FDIC flashes code red – Banking system insolvent and expecting more bank failures. Since 2008 247 banks with $616 billion in assets have failed. History of Federal Reserve designed to protect the big banks.

- 3 Comment

The FDIC which technically supports the nation’s banking system is for all practical purposes insolvent. I’m not sure the magnitude of this problem has sunk into the psyche of the American public. The FDIC insures accounts at banks that include checking, saving, and CD accounts from a bank failure. This has occurred with regular frequency since the recession started 29 long months ago. Some 247 banks have failed since 2008 with a total asset base of $616 billion. The government has tried to calm the unsettled waters by raising the regular deposit coverage from $100,000 to $250,000 even though the FDIC deposit insurance fund is in the negative. This seems to have calmed the nerves of people since the days of long lines at IndyMac Bank in California but nothing has really changed at least at the core of the financial system. To the contrary things have worsened for the banking system.

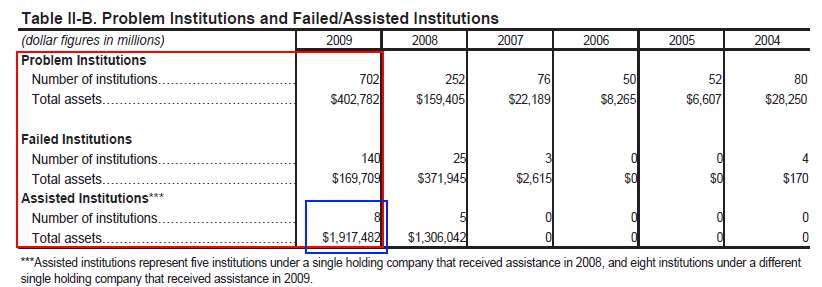

The list of troubled banks continues to grow:

Source:Â Fortune, FDIC

This chart tells us that we should be gearing up for another round of bank failures. The increase of deposit insurance from $100,000 to $250,000 is largely a charade. 1 out of 3 Americans have absolutely no savings whatsoever. We have 17 percent unemployed or underemployed and another 20 to 25 percent working in the low paying service sector. Nearly 50 percent of Americans have nowhere close to $100,000 in liquid assets to insure, so increasing the insurance to $250,000 is merely a public relations move to show strength.

The current amount of assets at troubled banks is over $400 billion but since the FDIC doesn’t list all troubled banks this is much larger:

Source:Â FDIC

Now the above survey only goes up to the end of 2009. Since the start of the year another 82 banks have failed and the FDIC is probably at some undisclosed location somewhere in the United States right now getting ready to close another few banks since Fridays have become synonymous with bank closings. The list of troubled banks increasing is a reflection of the massive amount of troubled loans. These loans wouldn’t be in such deep trouble if the economy was healthy and Americans were servicing their loans. But the middle class isn’t really participating in this shadow recovery.

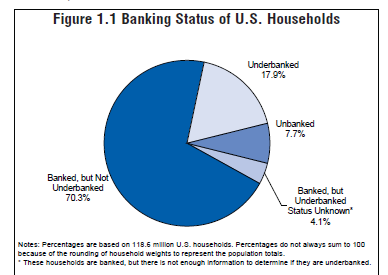

A recent survey by none other than the FDIC shows that a good portion of Americans don’t even participate in the banking system:

“ A substantial percentage of lower-income households are unbanked. Nearly 20 percent of lower income U.S. households—almost 7 million households earning below $30,000 per year—do not currently have a bank account. Households with earnings below $30,000 account for at least 71 percent of unbanked households.   Â

Not having enough money to feel they need an account is the most common reason why unbanked households are not participating in the mainstream financial system.â€

Do these people care that accounts are insured up to $250,000? Who are we really protecting here? You also need to ask how we are going to pay for all these additional bank failures if the deposit insurance fund is already in the negative. That is where the Federal Reserve and U.S. Treasury step in with more of your taxpayer money.

The Federal Reserve attempts to paint this image as a government agency but they are not. They serve the purpose to protect the banking system. Even the Fed website gives us a nice little history on this:

“(Fed history) From December 1912 to December 1913, the Glass-Willis proposal was hotly debated, molded and reshaped. By December 23, 1913, when President Woodrow Wilson signed the Federal Reserve Act into law, it stood as a classic example of compromise—a decentralized central bank that balanced the competing interests of private banks and populist sentiment.â€

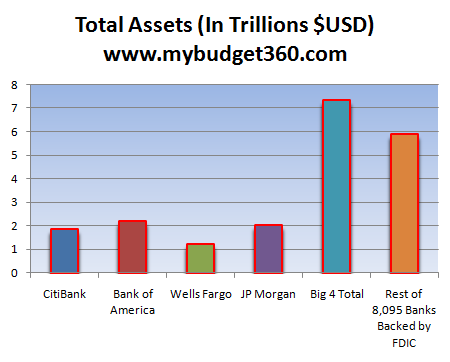

There is much more back history to this but suffice it to say that this move helped consolidate the power of banks into a few hands instead of having many more banks competing for your business. Keep in mind when this past, the public was heavily against it just like the public was against TARP when this crisis rolled around. Yet the Fed listens to their big banks and protects them at all costs even if it means robbing the public blind (a sort of reverse Robin Hood). In the end after nearly 100 years of the Federal Reserve, the main purpose is nearly accomplished:

