Worst Ever Housing Market in California: The Numbers Revealed.

- 4 Comment

It is clearly no surprise to anyone that housing is in a major slump across the country. What seems to be taking people by surprise is the rapidity of how quickly the market is retracting all the gains that it had made during the previous years. California faced many of the benefits during the peak of the housing bubble. Conversely, it is now facing major pains as the correction works itself through the system.Let us examine the numbers released by the California Association of Realtors in greater detail to see exactly what is happening:

“LOS ANGELES (March 24) – Home sales decreased 28.5 percent in February in California compared with the same period a year ago, while the median price of an existing home fell 26.2 percent, the CALIFORNIA ASSOCIATION OF REALTORS® (C.A.R.) reported today.

“Although sales rose for the fourth straight month in February by 9.5 percent compared to the previous month, they continue to be dragged down by the ongoing effects of both the credit/liquidity crunch and tighter underwriting standards that have reduced the pool of qualified buyers who can obtain a loan,” said C.A.R. President William E. Brown.

“It is crucial that FHA reform legislation currently under consideration by congress include higher loan limits for high-cost states like California,” he said. “The proposed legislation also includes a reduction in the down payment requirement for FHA loans and will include condominiums in the FHA single-family program, which will make it easier for buyers in the condominium market to qualify for loans.”

It is hard to understand why in the same month that prices fell at a record pace, that in the same news release this organization is also calling for higher loan caps. If anything, the median price of a single family home in California is now at $409,240 within previous conforming loan limits and the state is now an eternity away from the $554,280 reached in February of 2007. The changes are drastic and rather stunning. Let us take a look at some specific counties:

| California Region | Median Price | Decline Year over Year |

| High Desert |

$220,380 |

-31.10% |

| Los Angeles |

$467,200 |

-20% |

| Monterey Region |

$619,790 |

-11.70% |

| Orange County |

$596,520 |

-13.90% |

| Sacramento |

$258,680 |

-30.90% |

| San Diego |

$450,710 |

-24.10% |

| Riverside/San Bernardino |

$289,660 |

-27.20% |

Incredibly, these drops are very similar to the numbers reported this Tuesday in the Case-Shiller Index. The numbers that came out on Tuesday showed Los Angeles down by 16.5% and San Diego by 16.7%. The interesting factor is that multiple housing measurements are now forming an intersection of agreement on certain market measures. This is highlighting that the market is facing challenging times.

Sales are also showing significant weakness. Sales for the entire state are down 28.5% from a year ago. What we will most likely be seeing in the next few months is prices experiencing significant pricing pressure on the downside but we should start approaching a bottom in home sales. The only reason for this is that year over year prices are now essentially swallowing their own tail; that is, we are comparing poor numbers from last year with poor numbers from this year which should mitigate significant year over year drops. Keep in mind that this won’t stop the slide in prices simply because many of the current sales are distressed properties.

Another important highlight in the report is that rates are slightly moving lower for mortgages:

“Thirty-year fixed-mortgage interest rates averaged 5.92 percent during February 2008, compared with 6.29 percent in February 2007, according to Freddie Mac. Adjustable-mortgage interest rates averaged 5.03 percent in February 2008, compared with 5.51 percent in February 2007.”

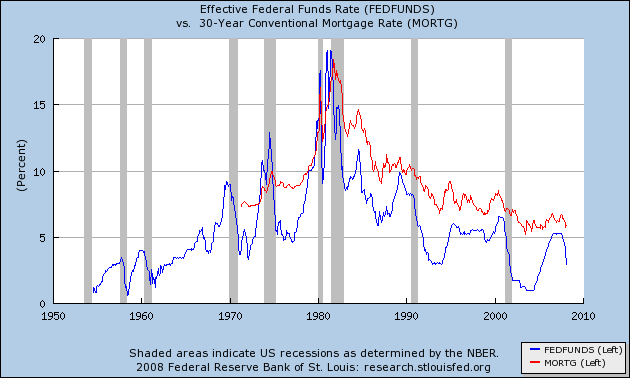

Interesting that within that same time frame that rates went from 6.29 to 5.92 a drop of .37 basis points the Federal Reserve has cut the funds rate from 5.25 to 2.25, a drop of 300 basis points. What this is showing us is in effect, that cutting rates is no longer having the same impact as it once did. Take a look at graph below and you can clearly see this effect:

Why focus so heavily on California? The reason so much focus is on California is rough estimate show that 20 percent of mortgage debt resides in this one state. Considering that most of the riskiest loans are here including all the sub-prime mixtures and so called Option ARM mortgages, many eyes are fixated on this state and how it weathers the storm. The above numbers do not bode well for the near future.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!4 Comments on this post

Trackbacks

-

robert fisher said:

Last year seniors had a chance to lock in their home value with a reverse mortgage. All the financial advisers told them it was a bad idea. There is egg on their faces now.

New news!!! HUD requires all credit lines on reverse mortgages to pay an extra 1/2% , compounded daily, on credit line balances. That means that a senior, 62 or older, that gets a reverse mortgage will earn about $4500 per $100,000 in their equity credit line.

Its a no brainer….the costs of the reverse mortgage are recovered within 15 months and equity interest keeps on pouring in each year. That means that no matter what the housing market does in the future, you are earning interest on the equity in your home.

Reverse Mortgages are perfect for Seniors who DO NOT NEED CASH. Let’s see the financial specialists knock this one down.

For more info see my blog :

http://www.xanga.com/reverse_mortgage

Thanks for your time.

Bob Fisher

bob@az62.com

623-214-6663March 28th, 2008 at 11:34 am -

Josh said:

Did you really just make a comparisson between the FED funds rate dropping 300 bps and mortgage rates only dropping 37 bps? How many times must it be explained that the FED funds rate does NOT cause mortgage rates to drop? In fact, every FED funds rate cut since 2007 has caused mortgage rates to immediately and sharply increase. There are many causes for this, inflation fears being the leader. Please do not continue to misinform the public that when the FED drops the FED funds rate mortgage rates also drop. That is WRONG!!!

March 28th, 2008 at 10:28 pm -

Brent said:

thank you Josh!!!!! I get so sick and tired of ill informed people continuing to spew wrong information. LET ALL REPEAT IT AGAIN

THE FED DOES NOT LOWER OR CUT OR HAVE DIRECT 1 TO 1 RELATION TO LONG TERM MORTGAGE RATES!!!!!!!!!!!!!!!!!!!Look folks the rates are not going to get much lower even if the Fed cuts to zero. Lenders are trying to get cash reserves built back up,they are making more on their SRP than before. What the common public does not understand is they really dont want a 30 yr fixed at 4%, that means your 401k or other investments are in the tank.

God help us all!

March 29th, 2008 at 7:07 am -

mybudget360 said:

Josh:

The misinformation unfortunately was done by the Fed. For example, why did they discuss that they needed to cut rates? To help the housing market? How? By creating further liquidity. If you believe their number one fear is inflation, you have something coming to you. They have an effective mechanism to counter inflation and Paul Volcker showed us via raising rates in the 80s.

They care not of a falling dollar. The reason rates have gone up is because credit risk has jumped. All the Fed is doing with lower rates is helping banks but those on main street see very little impact of this. Hence the comparison. It does matter since they are using the housing decline and credit crunch as impetus of cutting rates further. The point of showing the above is that they are implying that cutting rates is somehow going to help homeowners when as you have mentioned, it has done the opposite. But it has helped Wall Street and banks live another day.

Inflation fears? Why not stop on over at the http://www.bls.gov site and according to them, we have 0 percent inflation going on. What they truly fear is deflation.

March 29th, 2008 at 1:19 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!