Serfdom via student loans – Lenders going after Social Security and saddling college graduates with a debt albatross. Modern day debtor’s prison comes with a University degree.

- 14 Comment

The sharp attention being pointed toward higher education is important for a variety of reasons including the grim reality that we are facing another extraordinary bubble. Instead of blindly following into another credit fueled bubble we should probably pause as we cross the $1 trillion student loan threshold. The cost of education is becoming onerous and student loans are littered with financial landmines. Many are given to students to attend for-profit schools that will yield very little return on investment in the market aside from stockholders and corporate leaders. The uglier side also includes the inability to discharge student loans in bankruptcy. Americans have the ability to discharge mortgage debt if they are unable to pay their home payment. Businesses have the power to renegotiate contracts and loans with banks. Yet we somehow have managed to recreate debtor’s prison except it comes in the form of a student loan. Another dirty secret comes from the financial institutions gouging students with additional fees on top of the original loan balance. The higher education bubble is popping and the long-term implications loom large for our struggling economy.

Student loans creating a generation of serfs

One of the implicit tenets we live by in America is the ability to fail and comeback from setbacks. Currently this idea has been usurped by the giant financial organizations and has excluded virtually every other American. You have luxury hotels imploding and banks simply dishing billion dollar bad bets to the American taxpayer. At the core of the too big to fail bailouts is the notion that banks made horribly bad bets and needed to walk away. So they did by saddling the American taxpayer with the bill. Yet with student loans banks are lending to anyone and everyone willing to attend any questionable institution. The due diligence is comical and the corruption that is occurring is similar to the mortgage boiler rooms that were dishing out subprime loans to any person that walked in through the front door. The stories of student loan purgatory are starting to fill the internet. Take a look at this post from “Frank†over at Student Loan Justice:

“I graduated from law school in December of 97. I have paid on my student loans off and on over the past 9+ years and have paid back an estimated $75,000 on a loan that when I graduated was a little of $100,000. When I last checked the pay off amount it was over $135,000 and thats with paying $75,000 + over the past 9 years. I owe more on it now than when I took them out !! One of my loans is in default, they claim I owe them $23,000+ (which somehow jumped from $17,000 in a span of about 30 days) My two other lenders are close to defaulting and I am unsure if I should just let them default…â€

This is one of the darker sides of student loans that are kept hidden by the banks and the government. Many lenders gouge students when they encounter problems. Unlike a credit card for example, when you have really extraordinary problems you have an exit hatch with bankruptcy. Ideally lenders are doing enough due diligence to learn their lesson. Yet with student loans the market keeps increasing as for-profit schools and other institutions increase tuition and saddle students like Frank above with insane amounts of loans. First, they have this person stuck in a modern day debtor’s prison. No way out. Next, they compound the misery by tacking on fee after fee. If Frank was unable to pay the initial amount what use is it adding more and more on top of it? The ugly side of the industry is they realize that they will have to milk the student as much as possible on the front-end. The government guarantees most loans so many lenders care not if a student really has any ability to pay the loan back in the future. These lenders quickly say, “well Frank shouldn’t have signed.â€Â This cynical attitude is what is expected especially when the lender isn’t using his money. How about we ask the same lender to use their own money if they really feel many of these students warrant the current amount of loans being issued?

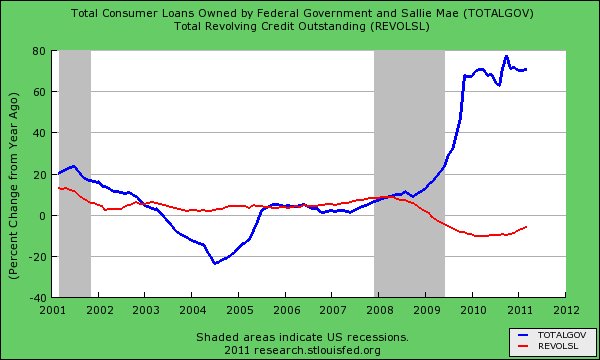

The acceleration and growth of student loan debt is incredible:

