Gear up for another lost decade in real estate. Housing will remain stagnate from 2010 to 2020. Demographic shifts, higher mortgage rates, and shifting consumer taste in real estate.

- 11 Comment

The dynamics for housing moving forward point to a very bleak future and a potential lost decade yet again from 2010 to 2020. Housing has a treacherous path moving forward and deep down demographic shifts will keep a lid on any significant housing appreciation moving forward. The economy is in the process of deleveraging from a market highly dependent on real estate. Wall Street and the government are doing everything they can to bring back the economy of yesterday but have had little success. This recession has shrunk the middle class so those looking to buy homes have declined simply because many can no longer afford to purchase a home even at today’s lower prices. Focusing on housing first was a big expensive policy mistake where we should have focused on creating sustainable jobs. The market is slowly shifting to a new housing paradigm. Family growth rates, employment trends, baby boomers, and wages will all keep a lid on housing prices moving forward.

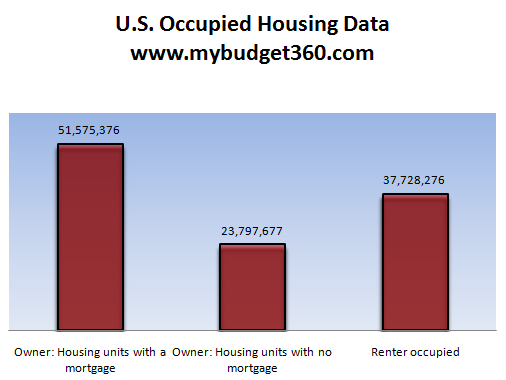

First we should break down the entire housing market:

Source:Â Census

The U.S. has a large number of homeowners. A total of 75 million Americans can lay the claim to owning their home. 23 million of this group (31 percent) actually owns their homes outright with no mortgage. Of course not having a mortgage does not mean that these homeowners have no housing associated cost. They still need to pay yearly property taxes, insurance, and all the cost in maintaining a home. Another 37 million American households rent. These are the basic dynamics of the housing market.

Of those homeowners with a mortgage, 7.2 million (14%) are in foreclosure or 30+ days late on their mortgage. This practically guarantees a few years of cheaper housing hitting the market in a steady trickle. This puts a herculean hold on any significant home building going forward.

From the recent Federal Reserve Flow of Funds Report, we find that current outstanding mortgage debt is $10.334 trillion. We have to break out the renters and the homeowners with no mortgage and find that the average mortgage debt for homeowners is:

$10.334 trillion / 51.575 million mortgaged households =Â Â Â Â Â Â Â Â Â Â Â Â $200,374

The current median home price comes in at approximately $170,000. Now some would argue that housing will regain traction and go on to rising to new levels. Yet this assumption assumes that middle class wages will be growing moving forward. If we look closely at the data the only real winner so far in this economic crisis is Wall Street but average Americans have seen very little benefit from the current bailout measures. Now those with big investment bank salaries can afford their piece of prime real estate in Manhattan or the Hamptons but this does not make up the bulk of the housing market. The bulk of the housing market is highly dependent on how middle class Americans are doing.

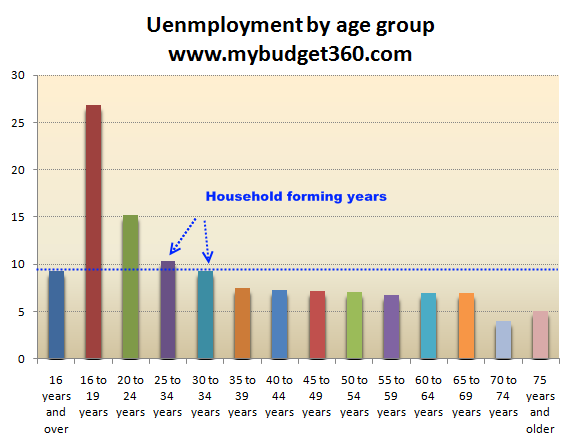

If we look at the current unemployment levels by age group, we see that those in the household forming age ranges or those entering into these categories, are taking on the brunt of this recession:

You can see that up to age 34, the unemployment rate is trending much higher than the total national average. These are prime age groups for forming households and if a family is not feeling safe financially, they will delay on purchasing a home. The middle class young family is also delaying on having children so the necessity for a bigger home is also being pushed out. This demographic shift is happening at the same time that baby boomers start entering retirement age and many will want to downsize.

And many of these people have a buffer for equity to sell since they bought prior to the housing bubble. Take for example data on current owner households:

Moved in before 1989:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 20.5% of all homeowners

Moved in before 1999:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 40.9% of all homeowners

It is highly likely that in this group, you have many baby boomers that will sell to downsize in the years coming forward and the current decline in prices will only cut into their equity but not put them underwater given the decade long bubble. They purchased before that. Those that moved in before 1989 will have a much larger cushion. So there is a large group of people that will sell regardless of market trends because they will have to simply because of life changing events.

