a bigger glimpse of the profound problems that confront Nevada moving forward. We’ll look at population changes but also examine the housing and employment markets of the desert state.

Population data

2,643,085 live in the state of Nevada. Yet this number does little justice to where the bulk of people live. The Clark County population is 1,996,542 and this includes the largest city in the state, Las Vegas. The state heavily relies on gambling revenues for their economy and state budget. Nevada has no state tax. So when a budget crunch hits, there is little to do but to cut. But taking a deeper look at the state we find that revenues have fallen hard:

“(Sunshine Review) Nevada relies heavily on gaming income for state revenue; 53% of the state’s gambling income comes from the Las Vegas Strip. November 2009’s state gaming report for September 2009 showed 21 consecutive months of declines. Nevada News Bureau reports, “State Budget Director Andrew Clinger had no real comment on the gaming report, saying other tax reports due by the end of the month, including taxable sales, will be examined before a decision is made on whether a special session of the Legislature is needed to keep the current budget in balance.â€

So for 21 months state gaming revenues have fallen like a lead balloon and have brought some casinos down to their knees. A large part of visitors to Las Vegas come from California. With California dealing with their own troubled economy and persistent unemployment, you can rest assured that the hit Las Vegas has taken comes from the economic ills of their neighbors. Nevada’s problems show how interconnected the economy is and how deep this recession really is. Americans are cutting back and a city that is dedicated to conspicuous consumption unfortunately is not on the menu for many Americans including spend-happy Californians. This is apparent when we track where people are putting their money.

High unemployment

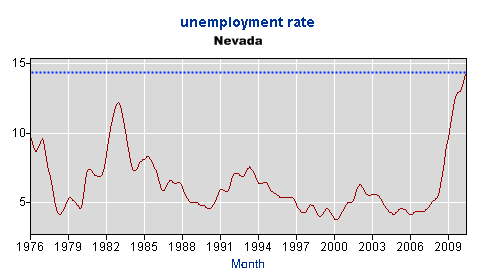

The unemployment rate in Nevada has gone from healthy to depression like in the matter of three years:

Source:Â BLS

Nevada’s unemployment rate went from 4.9 percent in August of 2007 to an all time record high of 14.3 percent. Nevada has leaped over Michigan for the highest unemployment rate (13.1 percent). The reality is, Nevada is likely to have an underemployment rate that is closer to 25 percent. Even though most Americans are feeling the sting of the recession some states are reflecting depression like stats.

You have to ask if this trend will reverse any time soon. The state heavily relies on gaming for growth and expansion. As we have seen from state budget reports, gaming revenue has fallen for an incredible 21 consecutive months. So why would anyone expand at this point? Who will lend any money? If you want to see the epicenter of the commercial real estate bust Las Vegas is it. Projects that started in 2007 when unemployment was near a record low, are now coming online at a time when the economy is tanking. Las Vegas is a hard charging city.  In the good times I recall walking into hotels that offered Prada and Gucci stores and five star hotels (all packed). This made sense when the bubble economy was going strong. Now, it is a relic of a debt bubble gone bad and walking through Vegas in 2010 is like going to a going out of business sale.

Foreclosure crisis

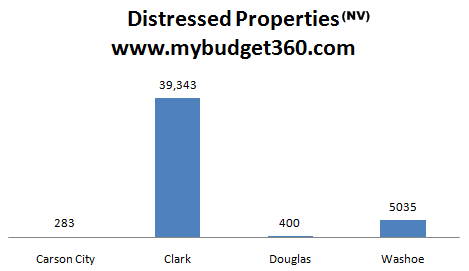

Las Vegas has the highest foreclosure rate in the entire country. In fact, over 60 percent of all mortgage holders in Nevada are underwater (it may be closer to 70 percent). This is simply incredible. If we look at the foreclosure stats they make us pause:

Las Vegas and surrounding areas show 15,853 homes listed on the MLS. But the distressed inventory is what draws your attention. In Clark County alone there are nearly 40,000 distressed properties. This number is unprecedented. But when you look at what went on during the housing bubble, you will be flabbergasted. Let us look at one example home that is scheduled for auction:

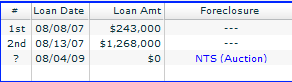

This home was sold in August of 2007 for $243,000. Now the loan data is a bit odd to track. But whatever is the case, someone put out a second mortgage on this place for $1.2 million. Now mind you, this is a 3 bedroom home out in Mesquite Nevada, about one hour away from Las Vegas.

Of course, the bank is trying to get everything it can. On July 28, 2010 only a few weeks ago the bank took it back for $120,000. Just like that, money evaporates in the Nevada desert. There are many cases like this and who really knows where the money went. But we all know that when bubbles burst, real money does evaporate with artificial values. Unfortunately sin city is dealing with a lot of pain and unless the real economy rebounds, there is little to believe the economy will improve here.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!5 Comments on this post

Trackbacks

-

jojo said:

What idiot bank give a 2nd mortgage of $1.2 mills?

If only the author would write How a private bank can be created with Loan Min.of $51 million. Good times are gone–big screw up :^/August 22nd, 2010 at 4:56 am -

Forty2 said:

Even at the height of the madness, that someone, somewhere decided that this lump of a house in the middle of a waterless desert was good for a $1.2 million non-senior SECOND is simply unfathomable.

August 22nd, 2010 at 7:33 am -

Joe in JT said:

Las Vegas is getting what it deserves. When I go there and play blackjack the pit boss and management look at you like you are a criminal stealing their money. Just because some people know blackjacks basic rules and count cards for a slight advantage over the house, casino goons try every trick in the book to make you lose. They send over the hot waitress in a mini-skirt to give you free drinks, hoping to get you loaded and make careless errors at the table. The pit boss stares at you like an African lion that hasn’t eaten in a week. You can feel the camera’s all over your body and over your shoulder watching how you play your hand.

I never did enjoy Las Vegas much, not at all. With the bed bug infestation they have….what happens in Vegas can stay in Vegas.

August 22nd, 2010 at 3:25 pm -

Don said:

But how could this be? Gambling is a recession proof industry. That’s what all the experts said back in the day. And experts are never wrong- that’s why they are experts.

August 22nd, 2010 at 8:35 pm -

j .q. addams said:

—> “when money dyes’ N. Ferguson, on

Deutschld. 1923 hyper inflation, + “Its the debt (too much)

stupid”August 23rd, 2010 at 11:29 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!