Student loan debt has long surpassed credit card debt but now is inching closer to $1 trillion. The bet is that by going to college a student will increase their earnings potential. The for-profits use multi-decade data on public and private institutions that actually show real increased earnings over a lifetime. This is true. Yet the for-profit machine is relatively new. They tout the earnings potential of a college degree even though they are selling a glorified piece of paper for tens of thousands of dollars with no measurable results for that specific institution. The result is you have a two-tier system developing with graduates; you have those that went to reputable schools and those who got conned:

“(Miami Hearld) It’s been a year since 23-year-old Carlos Tejero graduated Kaiser University with an associate’s degree in nuclear medicine. He’d been working in retail and as an insurance salesman for some six years before then, so he has some work experience, too. But Tejero is still unemployed, and all the while, the money he took out to pay for his degree is building interest. Tejero is loaded with $18,000 in student debt.“For people who are serious about their education, there’s really no other option,†he said.â€

The mentality of “education at any cost†is one that is surging out of control and is a bubble that is fully in season but is also starting to bust:

The cost of going to college has outpaced every category of living by a very wide margin. It is hard to believe but the cost of college has even surpassed the now historic housing bubble. How can this be? You have a perfect combination of:

-Un-regulated casino like financial sector

-Government bought out by financial sector and used as a dumping ground

-A myth that any college is a good college

-A marketing and propaganda machine that is actively destroying the middle class

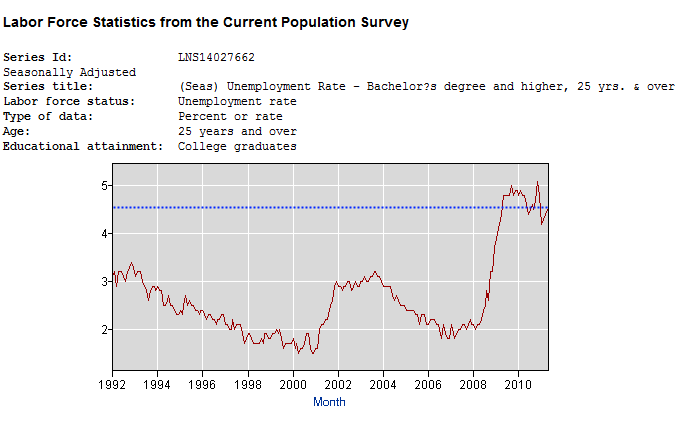

Add this all into the mix and you have the current environment. It is unfortunate because having a strong educated workforce is something that we should pride ourselves in. Instead of focusing funds on producing intelligent and knowledgeable individuals the financial sector and government are simply trying to increase the graduate count even if it means hundreds of thousands are coming out of schools with no measurable gain in knowledge. We are seeing now an army of unemployed college graduates:

This is a record level still and the above chart hides the fact that many graduates are underemployed in a field not utilizing their skill set.

“(eCollegeTimes) Tiffany Groene is waiting tables.

Erin Crites is making lattes and iced coffees.

And Anna Holcombe is buying and selling gold.

These three women share more than just scraping by with low-paying jobs: They all have master’s degrees and are unable to find work in their specialty areas.

There’s even a name for their situation. They are referred to as mal-employed, a term coined in the ’70s for college graduates who could not find jobs that require a degree. Instead, they settle for low-skilled jobs.â€

The big difference between now and the 1970s is that these “mal-employed†workers are being hounded by the albatross of student loan debt. It is interesting that every other item of consumer debt has contracted strongly except that of student loans:

This really isn’t surprising given that our current crony financial system is bent on sucking every nickel and dime out of the working and middle class. They don’t care that students are being taken for a ride. Many of these “colleges†set up shop in empty commercial buildings and suddenly are open for business. It is amazing that anything Wall Street has gotten its hands on it has turned into a giant bubble. Take housing for example. Prior to the casino era homes were rather boring investments and people actually built solid equity in their homes. That all changed as we know once the too big to fail banks got involved. The same is happening in education. There is no doubt that we have great institutions in the market. Yet the amount of subprime institutions is astounding and many are being sucked into this troubling trap.