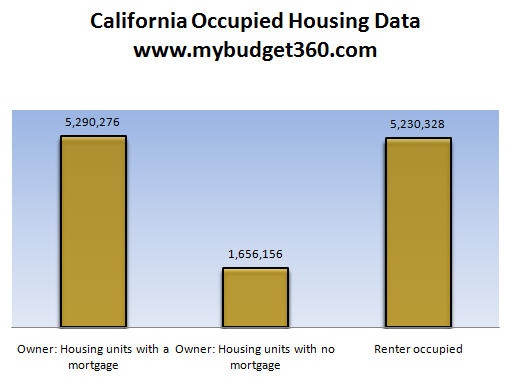

And then on the other hand we have the fact that one-third of homeowners in certain states are underwater on their mortgages. Take for example California:

California has a large renting population and most that own a home carry a mortgage (77 percent). Of those that carry a mortgage a stunning one-third are underwater. In other words 1.76 million mortgages in California are attached to homes that are worth less than the actual balance of the mortgage creating a large incentive to walk-away. Many of these loans come from Alt-A paper and option ARMs. These loans will impact the market at least until 2012 and hurt the state. California isn’t immune and other states like Nevada, Florida, and Arizona have similar dynamics. In fact, here is the amount of mortgage debt in a negative equity position according to a recent Deutsche Bank analysis:

California: $969 billion

Florida: $432 billion

Arizona: $140 billion

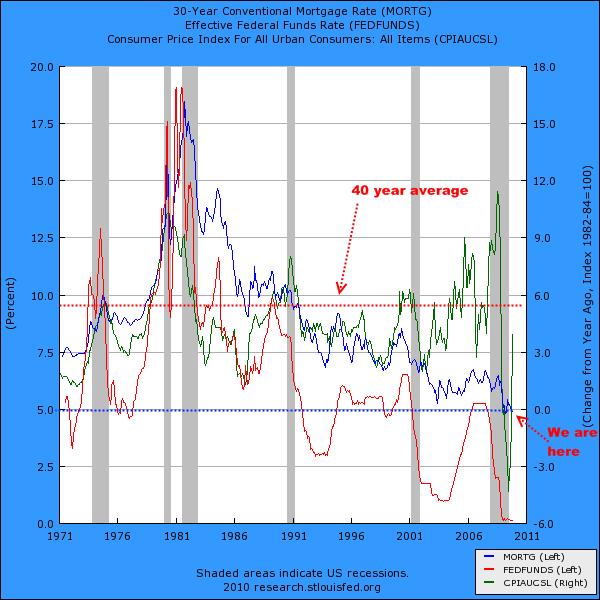

The only way that things would improve for banks is if prices moved higher. But how can prices move higher if middle class Americans are dealing with high unemployment and stagnant wages? The Federal Reserve and U.S. Treasury have really reached the end of options in terms of what they can do. Even the 30 year fixed mortgage is at all time lows in the midst of all this turmoil:

The 40 year average for 30 year rates is closer to 9 percent. Today it is under 5 percent. That is unsustainable and as we move forward with insurmountable levels of national debt, the rate will have to rise. I know this seems impossible for many but as we have seen with other debt ridden countries, the market can turn on like a tornado and quickly change the dynamics of the situation. For the housing market, this will mean even more pressure to keep prices muted.

The only way home prices can rise in a healthy manner is if we start seeing wage inflation. We saw some of this in the 1970s where wages went up in tandem with home prices. In the last decade, wages moved sideways while home prices went into a bubble. As far as the economy going forward, the big job sectors seem to be in low paying service sector jobs. Certainly someone can purchase a house with these jobs but not at current prices even though they appear to be solid.

The Federal Reserve and the U.S. Treasury have done everything to slam the dollar and create some level of inflation. Yet other central banks are doing the same. So what happens is easy money flows to Wall Street for gambling while the real economy stagnates. It is hard for many to believe that we will have another lost decade in housing but there is little reason to believe that prices will soon start to outpace inflation. In fact, in the last year or two we have been dealing more with aspects of deflation. We need to keep an eye on the real value of home prices adjusting for inflation/deflation.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!11 Comments on this post

Trackbacks

-

jdub said:

You do realize, you made the contradiction that caused the “real estate bubble”….

“The U.S. has a large number of homeowners. A total of 75 million Americans can lay the claim to owning their home. 23 million of this group (31 percent) actually owns their homes outright with no mortgage.”

As the current “John Galt” I have no mortgage and a nice, simple home. In my opinion, your above statement is a contradiction.

So, the correct statement that should be made is:

75 million Americans can lay the claim that they have a mortgage.

