Student debt hit a depressing amount now hovering at $1.5 trillion. Where do we go from here?

- 1 Comment

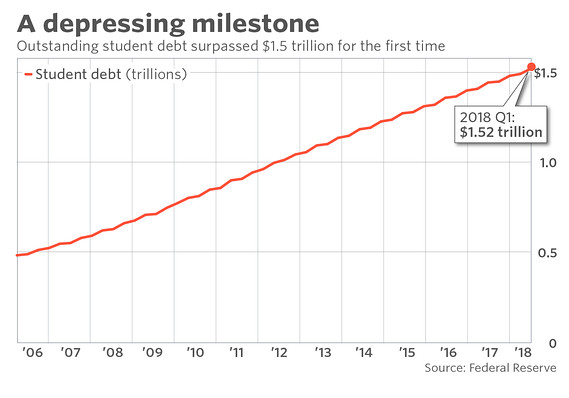

How much is a college education worth? This question seems to be growing in importance over the last decade as the cost of attending a university is getting out of reach for many. Going to college and getting an education seems to be part of the package deal when we think of the American Dream. However, the cost of attending college has gotten so expensive that Americans now find themselves in debt to the tune of $1.5 trillion in student debt. This is troubling on many fronts because young Americans are entering a market where housing prices are out of reach and the cost of living is simply outpacing any wage gains. Having a large student loan payment each month only makes it harder to build wealth and take the next step in being financially secure. There is something depressing about the $1.5 trillion figure because only a decade ago we were ag $600 billion – in other words, we’ve added nearly a trillion dollars in student debt since the iPhone hit the market.

Runaway student debt

It comes as no surprise that one of the big topics on the campaign trail revolves around college affordability. Long gone are the days where this was merely a young person issue. Millions of Americans are shouldering back breaking levels of debt and trying to ascertain where they went wrong.

Take a look at the growth of student debt in a rather depressing chart:

What is going on here? First, college tuition inflation is running out of control because of the way student loans are given out. Think about this – anyone with the desire to go to college can do so regardless of the cost of the actual college. This is actually very supportive on the surface. However, someone can go to a state school with strained resources for say $10,000 a year or go to a full-service private university where tuition can run $60,000 per year. That is a big difference. And with roughly 5,000 colleges and universities around the country this scenario is playing out over and over. And clearly the route many are taking is by going deeper into debt.

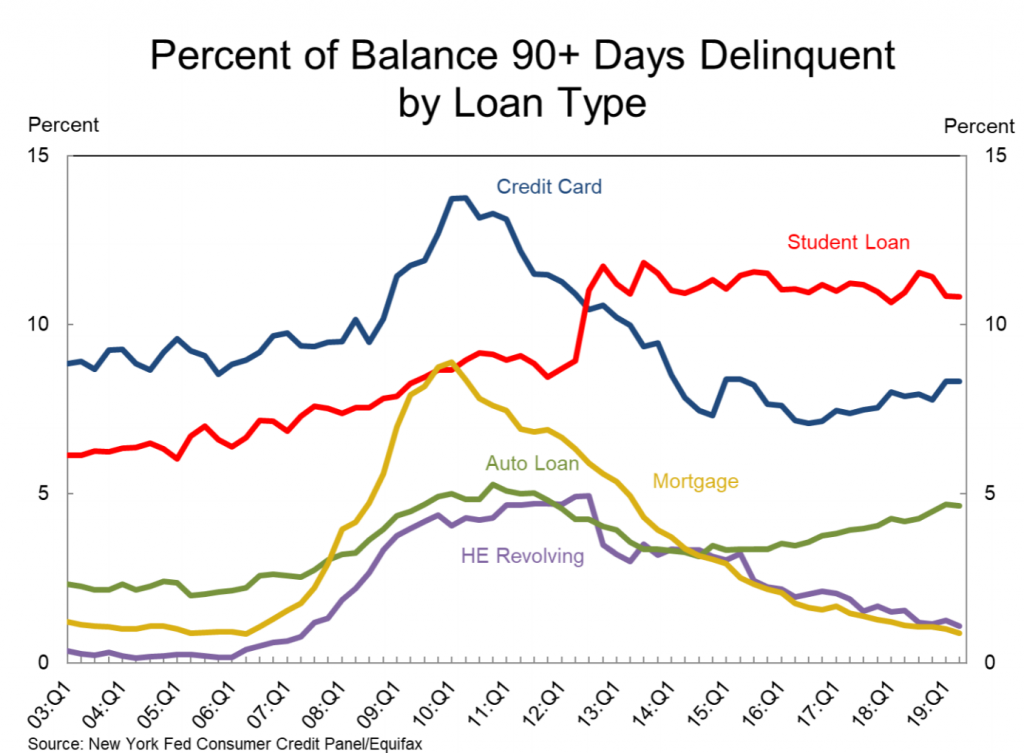

The amount of student debt in our country is stunning and it only seems to be growing. We are already seeing cracks in this mountain of debt. Student loans have some of the highest distress rates for any loan product:

Keep in mind that student loans stick with borrowers no matter what. This is somewhat insidious. If you buy a home you can’t afford, you’ll lose it in foreclosure and start from zero. Buy a car and no longer can pay for it? It will be repossessed and you start from square one. Maxed out your credit cards and can’t pay them back? You can default on them. While your credit score will take major hits on each, you can start fresh. But with student loans you are stuck with them for life, even if you have trouble paying them back.

This issue is not going to go away since you can’t simply waive away $1.5 trillion. The value of a college education is still high as demonstrated by the college admissions scandal where families paid ridiculous amounts of money to get their kids into selective institutions. People clearly value the signaling factor of a college education and the overall polish you will gain from being in a university setting. Pursue a degree in sought after fields and you are likely to find a job with little struggle. Yet there is also a mass dilution of quality where many graduates are finding it hard to gain adequate employment since their skills are not needed in the market. There is no issue with this if you are going to college and exiting with a modest amount of debt. But say you are coming out of a small private college with $100,000 in student debt and little job prospects. That becomes a bigger issue.

Where do we go from here? A few politicians are talking about waiving student debt altogether. This is a big mountain to overcome given that even the current loan forgiveness programs for public servants are having a tough time being honored. We still have affordable options with many state schools but the marketing prowess of many private institutions simply dwarfs what public schools can offer. It is a complex issue with a $1.5 trillion price tag. Expect to hear a lot more about this topic in the next year.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!1 Comments on this post

Trackbacks

-

Rumplestiltskin said:

Does anyone remember why universities or colleges were started. They were bastions of the Clergy because they were the only ones with the knowledge. The rich of the day conspired with the clergy to educate their sons while keeping them out of trouble instead of just the monks who transcribed and wrote the text.

So, the education system was basically designed for the education of the rich and until recently, (the last 100 years) was only their bastion.

With debt based education we are finding that educating the masses is problematic, because there must be complementary jobs creation for them to move into. So now we are left with highly educated young who wouldn’t know a beet from a rutabaga, or how to plant a garden.

BUT, all of them feel deserving of accolades just for having gone through the process. These entitled brats need to understand that a college education is not end-all in learning about life!

September 24th, 2019 at 5:51 am