While Social Security is a part of the topic, still there’s another type of security of concern — a security system. When considering a home investment, why not contemplate wireless security cameras. Hopefully they’ll never be needed in a time of crisis, but if so, you’ll be glad you had them! Be sure to check out this sites security Cameras for the home as well.

What is fascinating is that the vampire financial system might have found a backdoor at robbing people from their Social Security:

“(Valley Advocate) They get 25 cents on the dollar—on average they get $123,000 back from the borrower on a student loan for $100,000. There’s no statute of limitations. … Sallie Mae often brags that they can predict very accurately who is going to default. They treat the people they predict will default much worse. They don’t grant them forbearances. At the root of it is [lack of] bankruptcy protections, which enables the whole system to start cycling up in this predatory fashion.”

Wish number two, Collinge says, is that the system would stop garnishing people’s Social Security. “I’ve gotten submissions [for the Student Loan Justice website] from senior citizens who couldn’t buy medications as a result of a percent of their income going for their loans,” he says.â€

What an incredible mess. Using a college degree to saddle hundreds of thousands with insurmountable levels of debt. Is this really what we want from our education system?

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!14 Comments on this post

Trackbacks

-

David Beglinger said:

It is the duty of the lemons to be squeezed,

And all the fair young flowers to be plucked,

Who will save them, grant them mercies

Hear their sad pleas?

Money changers in The Temple?

No such luck.

Alas, my sons, my daughters,

You are well and truly f*cked.June 6th, 2011 at 7:16 am -

Laura Wilkerson said:

The law student metioned in the article should enroll in an online college and take the minimum amount of classes each semester to keep their loans in deferment until they croak.

June 6th, 2011 at 8:33 am -

Laura Wilkerson said:

The lawyer mentioned in the above aricle should enroll in an online college and take the minimum number of classes needer to keep their loans in deferment until they croak.

June 6th, 2011 at 8:34 am -

Lisa said:

Its crazy what’s happening to our future. Seriously …the average public university wants anywhere from $80,000 to $120,000 for simple B.S degree now. What makes matter worse is most degree programs FIRST two years is pretty much a repeat of high school and then the last two years you get to learn the core of your degree.

How ridiculous is this? Students should get some basic core living skills in high school such as nurse assit, dental assisting, auto mechanic etc..where they have actual skill to work off of.

College should be extending of all of these..but people are just getting into massive debt to repeat the same things over and over.

Its absolute dumb the American system of college. What it really is just a debt trap to enslave young people to keep paying interest on enormous loans for the rest of your life.

Seriously add up how much it cost ..your loan interest alone and the years you had no income while in college and your really not making much more. You just sold your soul to the devil.

Better love what you do..cause you will be paying a long time for it.

June 6th, 2011 at 1:20 pm -

DMC said:

I guess Article 1, Sec 8, Clause 4 of the Constitution should be changed to indicate that “…UNIFORM laws on the subject of bankruptcy…” doesn’t include student loans. Why the hell this hasn’t been challenged is beyond me.

June 6th, 2011 at 4:02 pm -

Dumbfounded said:

I wonder what the Emperor thinks about this. Perhaps he is too busy admiring his new clothes. This saddens and sickens me. All I can suggest to those who have these loans is to organize and vote.

June 6th, 2011 at 6:59 pm -

Larry Sellers said:

Just a thought – bankruptcy laws vary. I wonder, for example, if a debtor was to move and establish domicile in another country with more favorable law… An Islamic country for example – would the interest payment itself invalidate the debt in the view of the Islamic court? What are Irish laws vis a vis these stubborn debts? Israeli? The forgiveness of debt is common to all the Abrahamic traditions…

On a moral level, if I were young and owed an unpayable debt, I might think about applying to the Cuban medical school and finding myself doing medicine in some poor and remote village – where debt collectors might not trouble to find me…

June 6th, 2011 at 8:03 pm -

Elaine Kibler said:

Sadly, this does not surprise me since business, especially big business, has shifted from making a reasonable profit to greed and pure glutinony — get ours now and everyone else be damned!

