America’s wealthiest 25 percent of households own 87 percent of all U.S. wealth. How the middle class face growing income inequality in the new era of the psychopath corporatocracy.

- 4 Comment

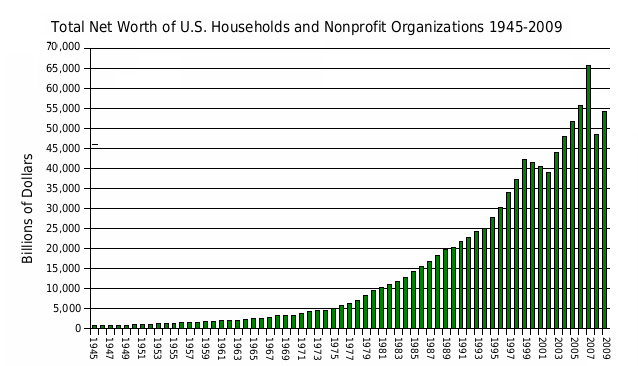

A true measure of economic vitality is measured by wealth. We can look at incomes or other measures of productivity but real wealth is measured by net worth. Who controls wealth in the U.S.? According to a study from the Joint Center for Housing Studies the top 25% of U.S. households control 87% of all wealth in the country. That number comes out to a nice hefty sum of $54.2 trillion. If we look even closer at income distribution, we will find that the top 1 percent in our country control 42 percent of all financial wealth. By all measures being able to acquire a piece of financial wealth was the hallmark of the middle class of previous years.

Today we have a society largely in debt to credit cards, auto loans, student loans, and immense mortgage debt. Net worth is measured by looking at assets minus liabilities and many Americans are lucky to break even while many have a negative net worth.

Even after the current wealth destruction of the recession, our country has grown wealthier and wealthier over time and the trend is clear:

Source:Â Wikipedia

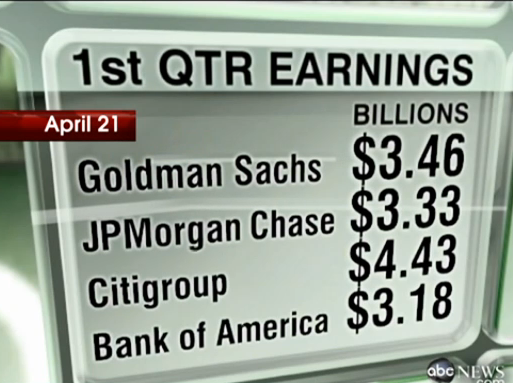

Yet more and more of this added wealth is filtering its way to a smaller group and not necessarily the most productive in our country. In the first quarter of 2010 some of the biggest banks in this country made continuous profits without really adding any benefit to our economy or society:

Source:Â ABC News

In fact, many of these banks simply made money by hoarding money and actually lending it back to the U.S. government (who actually bailed them out to begin with). These weren’t successful companies that produced a solid product. These are the companies that failed but had politically bought out the right connections. The U.S. Treasury and the Federal Reserve are designed to protect the top bracket of our society while allowing the systematic dismantling of the middle class. They call the current process the “free market†but this doesn’t apply to the biggest corporations in our country. In fact, many have leveraged the current recession to squeeze out every ounce of productivity from their current workers. Buying out politicians through lobbyist is merely another line item expense on their balance sheet.

Corporations are holding many working class Americans financially hostage. And if you look at our big trade partner in China, you will see that income disparities are also rising there:

“(China Daily) He said the income difference measured by certain indexes such as Gini coefficient might not reflect the real situation in China as it fails to take the local social welfare system and wealth disparity into account.

“Things could be even worse if we consider all these aspects,” warned Li, citing although the index of the United States is also above 0.4, but expenditure on social security and welfare accounts for about 50 percent of its total fiscal outlay, 40 percentage points higher than in China.

In addition, the assets of the richest 10 percent of the population account for 45 percent of the total residential assets in China, while the poorest 10 percent own just 1.4 percent of the total assets, according to an official report released in 2004.â€

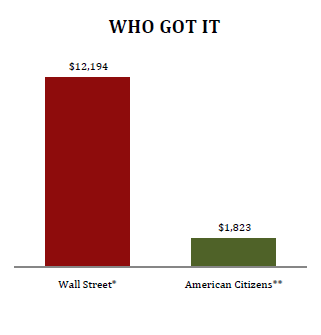

Think of those banking profits in the first quarter of this year. It would be one thing if banks were lending to Americans and small businesses making local communities stronger. Instead, they are gambling on the rigged stock market which really has become disconnected from every typical American. Trillions of dollars in bailout funds have been diverted to protecting the banking interest which in turn looks after the interest of the corporatocracy:

Source:Â It Takes a Pillage

When you break it down like this, you can see why most Americans have felt very little impact from the historical amounts of bailouts that have gone into the system. The quarterly profits from the banks should tell you exactly what is occurring. As local small businesses struggle with the recession and have difficult times accessing loans, big corporations and banks have no problem getting funding because they already have control of most of the wealth in our country.

