The great American debt purge – Americans more stressed out about debt. Mortgage, credit card, student loan, and auto loan debt up to $13.5 trillion. Average debt per household at over $120,000.

- 6 Comment

Every man, woman, and child would owe an average of $43,000 if we divided up mortgage, credit card, student, and auto debt in the United States. Of course, this is based on the current population of 309 million. But we know this isn’t exactly accurate since an infant really didn’t charge up a credit card or take out a HELOC. We should break this down to each individual household. If we average this figure out over all U.S. households the amount comes out to over $120,000 per household. When 1 out of 3 Americans have no savings, how do you think many will be able to pay off their debt? For decades, the model has revolved around servicing debt and not necessarily paying the initial balance off. But many American families are feeling the deep psychological strain of an economy largely built on debt.

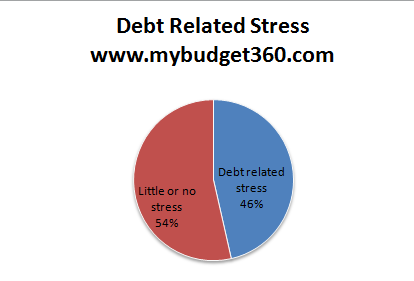

The emotional strain of debt is showing up in large numbers:

Source:Â MSNBC

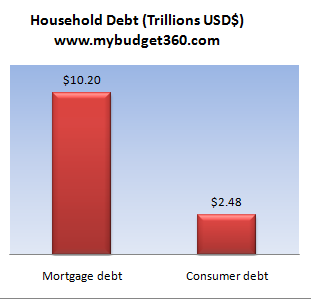

I think when we see surveys like this, some will tend to underestimate the amount of debt carried by each household. For example, not everyone has a mortgage and by far mortgage debt is the largest line item for consumer debt. We know that in the U.S. 51 million mortgages are outstanding. The latest Federal Reserve flow of funds shows mortgage debt at over $10.2 trillion. So run these numbers:

$10.2 trillion / 51 million mortgages = average mortgage debt of $200,000

Now the interesting thing is the median home price across the U.S. is slightly above $170,000. With that said, recent housing surveys have found that one-third of all these mortgages are attached to homes that are worth less than the actual mortgage. They are underwater. It is clear that the average American would feel incredible amounts of stress if they were living in a home that had fallen in value so much, that the attached debt was larger than the market sale price of the home. And most Americans that have a home have a generally good sense of what their home is worth. Many of course have their optimistic “dream†price but many deep down have a better sense of the real price. This is probably derived from recent home sales and other comparable properties in the area.

If we want to break down household debt, this is what we get:

The grand total of mortgage, credit card, student loans, and auto loan debt is a stunning $13.5 trillion. The tipping point came when total household debt aligned itself with the annual GDP of the United States. And this number seems to be reflected in the average income data. The typical household takes in approximately $52,000 per year and this is much lower than the $120,000 of debt each household would be responsible if we were to divide the debt share up today. What does this number tell us? We have spent far more than we earn and we earn at a level that is near the top globally.

I was fascinated that the survey was split nearly down the middle in terms of debt related stress. You have half of U.S. households worried about debt while another half seems to be comfortable with their debt. There are many households with no mortgage or that rent. You have others that pay off their credit card balance off each month. Others have paid off cars and no auto debt. What appears to happen with some American families is that they have a penchant for taking on inordinate amounts of debt. Confusing access to debt with wealth was also a large epidemic.