“The top 4 banks of Bank of America, JP Morgan Chase, Wells Fargo, and Citibank make up 55 percent of all banking assets.â€

And banking assets across the country are enormous. The FDIC backs 8,000 banks that carry over $13 trillion in assets. These big four banks have their hands in over 50 percent of this amount. Who controls the wealth in this country controls the levers of political power. The way the system is currently setup we find that the banks have an incredible amount of power. Actually, it is the biggest banks that have the big power since they are fine with hundreds of little bank failures since that opens up the market for bigger banks to step in and open up shop. Smaller banks don’t have access to the easy money Federal Reserve window and certainly did not get handouts like many of the biggest banks did.

Foreclosures remain at record levels and this means banks are facing more and more loans that enter into default. This costs money. As we have mentioned, the FDIC is insolvent so where is this money coming from?

“(US Banker) Treasury likes it, the Federal Deposit Insurance Corp. likes it, and the banking industry likes it—that is, S. 541, introduced last week by Sen. Chris Dodd (D-Conn.) The bill would permanently increase the FDIC’s ability to borrow from the Treasury for its Deposit Insurance Fund, raising the cap to $100 billion from $30 billion, the limit set back in 1991. The Depositor Protection Act would also temporarily allow the FDIC to borrow up to $500 billion after consultations with Treasury, the Federal Reserve, and the President.

FDIC chairman Sheila Bair voiced enthusiasm in a letter to Dodd, noting “the FDIC believes it is prudent to adjust the statutory line of credit proportionally to leave no doubt that the FDIC can immediately access the necessary resources to resolve failing banks and provide timely protection to insured depositors.†Passage of the increased borrowing ability “would give the FDIC flexibility to reduce the size of the recent special assessment, while still maintaining assessments at a level that supports the DIF with industry funding.â€

And there you have it. I am certain that the banks are spending large amounts of money creating a way to couch this additional bailout as a helping hand for middle class Americans but in the end if we don’t change the system, the money will flow through the same rivers as of those from the last decade. With so many bank failures lined up because of horrible commercial real estate and residential loans, we can expect to bailout indirectly failed casinos in Las Vegas and owning shopping malls in random parts of the country. The FDIC is flashing code red and they are lining up with hat in hand for taxpayer money. If after 29 months you still haven’t gotten it, this money is likely to funnel up to the top 1 percent in an incredibly unbalanced fashioned.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!3 Comments on this post

Trackbacks

-

JBPeebles said:

Excellent summary of the underlying motive of the bailout: consolidation of the banking industry. Here in my town, a banner just went up over a local bank for the newer bigger bank that recently acquired it. The new bank–PNC–received a giant TARP subsidy.

Now to clarify,it’s vital to understand TARP was only a fraction of overall Federal Reserve lending. Therefore the TARP repayments that we’re hearing about–most notably with Citigroup–don’t count all those billions the big banks got through the Fed, and are still owed to the Fed. These unofficial backdoor lending facilities allowed Citigroup to receive a $308 billion loan from Barack Obama as his first official act, before even his inauguration (see the Matt Taibbi article.)

Another clarification is the source of the money, at least the portion derived through our Treasury. This is all borrowed money! Nobody actually has to sacrifice anything to lend it out. I’d examine the exact US tax receipts month-to-month. Fedgov is taking in a fraction of what it’s spending.

It’s worth mentioning the IRS was created alongside the Federal Reserve. The taxes it imposes are the source of credit for the bankers. Without tax revenues–which are deposited directly to the Fed–the whole Federal Reserve note fiat/Ponzi scheme would have nothing tangible to back it.

Best of all, Fed member banks get all the interest for nothing. They borrow at below-market rates and lend out to the public at interest, using the public’s (Treasury’s) money. Meanwhile, the more the Treasury borrows, the greater the taxes that need to be funneled back to the Fed to pay for interest on the national debt.

June 18th, 2010 at 6:14 pm -

most of my money is NOT IN THE BANK ANY LONGER said:

anyone with a working brain should keep minimal amounts of cash in any bank. you might as well start to use it for toilet paper, as it is devaluing every second of every day to the point of worthlessness, too!!

June 19th, 2010 at 12:19 am -

Don Levit said:

JB:

I have a question about your last statement: the more the Treasury borrows, the greater the taxes that need to be funneled back to the Fed to pay for interest on the national debt.

The Fed is borrowing from the Treasury, right?

These are 2 governmental agencies, just as the Treasury loans money to the Social Security and Medicare trust funds.

These loans to the trust funds are counted as intragovernmental debt, which makes up about 30% of the total national debt, which is public debt and intragovernmental debt.

To my knowledge, the loans from Treasury to the Federal reserve are not counted as intragovernmental debt.

If I am right, why is that (it shouldn’t be debt to the public either).

Don LevitJune 21st, 2010 at 11:20 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market! Follow us on Twitter!

Follow us on Twitter!