The privateers of education – How banks collude with the government to inflate college costs. Student loan debt now surpasses total credit card debt.

- 2 Comment

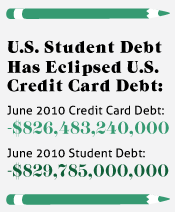

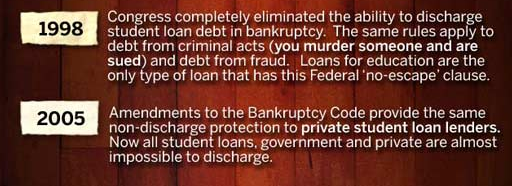

One of the more ominous statistics coming from this recession is that student loan debt has now surpassed total credit card debt in the United States. The reason for this is based on the deep impact of the recession. Credit card debt peak at $975 billion back in September of 2008 and is now down to $826 billion. This is good news right? Well the main reason for the decline has been through the rise of bankruptcies. As this number decreased student loan debt has continued to soar and is now larger than total credit card debt. Part of it has to do with the fact that you are not allowed to discharge student loan debt through bankruptcy. The government is the biggest player in the student loan market but the banks are the folks dishing out the loans. Similar to the housing bubble, when banks and government combine you usually end up with inflated prices and very wealthy bankers. The working and middle class end up paying for the bad bets in the end with inflated prices and giant amounts of debt.

Here is the unfortunate tipping of the scales:

Source:Â Mint

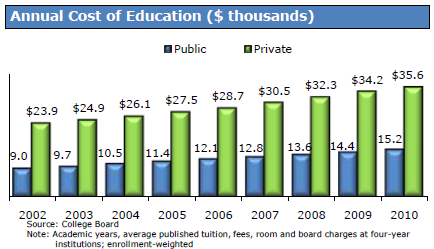

Past and current students carry a stunning $829 billion in student loan debt. The cost of a college education has far outpaced the rate of inflation. Private institutions realize the government will cover the cost of students going to college through loans so subsequently, they raise fees and push the government to increase their loan caps. How in the world can education costs be going up at a time when the economy came to a standstill in the last three years? In fact, in the last year we have been dealing with a deflationary environment yet costs of education still keep going up. If schools can increase prices and have the government subsidize loans, then you can rest assured the banks will be pushing these things out like candy.

“This is the problem when you have a government for the banks, run by the banks, and designed by the banks.â€

