The student loan racket – For-profit enrollment growth surged by 225 percent in last decade. For-profits live off the 85 percent of revenues they receive from the government and filter out to their Wall Street owners.

- 0 Comments

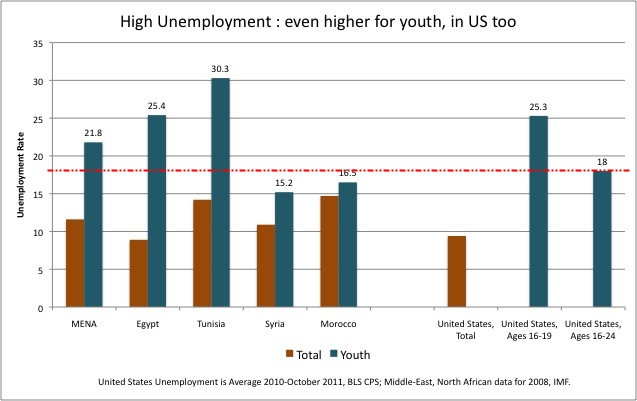

The loud commotion you hear rattling the global economy is the massive debt bubble imploding. A few notable economists have stated that too much debt is reached simply when the public acknowledges that there is too much debt. To this point the public is now waking up to the reality that too much debt is being taken on for higher education. Where there is money to be made you now have Wall Street and the government walking hand and hand smiling to fleece the American student without producing any measurable increase in value. With a web of connections and political pay for play we now have a giant bubble that is causing financially disastrous results for many young Americans walking out with diploma in hand and a massive albatross of debt securely wrapped around their bare wallets. With youth unemployment rivaling those of third world nations we are starting to see cracks in the current system. It seems that the $1 trillion mark with student debt might have been a tipping point.

The circle of student debt life

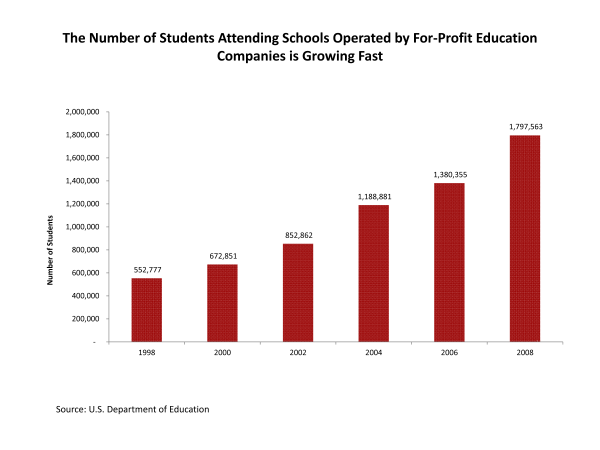

To understand the convoluted scheme of higher education it is useful to see the massive expansion in for-profit institutions:

Source:Â Senator Harkin

From 1998 to 2008 the growth of enrollments at for-profits has surged by 225 percent. Many of these institutions are one step above paper mills and largely provide little value added to students that attend. Many of the for-profits also market and target heavily lower income Americans. So who is paying for this? Step in the federal government:

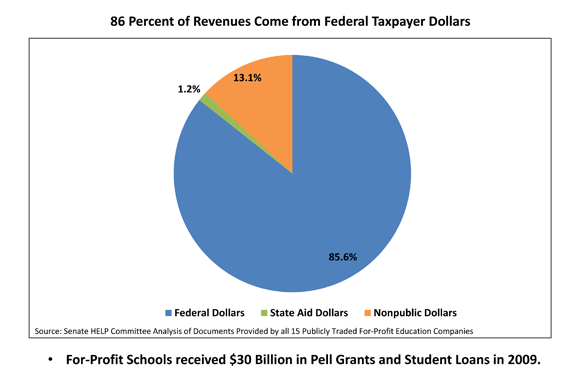

The life blood running through the veins of the for-profits comes from you guessed it, the Federal Government. In 2009 for-profits pulled in revenues from one source primarily. Over 85 percent of revenues to these institutions derived from the government (aka the American taxpayer). It would be one thing if these schools were producing solid results but they are doing everything but producing results. Take a look at default rates:

