TARP Readjustment: California, Florida, Nevada, and Arizona on a Financial Economic Island. Those Option ARM Loans Are Your Problem.

- 2 Comment

The morphing financial crisis has taken a major change today. Henry Paulson came out today announcing that the main component of the $700 billion bailout plan will no longer be the centerpiece. If you recall a few weeks ago with the highly unpopular bailout, the major contention was that much of the money would be allocated to purchasing highly toxic mortgages from irresponsible lenders. But as the economic landscape quickly shifted, that idea has now been shelved.

The repercussions of course were felt rapidly on Wall Street today. Overall the market had a horrible day since Best Buy projected lower earnings into next year and Macy’s posted a loss. But more focused pain was geared to regional lenders that had a major stake in subprime and option ARM mortgages. It is quite possible that investors were betting that a large portion of the TARP money would be allocated for these loans. After all, that was the initial plan. The massive 400+ page document included a section about posting purchases electronically 2 days after being made. Seeing that the Federal Reserve and U.S. Treasury want to remain in silence regarding $2 trillion in off balance sheet securities we can see why that is.

Other institutions faced major hits today with Ambac dropping 15%, Goldman Sachs falling 10%, and Morgan Stanley shaving off 15%. In fact, the statement made by Paulson today also indicated that they will be examining consumer debt and student loan debt which is also securitized and sold to investors. The auto industry is looking for $50 billion with no strings attach. That $700 billion is quickly dwindling into the final days of the year.

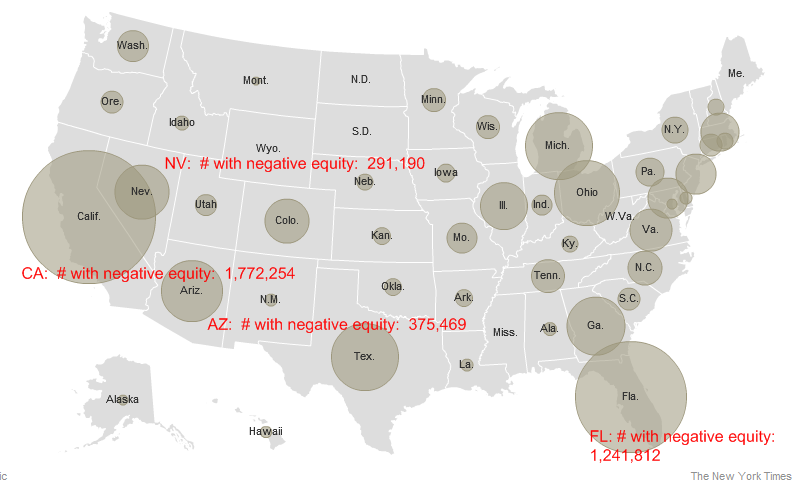

But the more significant thing to recognize is that this in effect now slams the door shut on 4 states primarily responsible for a large nominal amount of toxic mortgages. Really think about this for a second. Earlier in the week, the announcement came out that Fannie Mae and Freddie Mac will be modifying large number of loans. One slight problem for a state like California with many underwater homeowners. They simply will not qualify. The market fell so fast in California that statewide the median price is now down by 40% and still going lower. Even a 90% LTV on a home will shut out many who are in a tenuous situation. Take a look at this map from the New York Times:

*Source:Â New York TimesÂ

What this means is in these 4 states alone, 3.6 million homeowners are underwater. Fannie Mae and Freddie Mac estimate 10,000 borrowers a month would qualify under the plan and few from these 4 states. That number is like spitting into the ocean given the millions who are now underwater. The percent of negative equity is simply stunning as well:

Percent negative equity of those underwater:

California:Â Â Â Â Â Â 27%

Florida:Â Â Â Â Â Â Â Â Â Â Â 29%

Arizona:Â Â Â Â Â Â Â Â Â 29%

Nevada:Â Â Â Â Â Â Â Â Â Â 48%

That is simply a mind boggling number and with these 4 states alone, you can rest assured that 3.6 million homeowners are thinking about walking away. You should read the accompanying article from the New York Times about a city in California with 90% negative home equity but here is a snapshot of how people are thinking:

“But these loans eventually become unmanageable. In 2015, Mr. Martinez said, his monthly payments will be $12,000 a month. He laughed and shook his head at the absurdity of it.”

“For the moment, the family is just trying to hold on. But Mr. Martinez acknowledges that it has entered his mind to turn his house back over to the bank. “By next June, if things aren’t better, I’m walking,” Mr. Martinez said.”

People are willing to walk. Even if they weren’t willing, there is no way the family in the article would be able to afford $12,000 a month. That is how absurd some of these mortgages are and why the intial TARP plan has been abandoned.

But how much of this stuff is still out there? How many Alt-A or subprime mortgages are still floating out in the market? Let us run the quick numbers for California and Florida:

California Active Alt-A:Â Â Â Â Â Â Â Â 693,518

Average Balance:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $441,731

Total California Alt-A:Â Â Â Â Â Â Â Â Â Â $306,348,399,658

California Active Subprime:Â Â 435,974

Average Balance:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $326,259

Total California Subprime:Â Â Â Â Â $142,240,441,266

Florida Active Alt-A:Â Â Â Â Â Â Â Â Â Â Â Â 239,310

Average Balance:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $270,531

Total Florida Alt-A:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $64,740,773,610

Florida Active Subprime:Â Â Â Â Â Â Â 300,490

Average Balance:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $178,333

Total Florida Subprime:Â Â Â Â Â Â Â Â Â $53,587,283,170

2 state total Alt-A and Subprime total mortgage balance:Â Â Â Â Â Â Â Â Â Â Â $566,916,897,704

Maybe that is why Paulson abandoned this plan. Â Nearly half a trillion dollars in Alt-A and subprime loans are still outstanding in California and Florida alone. Â Much, as we have already noted that is heavily underwater. Â If we throw in Nevada and Arizona into the mix and there goes the $700 billion in one shot.

No wonder why the four primary toxic mortgage laden states have been left on an island alone at the period where most of these mortgages will start hitting their absurd recasts.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!2 Comments on this post

Trackbacks

-

Suzi said:

These numbers will increase quite a bit when the holiday seasons are over. This is a sad year for middle class home owners… we have all become poor class! To track real estate pricing in the cities above and others across the country visit:

November 15th, 2008 at 1:27 am -

Gregory Tsujimoto said:

Insightful article.

What is the source for the stats regarding the amount of Alt-A’s and Subprime loans and associated dollar amounts for CA?

I am looking for a source to research the amount and values of the Alt-A’s and Subprime loans in the US, CA, and counties in CA. Do you know of a source?

November 20th, 2008 at 11:21 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!