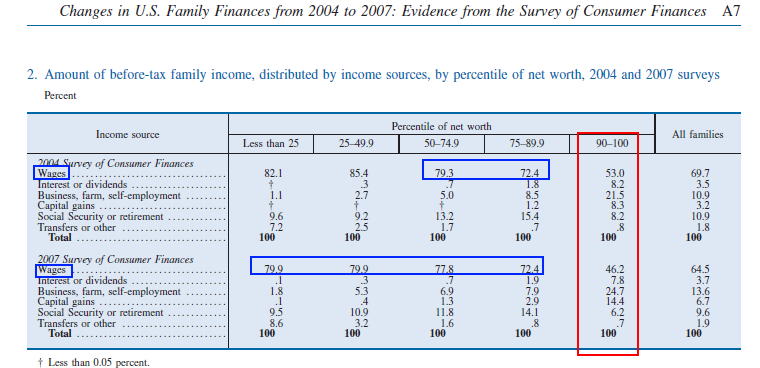

And contrary to the propaganda out from Wall Street, most Americans earn money from their jobs and not investing or speculating on stocks:

Source:Â Survey of Consumer Finance

90 percent of all households earn 70 percent or more of their income from wages (presumably from actual work). But take a close look at the capital gains line. The vast majority of Americans get 2 percent or less of all their income from capital gains. You have to get into the top 10 percent to see any sizeable amount. And even here, you would have to break into the top 1 percent to see real sizeable gains. So this idea that the stock market reflects the health of Main Street is bogus but is a form of consumer manipulation to get more people into the rigged stock market to continue to fund the corporatocracy hunger for more capital. Now that they have control of the government, they don’t care if average Americans jump into the game. It is easier to rob it directly from bought off politicians.

Even as the recession has put our underemployment rate to 17 percent and has wiped out trillions of dollars in aggregate wealth, those at the top have actually become richer relative to most Americans. You see many of these banking PR representatives with their sob stories of how much money they have lost. It is nonsense because money is worth what you can buy with it. So now, that millionaire banker won’t have to spend $20 million for that private home, he can have it for $10 million. So his salary might be off by 10 or 15 percent but his buying power just increased because most people are struggling with wealth destruction if they work in the real economy. Or these large banks can hire cheap labor since so many people are unemployed and use bailout funds to turbo-charge their bonuses. This is how America is looted by the corporatocracy.

The corporation in the eyes of the law is seen as a person. Yet it is driven by:

-The bottom line

-Disregard for workers long-term stability

-Ignores long-term objectives

-Narcissistic behavior

In fact, it is a casebook psychopath. Yet under the law it is treated as a person and presumably, is acting under a moral obligation to society. If you went out and robbed a bank, you will go to prison. If a corporate bank robs the U.S. Treasury, it gets even more money with the threat of “we are too big to fail.â€Â So it should be no shock that banks are raiding the public trust and buying out politicians even though the current Wall Street structure is damaging to the health of America. These people are so delusional preaching their “all things are great†mantra and forget to see that the current structure has led us to the biggest economic calamity since the Great Depression. Clearly something has failed here.

If we keep allowing the current structure to play out the middle class will slowly fade away and be replaced by an even stronger corporatocracy. The growing income disparity should give you a quick hint where things are heading. The fact that you can’t pay for college without going into massive debt through the banks is another hint of where we are going. This falls into the new paradigm of corporate rule because they would love nothing more than a giant population of mindless drones who simply go out and purchase their goods without questioning the system.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!4 Comments on this post

Trackbacks

-

Ray said:

I wonder if they have a grasp on the “nothing left to lose” dynamic?

Because I for one would truly love to provide them with a small

lesson in the illusion of impunity.May 24th, 2010 at 4:43 am -

Don Levit said:

Can you provide the link for the Joint Center for Housing Studies report which stated that the top 25% of all households control 87% of all the wealth?

According to the 2007 Survey of Consumer Finances, the top 25% control over 88%of all financial assets.

Even more disturbing is that the top 10% control 72% of all financial assets.

With 70% of our GDP dependent on consumers, this seems to be way too much concentration of wealth.

Go to:

http://www.ebri.org/pdf/notespdf/EBRI_Notes_05-May10.IAs.pdf.

Don LevitMay 25th, 2010 at 10:33 am -

cgo said:

we now live in a financial dictatorship which is more insidious and malevolent than any human dictator could ever be // these corporations bend the political system to their will while they stifle competition so as to maintain their unregulated monopoly status// it will not matter who we elect they will simply corrupt that individual to do their bidding// as much as possible power must be brought back to the local level so as to diffuse the concentration of power or we must dismantle these corporations into a more manageable size// that is probably why the old folks let the great depression occur// we need to do the same

May 26th, 2010 at 6:11 pm -

Markus said:

We might as well get ready for a holocaust 🙂

June 27th, 2010 at 11:11 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market! Follow us on Twitter!

Follow us on Twitter!