Owners’ Equivalent of Rent: The Fed and BLS Gaming the System.

- 1 Comment

It probably won’t come as a surprise to you that consumer prices are rising at an incredibly rapid pace. If you were to only look at the Bureau of Labor and Statistics (BLS) CPI numbers you would think that inflation is hovering around 3 to 4 percent. Of course this is utterly devoid of any reality given that food, energy, and even housing prices are growing exponentially. For the average family housing is the most expensive monthly cost to their budget. Given that 67 percent of Americans own their home and the rapid rise in housing prices over the past decade, why has inflation been low?

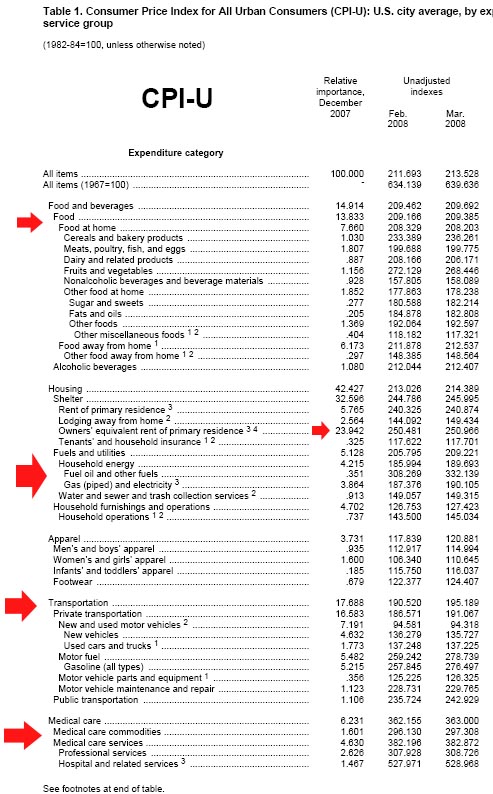

According to the BLS, 23.9% of the CPI index is made up of what is considered “owner’s equivalent of rent.” This is one of the largest percentage items in the entire basket of goods that makes up the CPI. Just to give you a cleaner definition let us look at the BLS website:

“Until the early 1980s, the CPI used what is called the asset price method to measure the change in the costs of owner-occupied housing.

The asset price method treats the purchase of an asset, such as a house, as it does the purchase of any consumer good. Because the asset price method can lead to inappropriate results for goods that are purchased largely for investment reasons, the CPI implemented the rental equivalence approach to measuring price change for owner-occupied housing. It was implemented for the CPI-U in January 1983 and for the CPI for Urban Wage Earners and Clerical Workers (CPI-W) in January 1985.

Rental equivalence. This approach measures the change in the price of the shelter services provided by owner-occupied housing. Rental equivalence measures the change in the implicit rent, which is the amount a homeowner would pay to rent, or would earn from renting, his or her home in a competitive market. Clearly, the rental value of owned homes is not an easily determined dollar amount, and Housing survey analysts must spend considerable time and effort in estimating this value.”

So what this did in the last decade is horrifically understate housing prices in practically every part of the country especially in high priced areas like California. First, it was not uncommon for someone to pay a monthly mortgage of $3,000 on a place that would rent for $1,700 to $2,000. This in itself understated a significant portion of the CPI index which again is a reason why rising prices were not being reflected. It also gave the Fed ammunition to slash rates since they could argue inflation was tame. With easy access to credit and homeownership rising, rent prices were holding steady simply because in the market more people were electing to purchase homes. Let us isolate the owners’ equivalent of rent and look at the year over year change for the past decade:

At the highest peak, we had 4.5% being our peak jump in 2002! Clearly this does not reflect the cost of the actual price of a home which grew by double digits throughout the decade. In fact, after the 2001 recession rents increased most likely because during tough times there is a premium on renting. That is why we are seeing rents holding steady in many areas and in some cases, even increasing with the demand of people looking for shelter.

The government managed somehow to understate inflation which is actually a useful cost saving mechanism since Social Security and many public workers have salaries tied to cost of living adjustments which derive their information from the CPI. The Fed had no regard for the rising price of assets such as housing since they knew it would not be reflected fully in the CPI thus fueling their lax monetary policy – they had data to back up their policies. Yet they have now caused unintended rises in other areas, primarily food and energy:

Take a look at the CPI components:

The major areas of food, housing, transportation, and medical care are all rising and have been rising drastically in the last decade. Amazingly the government tries to focus on core inflation, a measure that eliminates volatile areas such as food and energy. Given that energy has risen to a point where it is impacting the daily lives of Americans and food is also increasing, I think it is safe to say that the measure does not reflect the lives of most Americans. So you are wondering why the Fed is always so tempered regarding inflation. Well here is the reason:

“Since February 2000, the Federal Reserve Board’s semiannual monetary policy reports to Congress have described the Board’s outlook for inflation in terms of the PCE. Prior to that, the inflation outlook was presented in terms of the CPI. In explaining its preference for the PCE, the Board stated:

The chain-type price index for PCE draws extensively on data from the consumer price index but, while not entirely free of measurement problems, has several advantages relative to the CPI. The PCE chain-type index is constructed from a formula that reflects the changing composition of spending and thereby avoids some of the upward bias associated with the fixed-weight nature of the CPI.

In addition, the weights are based on a more comprehensive measure of expenditures. Finally, historical data used in the PCE price index can be revised to account for newly available information and for improvements in measurement techniques, including those that affect source data from the CPI; the result is a more consistent series over time. -Monetary Policy Report to the Congress, Federal Reserve Board of Governors, Feb. 17, 2000″

The PCE rises about 1/3% less than the CPI which is a trend dating back to 1992. Talk about massaging the data. In a few years, we’ll have no inflation and gas will cost you $7 a gallon and your grocery bill will double but according to the government all prices have stayed the same.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

1 Comments on this post

Trackbacks

-

Aaron Krowne said:

Chain-weighting is so completely bogus that it typically doesn’t even add up to 100%.

By the way you didn’t mention that OER leads to an over-stating of inflation in a housing downturn, which is what we are in now. Poetic justice for our mendacious bureaucrats. Of course, there is little danger of them accidentally over-stating TRUE inflation.

May 9th, 2008 at 7:45 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!