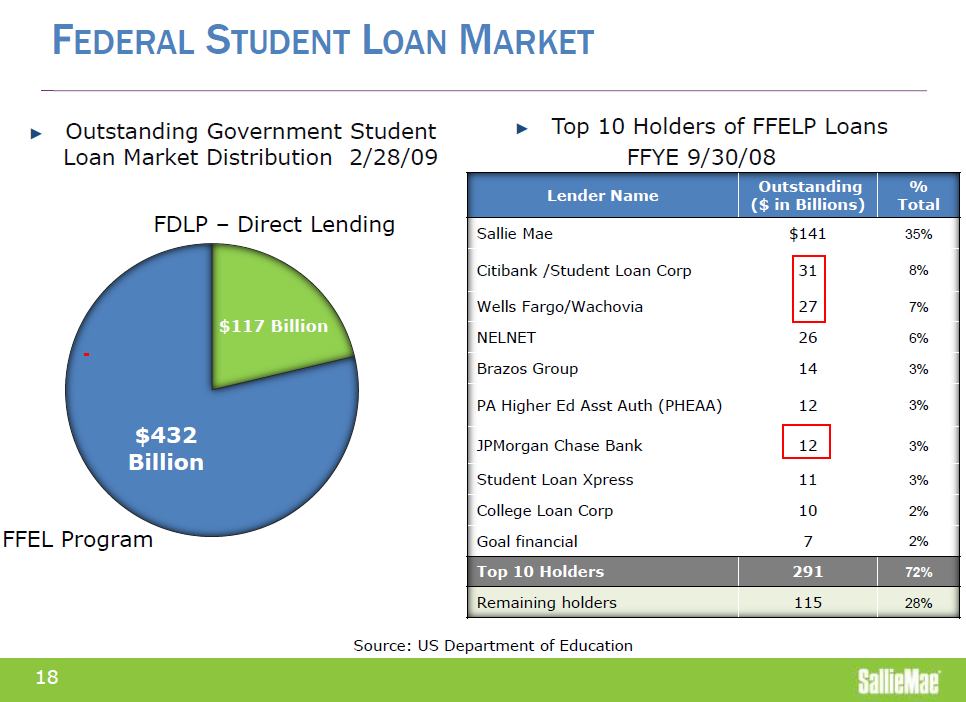

It is no surprise that when we look at the top players in the student loan market, many familiar names pop out:

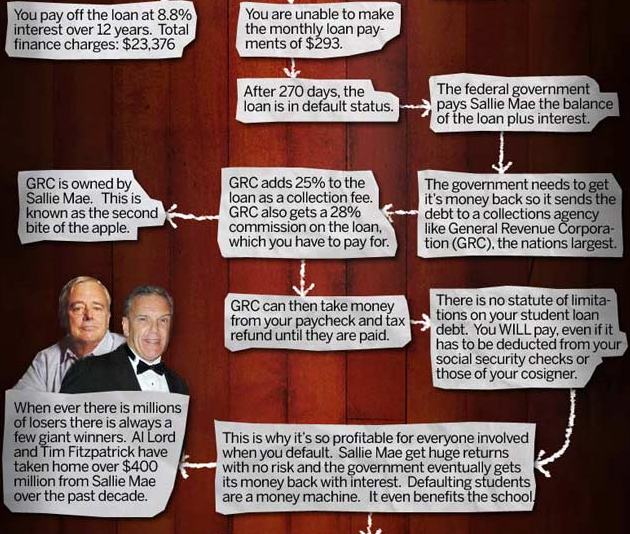

The same too big to fail banks also rear their familiar faces in this market as well. There is nothing better than a student loan for banks. If students default, the bank will be reimbursed by the government. The government can then sell the loan off to a collection agency and go after the student by garnishing wages and other venues that even loan sharks don’t have. Is this double dipping? Absolutely. It is pure economic wizardry when banks are merely serving as middlemen with no risk at the table and are dolling out government backed loans.

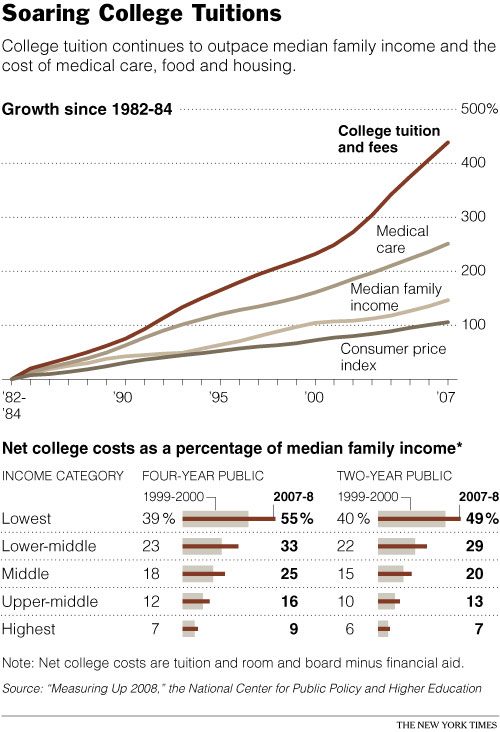

You can see the rise of college costs outpacing even the price of expensive healthcare:

Source:Â New York Times

What is interesting to note is that college costs haven’t even adjusted during this recession. Even the housing bubble popping has brought home prices lower. Why? Because if you can’t pay for a home then foreclosure is an option. Can’t pay for a student loan? Too bad. The bank that made the loan is already backed by the government so they don’t care and the government is going to use debt collectors to get their money through a variety of ways:

Source:Â The Consumerist

The student loan market has enriched a few while pushing on the inflated cost of education to the working and middle class of the country. Clearly people can’t afford the cost of education as it stands and thus go into massive debt (just like housing). As usual, this is part of a bigger theme of squeezing out the middle class from an elite and increasingly desperate banking class. The banking class is bent on making money through usury rates and basically skimming money off people via non-productive means. Plus, they are lending taxpayer backed money. There is a specific reason why college costs have gone up (and are still going up) even though the working and middle class are getting poorer.