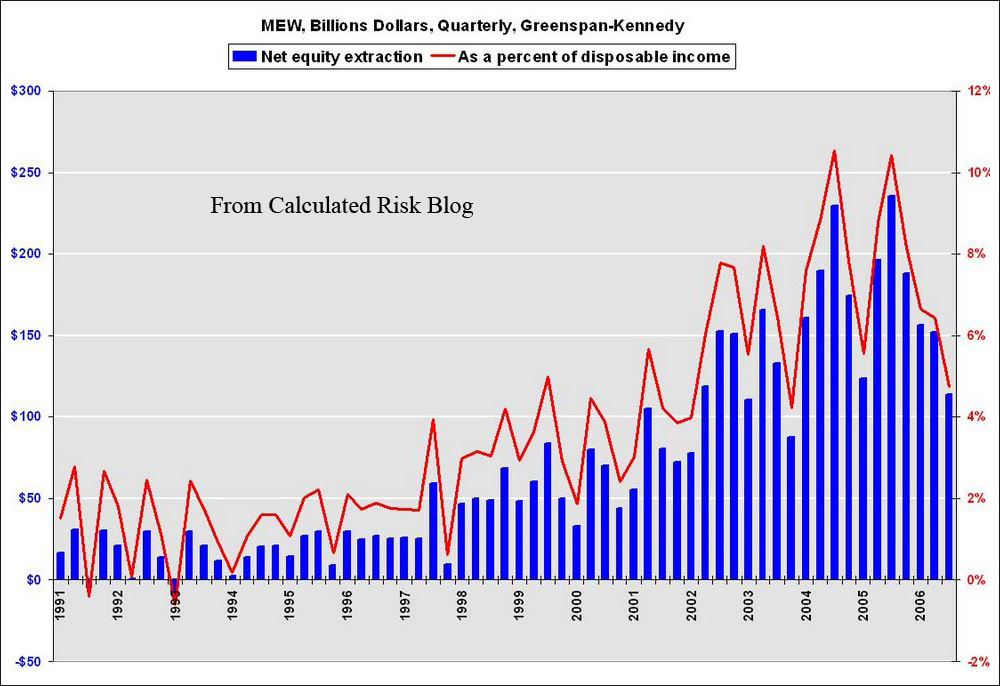

In California during the peak days of the housing bubble, a colleague was talking about how they refinanced out $100,000 from their home. This money was used for a lavish vacation and other “toys†that filled up their garage. When we talked, the perception was that the $100,000 home equity loan was actual free money. They failed to make the connection that the $100,000 would have to be paid off at a certain point. And many went down this road as evidenced by mortgage equity withdrawals:

Source: Calculated Risk

The great hoax was creating an atmosphere that made people believe that this money was actually free. I remember seeing many letters that had an actual check attached with the sum of $50,000 or higher as if it were a novelty gag. All you needed to do was sign and cash the check at a local bank. It really had the symptoms of a once in a generation mania. The perspective from Wall Street and banks was that there would always be someone willing to pay a higher more inflated price and willing to take on more debt to make the purchase happen. Around 2006 many insiders started getting out slowly while talking up to the public that all this wild debt was somehow sustainable.

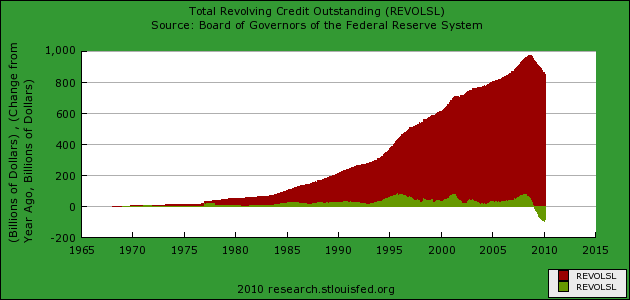

Now as a county we have always been comfortable with mortgage debt. In fact, a 30 year fixed mortgage with a decent down payment was the bread and butter of our economy for decades. Consumer debt on the other hand is really an astonishing concept. Think of credit cards. You are allowed to spend money you don’t have. Would you allow someone, completely unsecured, to spend your money on the promise they will pay you back? Maybe and this is largely how the system has been built. Banks have given Americans $850 billion in credit card debt. Some can pay it back but with the current recession, many cannot. We can see the purge going on in this sector rather clearly:

Since the peak in 2008 of $975 billion in revolving debt, $123 billion in credit card debt has been purged. Much of this has come through bankruptcies and write-offs as banks deal with poor performing loans. Ironically when Wall Street in 2007 and 2008 asked for trillions in U.S. taxpayer dollars, it was under the implicit notion that it was to keep the lending channels alive. Look at the above chart and you can clearly see that this is not the case. Credit card offers have dwindled to a trickle and credit lines have been slashed on even good standing customers.

I found this interesting article dated 1986 when interest rates were relatively high:

“(LA Times) Charles Newcomer, spokesman for General Motors Acceptance Corp., General Motors’ auto-finance subsidiary, said, “All the traditional assumptions about the auto-finance market are not necessarily true today.” He noted that just as home buyers are increasingly picking 15-year mortgages over 30-year loans-despite the fact that shorter maturities require larger monthly payments-some customers are also asking for shorter-term auto loans, possibly reversing the trend of recent years toward longer terms.â€

It is amazing that today, many dealers offer 72 month financing. Just like housing, Americans have taken on too much debt to finance auto purchases. It seems that we reached a point where we simply could not expand terms and pile on more and more debt. This is a debt purge that is likely to take a decade or even longer.