Not everyone needs to go to college and certainly not right after high school. Most of us need time to discover our “calling” — what really makes us want to get up every day and go to work. Sometimes working a job for a while helps to clarify what is important to the young person. This coming from a former college admissions officer at a public university. The most successful students tend to be the adult student. This student is focused, on a mission. They understand the time value of money. They aren’t there to play around socially. Their studies are directly applicable to their professional endeavors.

Ethics and integrity are whittled away daily. Accountability issues are rampant. We see that daily in the news…today it is Congressman Weiner. As individuals we need to decide whether we will participate in this nonsense further destroying our country or draw a line in the sand and say I will not…I practice integrity in all aspects of my life. It is not okay to expect others to do what is right and not practice the same!

Most consumers do not understand how the interest on their loans is calculated, open ended or closed or referred to as simple or compound interest. Who would think to ask this question especially when the loan is the only way you get to go to school? Compound interest is what you want to earn on your money not pay on your loans. The effects of compounding calculations is what is driving the outrageous growth of the loans. The good news is that there is a way to pay them off without changing the payments, refinancing or consolidating them and little if any change to the lifestyle or budget or ending up in debtor’s prison as is forecast in the article. How do I know? Because it is one the things I do as a business professional – help people get out of debt and build wealth!

June 6th, 2011 at 10:46 pm -

tyler said:

Unfortunately its the biggest myth perpetuated on the american public and teenagers. “A college degree is your ticket to a better life.” People are brainwashed, I’ve seen teenage single moms enroll in college. Times have changed and a college degree is worthless for ninety percent of people. The colleges know the public and parents are brainwashed and can charge whatever they want.

June 7th, 2011 at 10:41 am -

tyler said:

They’ll even send in a swat team if you don’t pay your loan. http://www.news10.net/news/article/141072/2/Dept-of-Education-breaks-down-Stockton-mans-door

June 8th, 2011 at 9:28 am -

Glen Litsinger said:

With internet courses a student today can get a top-quality college education for anywhere from $8K to $15K. The students can work those same jobs that the graduates are now stuck in (waitressing etc) part time, and not be saddled with a loan at all.

June 9th, 2011 at 10:15 am -

DaDumfuk said:

“What is probably most important to glean is that these nondischargeability provisions came up at the last minute over the opposition of key legislators. Both the primary co-sponsor of the 1978 Bankruptcy Code (Rep. Don Edwards) and the Chairman of the House Subcommittee on Post secondary Education who oversaw the Education Amendments of 1976 (Rep. James O’Hara) objected to the introduction of a student loan nondischargeability rule. O’Hara protested bitterly that Congress was “fighting a ‘scandal’ which exists primarily in the imagination†and that the amendment “treats educational loans precisely as the law now treats loans incurred by fraud, felony, and alimony dodgingâ€

“The evidence of a lower than 1% discharge rate of federally insured student loans in bankruptcy did not block the nondischargeability provision from entering the Bankruptcy Code — this even so under a comparatively liberal Congress that passed the debtor-friendly 1978 overhaul of

the Bankruptcy Code.”Instead of getting new books, they should have given us a shirt that said, “Welcome to F. U. University. You da one getting F’ed.”

June 12th, 2011 at 6:18 am -

DaDumfuk said:

Ya know what is really sad?

The fact that those first people who defaulted in the 80’s, the first victims of the trade schools, whose bankruptcy rights were taken away by CONGRESS before and after the 1992 “reforms”, are about to start retiring, and they will do so, while their Social security checks are being cut by budget needs AND garnishments for student loans.These people are no different than someone who gets victimized by a used car salesman who sells a Flood car to someone as “mint condition” (they are scrap). They should be able to get their money back, and their loans wiped out.

Until we accept this fact, Hundreds of thousands are going to start to really suffer.

June 12th, 2011 at 6:27 am -

hiway280z said:

congress and the rest, their children are exempt. they get the loan and don’t have to pay it back. No wonder they all spend millions to get elected.

June 17th, 2011 at 1:16 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!