23 million of this group actually owns their homes outright with no mortgage.FYI: As a Financial Advisor I can tell you that your latter number is high…..I would guess only about 10%-20% of Americans own a home without a mortgage.

We must start speaking clearer or this problem will never go away.

June 16th, 2010 at 12:29 pm -

NOTaREALmerican said:

Good article. Enjoy your site.

June 17th, 2010 at 10:59 am -

CPA, MBA said:

The government is forced to inflate(monetized the debt) to pay off its debts. That will mean that housing prices will go up.

June 18th, 2010 at 8:19 pm -

Ross Wolf said:

This article does not mention costs of forced health insurance will disqualify middle class home buyers needed to support home values that secure trillions in bank held mortgages. Home buyers will have to decide between buying a home or paying a penalty not to buy health insurance with money they could use to pay a doctor. Meanwhile Obamacare will pay health insurance for those deemed poor. It is imaginable the obama government might start moving Americans deem poor into foreclosed homes to live near free further damaging the residential rental market.

June 19th, 2010 at 2:07 am -

JT said:

Another good article. Keep up the great work!

I’ve been starting to do research on housing in my area. I have almost no intention of buying for AT LEAST the next two years as I believe that will be the time period necessary for rates to start climbing, further pushing prices downward.

I think a decade of structurally high unemployment, baby boomers looking to downsize, and college grads with $100,000+ in debt will severely curtail any housing price increases for a while. I expect prices to bottom out in the next few years (2-4 years) and then remain flat for a very long time.

But don’t tell a Realtor I said that. The only words they know are, “Now is the time to buy! Interest rates are at historic lows and so are prices!” Too bad the idiots can’t see through their own BS.

June 22nd, 2010 at 8:42 am -

kingcalvin said:

CPA, MBA please tell me you were joking about monetization causing housing values to rise. or tell me you’re not a CPA or an MBA. Because that is just about the most ridiculous statement that could be made by anyone, let alone someone with multiple letters after their name!!

June 22nd, 2010 at 11:36 am -

Bob Carpenter said:

Normally monetizing would lead to inflation. However, we have two factors involved that are skewing peoples perception of inflation. Inflation can be found in energy, health care costs and food due to commodities rising. This would normally lead to wage inflation but it has not because there are other forces at work. Our higher paid jobs are outsourced to contain costs brought on by inflation here in the states. Then we have illegal immigrants tilling the fields keeping those jobs low paying. Years ago students could find a job in a field or on a farm but wages are so low its even impossible for a student to make enough to pay their bills. Mr President its not a job an American will not do, they’d do it if the pay were realistic.

June 22nd, 2010 at 4:38 pm -

JP Merzetti said:

Ah, an economy structured on real estate dealings bought by people with lousy jobs, no jobs, unreliable jobs….

(the “wisdom” spun through the wall street web?)I’m impressed with the clarity of the point you hammer home here –

that it is the chronically sick job market that will strangle any real

estate recovery.

Until that issue is addressed, I think you’re right – it doesn’t really

matter how relatively cheaper houses get, if middle class people

can’t afford to buy them.I suppose any measurement of the time it would take to correct

this problem…must take into account where our job market is headed in the long term – and it sure doesn’t look pretty!June 28th, 2010 at 10:58 pm -

Jeff said:

For the Unemplyment by age group graph, one of the age ranges is 25 to 34 years. Should that be 25 to 29 years? The title is Uenmployment, should that be Unemployment?

July 7th, 2010 at 9:59 am -

We Buy Houses said:

JT, I certainly agree with you. I am in Orange County, CA and I could have purchased a house a few years back but chose not to because I saw the bubble market in housing hitting a wall in near future. I didn’t want to get caught as it went over the falls, so to speak. I plan to buy at some point, but I’m waiting until prices are closer to the 1999 price levels (which better reflect “normal” price inflation) and/or price to rent ratios are back around 20 or under. Orange County is nowhere near that – unless you’re talking low-income areas. Some areas still are absurdly priced. It still blows my mind that 1970s era 4-bedroom houses in many supposedly middle income areas are still pricing in the $600K range. Absurd! And who can afford that??

August 4th, 2010 at 4:46 pm -

wowlfie said:

The mobilization of America continues…..not with mobile phones and loss of land lines but loss of homes owned by Americans and gains held by foreign interests (the new Pottersville, USA corporations).

In 20 years more than 60 percent of homes will be rent and rental rates will be skyrocketing due to greed from overseas.

Careful America your about to witness a demographic shift of enormous proportions and it’s ALL Obama’s fault because he fails to recognize that home prices in America relative to Europe and Asia are bargains and that the market MUST be stabilized with increased subsidization or the America is going under (bankrupt).

Stupid does that stupid does. And Obama is it.

November 12th, 2010 at 11:20 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market! Follow us on Twitter!

Follow us on Twitter!