The current flushing out of debt is coming through many different avenues. Foreclosures are one large way of flushing out debt. Bankruptcy is another. And these have been at elevated levels going on for a few years now. It is hard to say where the balance will occur. If the economy picks up and picks up quickly, then many Americans will be able to service their debt again. Yet all market indicators have shown that a real debt purge is occurring and is likely to continue for years to come.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!6 Comments on this post

Trackbacks

-

Don Levit said:

Thanks for writing this article.

In my opinion, private debt is merely a reflection of our public debt.

When we refer to public debt, usually that refers to the debt we owe others, individuals, foreign countries, etc.

The total debt is made up of debt we owe to the public, and intragovernmental debt – debt the government owes itself!

The debt the government owes itself is represented primarily by borrowing the trust fund IOUs frpm Social Security and Medicare.

This intragovernmental debt is not reflected in any current outlays, for when the governemnet owes itself, the right hand is an aset, and the left hand is a liability.

Thus, in reconciling these figures, it is a wash!

Other than God, only the federal government can create something out of nothing.

If anyone would like more details, I have some good third party links, such as the Treasury Department, GAO, etc.

Until the government sets the pace, we will continue to emulate its debt-ridden ways.

Don LevitMay 30th, 2010 at 2:22 pm -

Bruce C. said:

I’m a little surprised that people are choosing to take out shorter term loans. I’m not sure what they’re thinking. We’re in a very uncertain environment. There may be deflation and there may be inflation. Taking out a longer term loan is a hedge against both scenarios for relatively little potential cost. If the future will be deflationary then that could mean lower income for various reasons (reduced hours, salary freezes, higher taxes, etc.) and or job loss through layoffs, business bankruptcies, etc. In that case. lower payments due to longer loan terms would be more manageable. Also, it would be easier to re-negotiate lower payment terms in that environment because the real threat of individual bankruptcy would be more likely and “believableâ€, and the loss would be higher for the lender if that were to happen. Similarly, if we have inflation, then one would have an opportunity to play the game enjoyed at the Federal level and repay debt with devalued dollars. Furthermore, I suspect that if we do have inflation, the rate could very well exceed the interest rate of the loan, being historically low, which effectively lowers the loan cost.

Perhaps most people aren’t this sophisticated, or are trying to be more responsible by following the “old rules†of responsible borrowing. Trouble is, everything is upside-down now.

May 31st, 2010 at 6:51 am -

Roberto said:

Americans are far more concerned with American Idol and Dancing with the Stars, than they are about their financial future. They will spend hours discussing these shows,(who cares?), and 10 minutes a week thinking about their finances.

May 31st, 2010 at 7:07 am -

Jan Parker said:

We were debt free including the house, but now have 4k in medical bills for a trip to the er. We’ll pound that out quickly, but it just shows that even with the most careful planning, you can get stuck with the bill. And a padded bill at that.

The only reason we didn’t have the money is that we were doing a kitchen remodel when it happened. We still didn’t go to the bank for a loan. I have no tolernance for debt, and I think that most americans have learned this lesson the hard way. We are paying it off as americans, and not planning to do the debt dance again.

The love affair with the banks is over, they are no longer a neccessary evil in my life, and I hope that everyone feels that way soon.

June 6th, 2010 at 9:17 am -

tw said:

@Jon Parker:

Sounds like you have no health insurance. $4000 is a drop in the bucket compared to what a real illness costs. I hate insurance companies as much or more than the average guy, but then I hate going to the dentist too. New figures I saw this weekend say 41% of us are going to have cancer in our lifetimes. I think my point is becoming clear without my spelling it out…June 7th, 2010 at 6:45 pm -

Tim said:

The biggest debt is the debt we have paid to the banks. When they can get money at 0% and we pay the difference – then we pay the difference.

How – One way is to raise SS retirement requirements and at the same time reduce what they pay. Work longer, receive less, and pay more – problem solve.

Thank you congress (electionpledge.com)

January 23rd, 2012 at 2:25 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market! Follow us on Twitter!

Follow us on Twitter!