The infection of massive global debt and the era of permanent bailouts – Global bankers on a mission to dilute currencies around the world. Ireland GDP equal to Louisiana GDP.

- 3 Comment

The problems plaguing Ireland are common and something very familiar with Americans. Irish banks got drunk on housing bubble beer and loans were made without any actual thoughtful analysis of whether the loans would be paid back. Now the European Union is stepping in with the IMF to bailout Ireland not because it has a soft heart or cares about the people in the Celtic country but because it is trying to protect the big interconnected web of banking interests of German, Spanish, English, and US banks. That is the ultimate issue at hand. After all, Ireland has a GDP of $222 billion or roughly the same amount as Louisiana so it doesn’t seem like such a small country could captivate financial news for weeks on end. But if you look at the external debt of Ireland it just blows you away in relation to the size of the country. Let us take a look at these metrics:

Source:Â Wikipedia, CIA World Factbook

You’ll also notice that Italy and Spain are right there ahead of Ireland and these are the next dominoes to fall, especially Spain. Portugal is also facing big issues with debt. The EU and IMF are trying to avert a massive global run on these countries but the problem isn’t one of liquidity. The issue at hand is of peak debt. People and countries have borrowed too much based on what they are capable of paying back. If Ireland’s GDP is $222 billion and their external debt is $2 trillion you can see that this will be a major issue. It is hard to imagine this amount of debt for the production of the country but remember that the global banks were all the willing to lend money out to Ireland for over a decade. Yet the bailout issue and the problem with central banks is that they are only concerned with saving their banking colleagues. Even when the Federal Reserve was developed in the US it was premised on preventing bank runs and protecting network banks. That was and continues to be their primary mission.

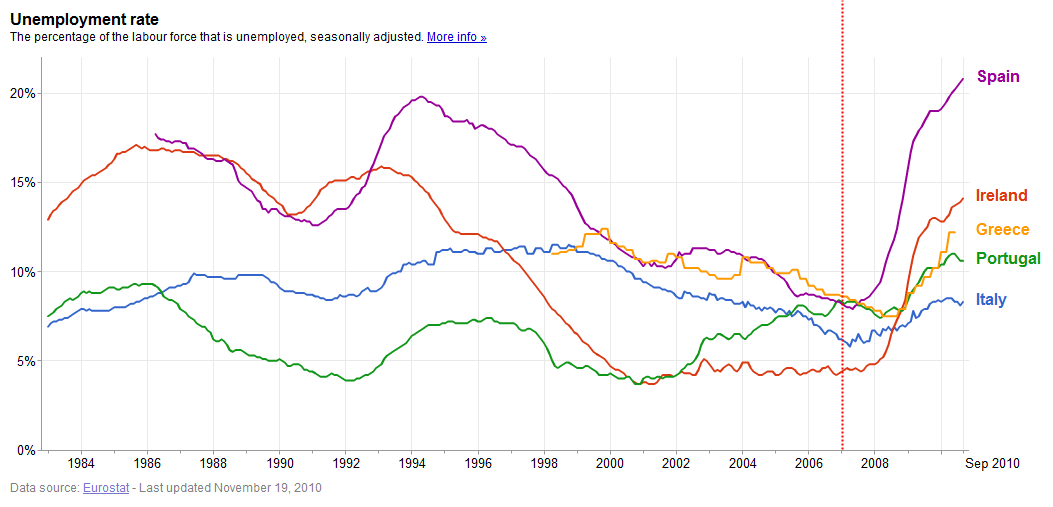

Yet the bigger problem is the troubling unemployment plaguing many countries with a mammoth amount of debt. Let us take a look at unemployment in some select EU nations:

The spotlight is glaring on Ireland at the moment with a 14 percent unemployment rate yet the more stunning case of Spain shows a headline unemployment rate that is over 20 percent! We can only imagine what their underemployment rate would be. These bailouts do very little to address the problems and dislocation in the employment market. We already know here in the US where the unemployment and underemployment rate is up to 17 percent and has remained stubbornly high now going on four years that more debt does little to ameliorate employment conditions. Yet the US Treasury and Fed try to put on a vibrant charade that all is well. Does it feel like all is well?

The EU problems are gigantic in scope. Ireland only a few days ago was openly talking about their solvency until the summer of 2011 and that they had plenty of cash to get by for half a year. Well a few days later rates roared upwards and people started yanking money out of their banks. They saw the above numbers just like you are. Think about the ratio more on a human level. The amount of external debt for Ireland is like someone making $20,000 a year yet having debt connections of $180,000. That is absolute madness and shows how the allure of easy money and the fact that bankers have no restrained with printing money will put the entire global economy at risk. The solution of the banking system here in the US and EU is basically to bailout the bankers at the cost to all local taxpayers. The bankers are so consumed by their tiny niche market issues that they fail to recognize that the employment markets are collapsing all around them.

Having too much debt is a recipe for financial disaster. Greece was only chapter one followed by the Irish in chapter two. Portugal and Spain will be next. It isn’t a question of will they need a bailout but when. Spain’s GDP is $1.6 trillion or $200 billion below that of California. A collapse of Spain will be enormous news and will sent ripples across the globe especially in the EU. Yet with a headline unemployment rate of 20 percent how will they pay their debt back? They can’t to answer that question.

The US has also reached a peak debt situation. The answer from the banking sector is to dilute the US dollar and make the American standard of living collapse because banks gambled irresponsibly for decades. The banks now have taxpayer dollars so they don’t care about the unemployment and underemployment rate of 17 percent. Now, they talk as if we need to take our hard knocks and speak with authority.

“These are the same people that had Hank Paulson on bended knee begging the House Speaker a few years ago for a $700 billion blank check.”

The central banks are merely infectious puppets of the banking system. They aren’t accountable to the people or local governments. Did we even debate quantitative easing here in the US? The continuous bailouts are merely a way to protect the banking sector while the stats on employment speak for themselves. How can you tell when a central banker is lying? When they open their mouth.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!3 Comments on this post

Trackbacks

-

tyler said:

Great article, you broke it down better than anything I have seen. The numbers are mind boggling. I will stick to the advice of mark faber and jim rogers who called this piigs situation and the surge in agriculture prices. Paul Krugman is the guy who has never been right about anything.

November 22nd, 2010 at 5:02 pm -

R said:

I think that its great that you pointed out Spain’s very dire situation. They are in enormous amounts of debt, but can barely afford to make ends meet. Does this remind you of a certain article about student loans posted here a few days back? What are they to do?

November 22nd, 2010 at 8:47 pm -

Gastone Ciucci Neri said:

In order to avoid a disorderly default the EU has lent so far to Greece, through various programs such the EFSF,etc, approx 240 bn euros.

By doing so the EU has put the country in a vicious circle

The present austerity measures imposed to Greece to rein its public deficit, prevent the economic growth and this makes it harder to collect the tax revenue necessary to reduce the public deficit. At the same time the amount of interests that Greece must pay on its sovereign bonds is not lowered because debts are cancelled with the proceeds of other debts ( from the EFSF ).

Under these conditions for Greece it will be extremely difficult to mend its economy and the country will always be dependent on the EU bailouts in order to avoid a disorderly default.

For how much painful this could be, the EU should draw the conclusion that only the forgiveness of part of the greek national debt can solve radically the problem.March 20th, 2012 at 5:15 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!