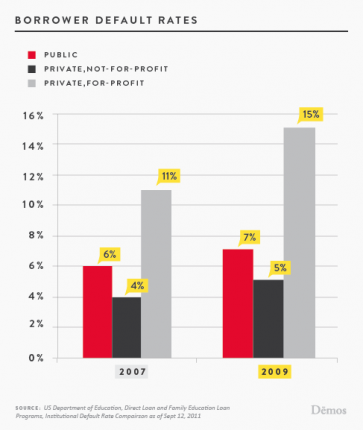

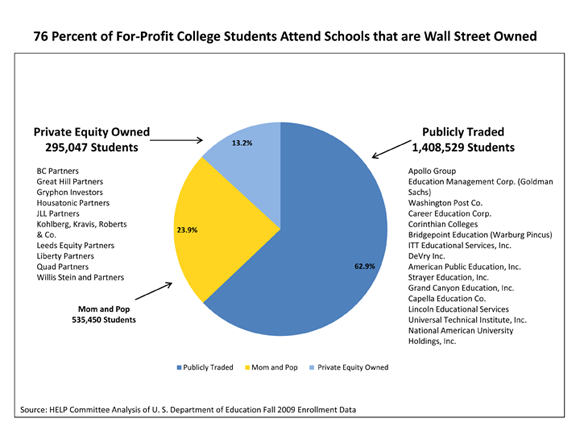

The above chart only goes by generous measures of defaults. If we look at longer term cohort default models we start seeing default rates soaring into the 40 to 50 percent range. This student loan bubble is popping because of the lack of quality and infusion of for-profits merely ripping students off. Yet someone is making money here. The government is merely a funnel of taxpayer money into select Wall Street institutions:

It should come as no surprise that most of the for-profits are publicly traded companies. For-profits spend more money on marketing than they do on actual instruction. This reminds us of the homes that were built at the peak of the housing bubble with shoddy craftsmanship yet with higher and higher prices.

College costs outpacing every other sector in our economy

The cost of attending college is far outpacing every sector in our economy:

Since 1982 college tuition and fees have increased by a stunning 400+ percent while the typical household income has gone up roughly 150 percent. This segment of our economy has even surpassed the ridiculous inflation in medical care. This burden is largely falling on the young. It would be one thing if younger workers were finding better paying jobs with the large amounts of debt they have taken on. This is not the case:

Source:Â IMF

The youth unemployment rate in the United States is rivaling many countries rife with political and economic turmoil. The only difference is that the U.S. is the biggest and wealthiest country in the world. The big issue has been the aggregation of wealth into a smaller group of people, including many of the owners of the for-profit paper mills, spiced up by the melting of government and Wall Street into one financial entity. This is why the American public is so disgusted with the current political system:

“(CBS) Ten years ago, as many as 65 percent of Americans actually liked their elected officials. But as Congress has gotten more and more dysfunctional, its popularity has fallen dramatically to today’s all-time low – a nine-percent approval rating.

Even the hated IRS has an approval rating four times that!

At the height of the oil spill, the BP oil company – at 16 percent – had a higher approval rating than Congress.

So does Paris Hilton, who scores 15 percent.â€

This single digit approval rating is disastrous but well warranted. We have gone through plugging in Democrats and Republicans but they are simply cogs in the broken system of government and Wall Street finance. The for-profits are just the tip of the iceberg in the student loan bubble. This is a case of artificially setting up educational landmines and creating a new class of debt serfdom by conning many Americans with the allure of a college diploma. No one is disputing that education is good, it is, yet the system is full of predator institutions that merely exist because the government and Wall Street are cozy in their arrangement of ripping the public off. Was it any surprise that the new consumer protection agency was dismantled to the point of it being a laughing example of government protecting Wall Street interest?

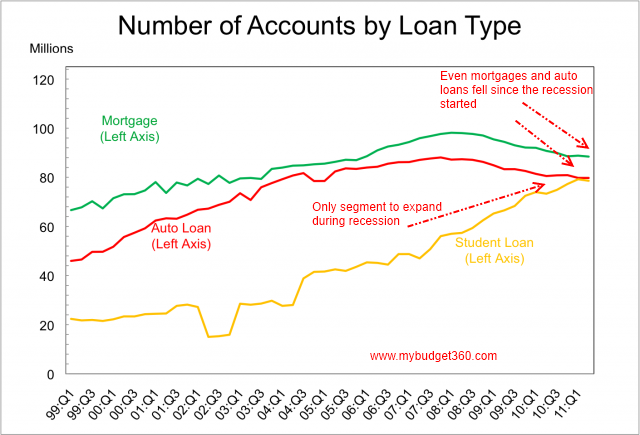

The desire to get a college degree continues with unquestionable blindness and this is the only loan sector that has grown in the years since the start of the recession:

Source:Â Federal Reserve

People are finally waking up and realizing that many colleges are simply operating within the confines of the government and Wall Street racket of student debt. Some people are getting very rich from the for-profit college machine but it is clearly not the students.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!