The COVID19 Depression: 22 million file for unemployment insurance as unemployment rate is now fully in double-digits.

- 0 Comments

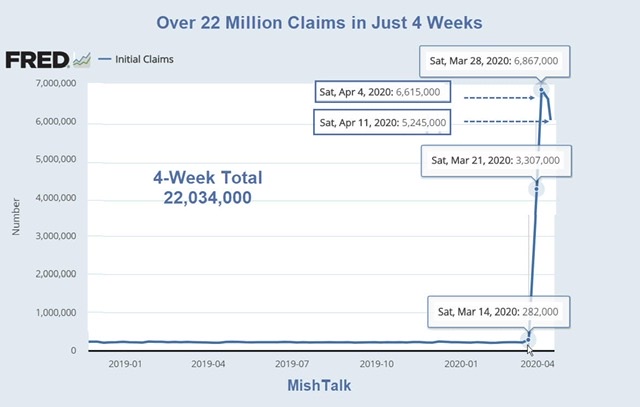

For many years we have talked about how many Americans were living paycheck to paycheck. One troubling statistic that came to mind, even before the COVID19 outbreak, was that half of Americans were one paycheck away from financial disaster. What the COVID19 outbreak has shown is how frail the economic situation was for many Americans and how disconnected Wall Street was from the lives of millions of Americans. Even in the last two weeks, the stock market has rallied in the face of 22 million people filing for unemployment in a span of one month. This is an insane number and never in our history have we seen so much economic carnage in such a short period of time. But the reality is, the entire system has shut down and people now need to start thinking what the next phase of all of this is.

The massive surge in unemployment

The sectors that employ most Americans in raw numbers are the positions that pay the least and have little to no health insurance coverage. So this crisis has compounded the two areas they are most vulnerable: financial and healthcare. The crisis has of course slammed the most susceptible people first but many other sectors will follow.

First, let us look at the employment damage:

This chart is simply stunning. And the only reason the numbers didn’t seem so bad last week is that we had a 4-day work week and one day was shaved off. This week will have another few million people filing for unemployment insurance (if they can even get through) and this will be adding to an already high figure.

Why will this be a depression? First, even when we do reopen, does anyone envision people going out in mass to restaurants? Do people plan on going on cruises in mass? Are people going to go to amusement parks or movie theaters in large numbers? That is yet to be seen and it will look very different (e.g., face masks, temperature checks, etc.).

Also, people are realizing how important it is to have an interconnected system. Try having two working professionals at home trying to teach their kids all the while trying to work from home (if they are fortunate enough to still have their jobs). These people are not operating at 100% productivity. You need teachers, daycares, healthcare providers, and others to push forward our society. No one person or family can be everything to everyone.

And let us talk about the biggest expense for most Americans, housing. This month about one out of three renters was behind on their rent. On the mortgage front, there are millions of Americans asking for forbearance on their payments because of COVID19. Banks are allowing 3-months for now. But then a balloon payment will be due in 3-months. This is nuts. So you think someone that can’t pay this month is suddenly going to have the ability to pay 3 full months of mortgage payments down the road? That just doesn’t seen realistic and highlights the current government and banking mindset of kicking the can down the road.

Also, the $2 trillion relief shows how much bloat can come from these kind of packages. There are 128 million households in the US. We could have given each household $15,625 for that amount! Yet each adult gets $1,200 and $500 per kid. Frankly, that means you could have given each household $1,300 for 12 full months. Let us not get into our massive debt but if we are going to talk about direct relief, just send the money out to households and let them decide where the need is (instead of picking winners and losers with all the political horse trading)

This COVID19 depression is simply highlighting the economic fissures that were already in our system. Now they are fully open. So we have to deal with a health crisis alongside an economic crisis. Now is not the time to play politics if we really want to help American families.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!