You have been lied to about inflation and here is the proof:Â Take a look at where we have gone since 2000 to today.

- 5 Comment

I know it might be hard to believe but the way we measure inflation understates the true devaluation of your purchasing power. You feel it by how much tighter your budget is or by your perception of the cost of items going up. Inflation is actually rather high and it has been inflamed thanks to our policy of low interest rates and a tendency to own people via debt. We will look at the actual raw numbers of inflation as they are given to us via government statistics but take a deeper look as to what the cost of certain items really is. The results may shock some of you.

Inflation from 2000 to today

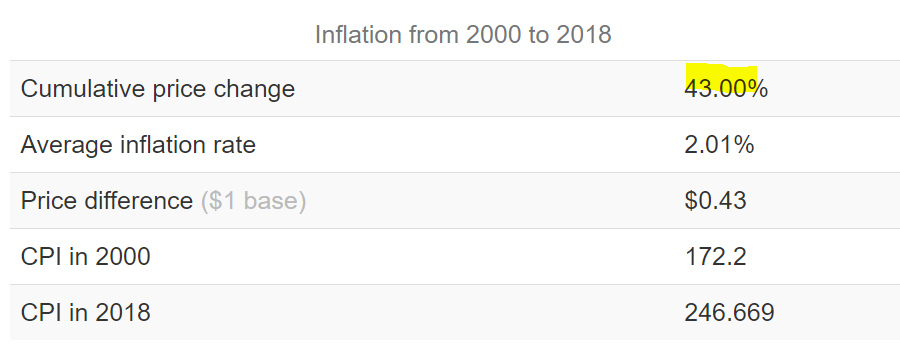

A very simple analysis of inflation from 2000 to today shows the following as measured by the CPI from the Bureau of Labor and Statistics:

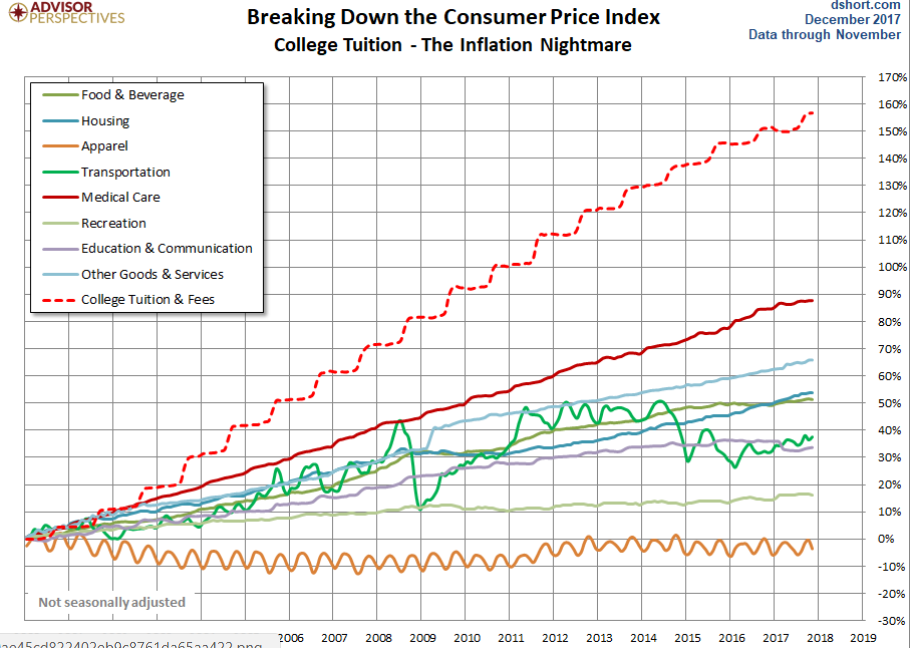

According to this chart, the overall CPI is up 43 percent since 2000. That seems modest over nearly 20 years right? But you have to break down the components deeper to understand inflation is much higher. Take a look at the various segments broken out:

For most Americans the biggest monthly expense is in the form of a mortgage payment or rent. But the CPI actually looks at the owners’ equivalent of rent (OER) which looks at a home via rental market value. This just doesn’t make sense for a few reasons:

-1. Most households own their home

-2. It doesn’t account for major shifts in interest rates that actually inflate the underlying asset value while keeping monthly payments fixed

-3. It assumes renting and owning are similar in costs but doesn’t account for the benefits of owning or the flexibility of renting

With that said, the above chart shows the following:

-Housing is up over 60+ percent from 2000

-Medical care is up over 80 percent

-College tuition is up nearly 160 percent since 2000

So the biggest expense is dramatically under counted and with many baby boomers entering their peak years of medical care usage, their budgets are going to be blown out of proportion. Most elderly Americans rely on Social Security for their income. What is even more troubling is the cost of tuition is up a stunning 160 percent since 2000. We have discussed this in great detail but in today’s economy, having a college degree is nearly essential in moving into the middle and upper middle class. However, with a saturation of colleges and degrees that don’t meet market needs, you have many graduates coming out with record student debt and very little ability to pay it back – we have over $1.4 trillion in student debt outstanding.

