Real Unemployment Situation: Approximately 26,000,000 Unemployed or Underemployed. Job Growth in $10 per Hour Jobs while $20 per Hour Jobs Disappear.

- 7 Comment

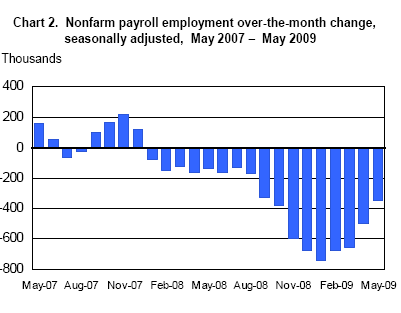

On Friday, we learned that the unemployment rate jumped to 9.4 percent from last month’s 8.9 percent. The BLS data surveys 160,000 businesses and government agencies that affect roughly 400,000 people so the data does cover a large portion of Americans and gives us a good sample size. The markets were largely moving sideways on Friday unable to make sense of the mixed data because we are still largely living through a highly volatile market.

Yet the interesting thing that happened on Friday was the jobs lost in May were much smaller than expected. The market was expecting a 500,000+ job loss month and only 345,000 jobs were lost for the month. Yet the market was also expecting a rise of the unemployment rate to 9.2 percent while it spiked up to 9.4 percent, the 0.5 percent jump is tied for the largest monthly jump since the recession started (the other major monthly jump occurred in February).

So this is good news right? Well any time we see job losses abating that in fact is good news but we have to look at the data more closely before arriving at any major conclusions:

It is clear that the actual raw number of job losses is improving but the troubling sign is deeper in the data. Nothing highlights this more than Wal-Mart announcing it will hire 22,000 workers and expand while General Motors on Monday announced it would be filing for bankruptcy and downsizing. We are shifting to retail low wage work while destroying higher paying manufacturing work. Let us first look at what occurred in May:

Click for sharper image

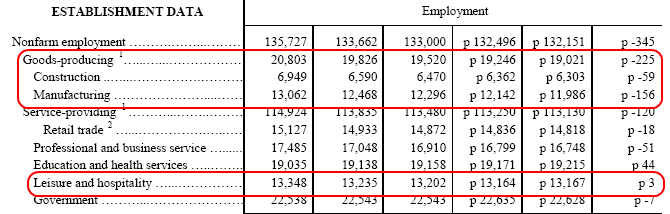

As you can see from the chart the biggest sector to lose jobs in May was “goods-producing” jobs which pay higher wages. We saw an increase in leisure and hospitality work. This would be good if it wasn’t the case that we were replacing $20 per hour jobs with $10 per hour jobs selling goods produced in other countries.

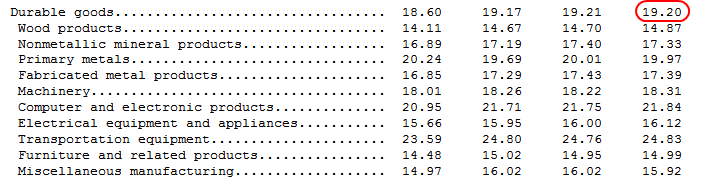

Now if we look at the hourly wages we start realizing that there may be little improvement in the employment picture when it comes to better paying jobs:

Now why is this occurring? Well the first thing we need to understand is that this is the deepest recession since World War II and probably since the Great Depression. The large pseudo-prosperity of the past three decades has been based on major bubbles including the housing and technology bubbles. Now much of the good paying jobs during this decade occurred in the finance and real estate sectors. Those jobs are largely disappearing and not earning what they once did. But more troubling has been our systematic dismantling of manufacturing. The case of Wal-Mart contrasted with GM this week tells us where we are heading. We are breaking our employment base into a largely service driven economy. For all those claiming this is good ask those people working in manufacturing who just lost $20 per hour jobs and now are battling it out for $10 per hour jobs at Wal-Mart.

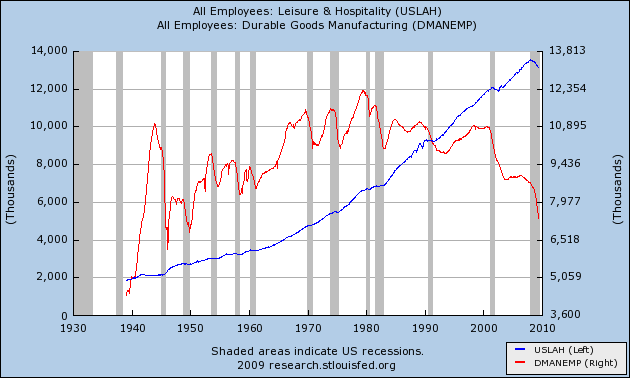

This did not occur over night:

As you can see, since the early 1980s we have replaced “durable good” jobs with “leisure and hospitality jobs” which basically means we stopped making things and started consuming things in large quantities. Unfortunately we did all of this with massive amounts of debt that have now put our country at risk.