If you look at the annual cost of attending, the trajectory of cost is rather clear:

Up and up it goes. You see this expansion with private schools costing upwards of $50,000 per year. But even the state schools which were usually the mechanism for educating the largest group of students in the public is also expanding:

Source:Â OC Register

Interesting that in 2005 when costs started skyrocketing this happened:

So banks now had the same protection as all federally backed student loans. The same thing that happened with the housing market is happening with student loans except this is more nefarious. There is no way to walk away from a student loan. This might not be a problem if students were coming out with high paying jobs and able to service their debt. Unfortunately this crisis is hitting every corner of the economic spectrum:

This is the highest unemployment rate for college graduates ever recorded. Think about that. As college education reaches and enters a new price apex each year, the growth of unemployment for college graduates inches higher and higher. Now the mission of education isn’t necessarily to get a job. But when you put such a giant price tag there should be some direct career added benefit. In many cases this is true. Yet in other cases there is a severe self selection bias. That is, most of the ambitious people in this country go to college (not all of course). So trying to justify a high cost for this reason usually hides a lot of the reasons for career success.

Yet the challenge is revealed when you realize some people are going to college for four years at $50,000 per year with degrees that have little marketability in the economy. I’m all for people pursuing different career paths but why subsidize this through taxpayer dollars and why in the world do we need banks as middlemen here? There is still a demand for students with hard skills yet other countries are mass producing students in these areas at much lower prices:

China is graduating nearly three times the engineers compared to the U.S. They are much larger in proportion as well but so is India yet we graduate (for now) more engineers. Yet this is where we have shifted and outsourced most of our manufacturing base. So we have many questions to examine including what do we want from our education system if the price is so high?

One thing is certain however and that is that we cannot continue to have the banking industry and the government so closely intertwined. Every industry in the last two decades that banks have touched have sprouted out bubble tentacles. Technology, real estate, and now the college market. Keep in mind as many more people are unable to pay these loans, the taxpayer is paying the bill yet banks are being paid full face value here. Banks have dumped trillions of dollars of bad housing debt onto the taxpayers and have been pushing student loan debt onto the taxpayer as well for years. Al Lord and Tim Fitzpatrick, both Sallie Mae big names have pulled in over $400 million over the last decade. Glad that the new mission of education is now paving the way for subsidizing the salaries of big financial lenders.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!2 Comments on this post

Trackbacks

-

JeremiadJones said:

At least the $1t in student loan debt paid for something a little more worthwhile than the Chinese-made geegaws purchased with credit cards. With respect to that stuff, people will still be making payments on those purchases long after most of it has gone to its final resting place at a landfill (that may be in China!). … Which is a back-handed compliment for your article, I suppose.

Point being, why is student loan debt treated differently (i.e., as a form of indentured servitude) than other forms of debt?

September 8th, 2010 at 6:54 am -

Ephraim said:

AT LAST mybudget360 has picked up on this story, and the true root cause of the crisis, the link between the banks and policymakers. Two things this article misses:

1. Despite the permanent, life-long destitution which results from a student loan default, the default rate is now approaching one in three.

2. The collections companies which collect on these defaulted loans are subsidiaries of the lenders themselves. I.e., the “double-dipping”, collecting on the federal insurance for the loans as well collecting by force from the borrower him or herself, means the lender doubles his profits on a defaulted student loan. I.e., as many student borrowers have found, there is a very strong profit motive for student lenders to force a student into default by hook or by crook, rather than accept a payment plan. Defaulted credit card recovery rates are 20%. Defaulted student loan recovery rates are 120%. That’s what happens when bankers write the laws.September 13th, 2010 at 2:54 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!