If we break down the unemployment numbers further, we see that nearly 26,000,000 American workers are either unemployed or underemployed:

Unemployed:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â 14,500,000

Part-time workers:Â Â Â Â Â Â 9,100,000

Marginally Attached:Â 2,200,000

Total = 25,800,000 unemployed or underemployed workers

The U-6 rate is at its highest point ever measuring a more accurate picture of the employment situation registering a 16.4 percent rate. It is amazing how high our part-time work force has now become. Keep in mind the large number in this group have no benefits and no security of a full-time job. The growth in this area is troubling. In May of 2008, we had 5.2 million workers classified as “part-time for economic reasons. Now, that number has grown to 9.1 million. An increase of 75 percent in only one year is troubling but this is the new trend of replacing $20 per hour jobs with $10 per hour jobs. Although it is good news that job losses are not so deep, one $20 job lost is the equivalent of two people finding $10 per hour jobs.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!7 Comments on this post

Trackbacks

-

The Weakonomist said:

This is a good analysis of the jobs situation. I hadn’t really thought about the growth being in low wage employment. The one thing I’d add is that the jobs in high finance aren’t going anywhere. There are some gone but for the lost part they are going to be fine. Where we’re going to get killed is the loss of manufacturing jobs. GL and others have contributed a lit to the middle class and when they’re layed off they end up working at walmart.

That is great analysis though.

June 6th, 2009 at 10:42 am -

Finance Junkie said:

Beautifully well written. Highlighting the disparity between $20 and $10 jobs is important. Additionally, the U-6 total unemployed/underemployed rate doesn’t normally get advertised like it should.

Over the next decade the liesure sector job growth should deteriorate since household disposable income is eroding with the trend of jobs switching from $20+ to $10-$12 range.

June 7th, 2009 at 10:01 am -

Mark M. said:

Nice article that would benefit from a follow up that investigates why we are shifting from a production based to a service based economy -and it’s not all about China. I’m referring to something even broader.

Forgive me for the generality, but essentially the last 150 years has seen:

1850-Trains

1880-Electricity

1900-Industrial Revolution

1910-Auto/Planes

1920 -WWI

1930-GD

1940-WWII

1950-Plastic

1960-Space

1970-ComputersThe refrigerator is not yet even 100 years old!

Sadly, Economies are “bubbles”. Even slow growth is not enough to sustain the standard of living for the masses, especially in the long run. Large scale, pent up, aspirational demand is what is needed, but demand for what? I-Pods? Who (in sufficiently large numbers) still needs a new….anything???

I posed this question elsewhere and two the top three responses were: Cold Fusion, Internet and Green Tech, but realistically, only something like Cold Fusion, and all the new products it would create , really has the “shock and awe” factor needed.

Otherwise, Mexico is the future for the world where 40% live in relative splendor while 60% live in “comparative” poverty.

June 7th, 2009 at 2:03 pm -

CD Rates Guy said:

America is turning into a service-based economy, and things aren’t looking too good. Well-written post.

June 9th, 2009 at 9:14 am -

Brett said:

Good article.

It is interesting to consider that we have done away with domestic manufacturing because our wages are too high (relative to some countries), and our wages are too high as a result of bubble economies (finance, real-estate & services for those people with high wages from the bubbles)!June 9th, 2009 at 3:48 pm -

Pim said:

I agree that we are turning into a services country..

But isn’t that what Bill Clinton said he wanted for us???After he signed NAFTA…I believe I am right..

Good article, very good comparative.August 7th, 2009 at 7:32 pm -

JonnyL said:

The commentators seem to think we are heading for a service based industy. Ummmm comon guys peel off the surface layer. On the surface its a changing of a casino regulated financial sector. But it goes much deeper. High priced manufacturing products, which means high paying manufacturing jobs, have been over produced and the market is oversaturated. So they must be fired… People must sell the excess supply of goods, bought by credit, over time. Lots of people fired, all at once… but to prevent this the fed inserted stimulus to prevent a collapse of how the system works. Stimulus was created liquidity to fix failed balance sheets at the bank. Instead of a collapse, it has become a gradual decay until equilibrium, which will never be acheived with “created” money constantly being pumped into the system. Collapse is inevitable. 1 year of growth (which is just increasing GDP nominally. Not only that but GDP is a bad way of assessing a countries economic wellbeing) then a decline like nothing we have ever seen. As the housing market fails to return to any sense of normalcy and commercial real estate debts come due, mass defaults will occur and collapse will occur. Commercial real estate debts maturing will increase between now and 2012 (I read somewhere its been 260 worldwide commercial bankruptcies just this year). As these debts have no new equity, because nobody has any cash to buy anything, there will be no money to be made, therefore the bank cant refinance because of the lack of equity. They will be forced into forclosure, and this will happen at an exponential rate.

The pensions promised to the employees are not there because companies are going bankrupt forcing the baby boomers to continue longer which affects new workforce entrants screwing with the balance of jobs gained and jobs lost… welcome to generation unretired (baby boomers) and the lost generation (? – 27)…these first few bubbles (the housing, the stock market) are just blips compared to what is down the road.

I hope that i am wrong every day… but the evidence keeps building up.

Although all of this is bad news I am optimistic, New deregulations of communication have occurred and new open source discussion tools are being created right now (scribblelive.com, googlewave.com). This will hopefully allow more transparency of true and valid information to be brought into th spotlight. What im seeing is a tool like wikipedia but for discussion boards, most viewed + highest rated discussions, hopefully this will allow people to make more educated decisions.

December 13th, 2009 at 5:53 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!