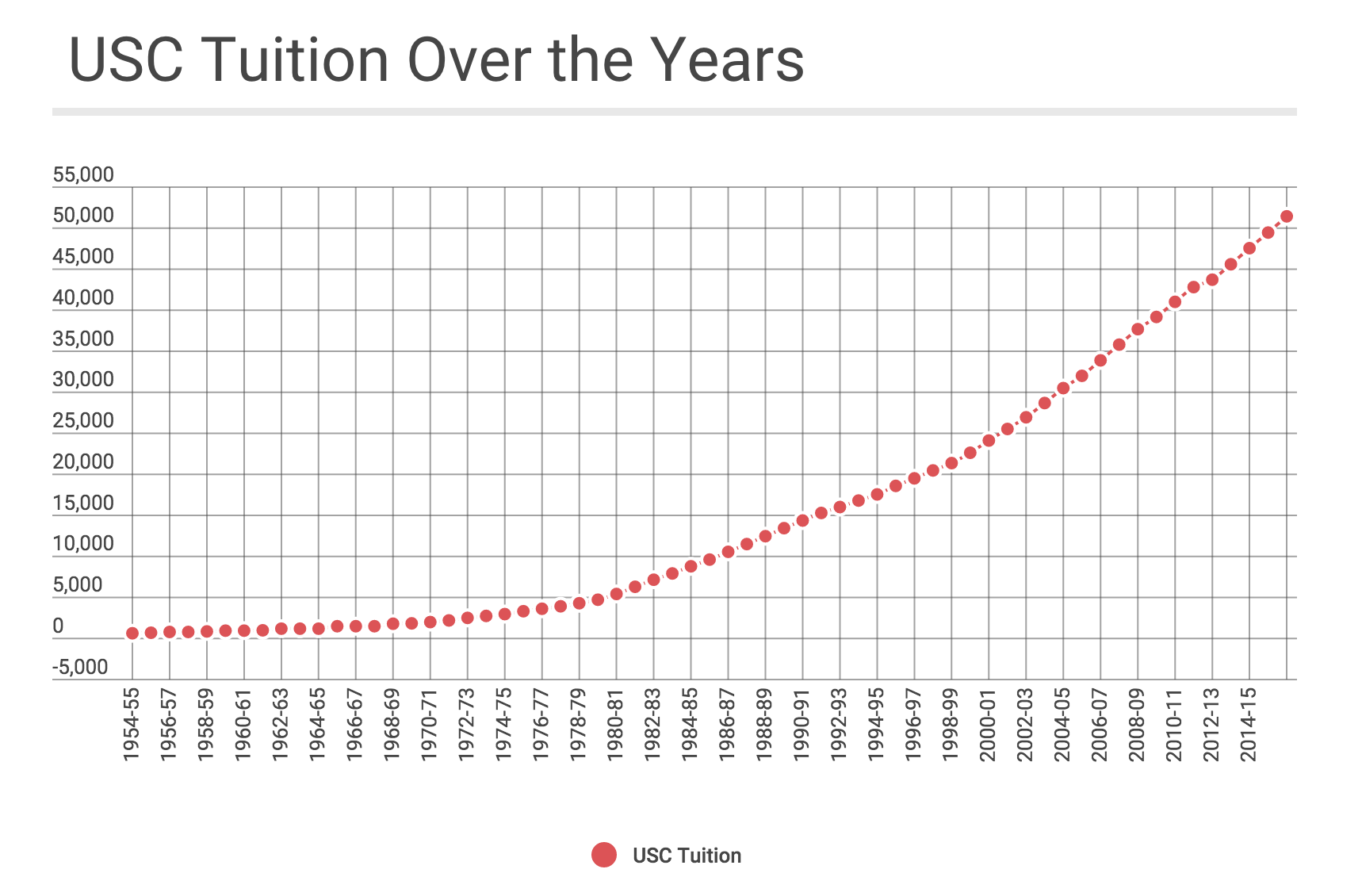

On the college tuition front, we have the largest percentage of young Americans going to college but the end results are troubling. Is the degree worth it? This tends to bring up subjective responses. If you look at income level, it may depend on the degree you get. But for other subjective gains it may not directly translate to income but there is still deep added value. It is hard to argue against being educated but the cost has been inflated thanks to government loans and allowing for schools to up tuition for any reason. Students simply take on the loans and start paying the debt six-months after graduation. Then reality hits.

Here is an example for the University of Southern California:

Back in 1999-00 tuition was $22,636. For 2016-17 it was $51,442. This is a 127 percent increase when the CPI went up 43 percent. So a young adult going to college today is paying way more in actual dollars and will be paying for this over many years given to taking out student loans.

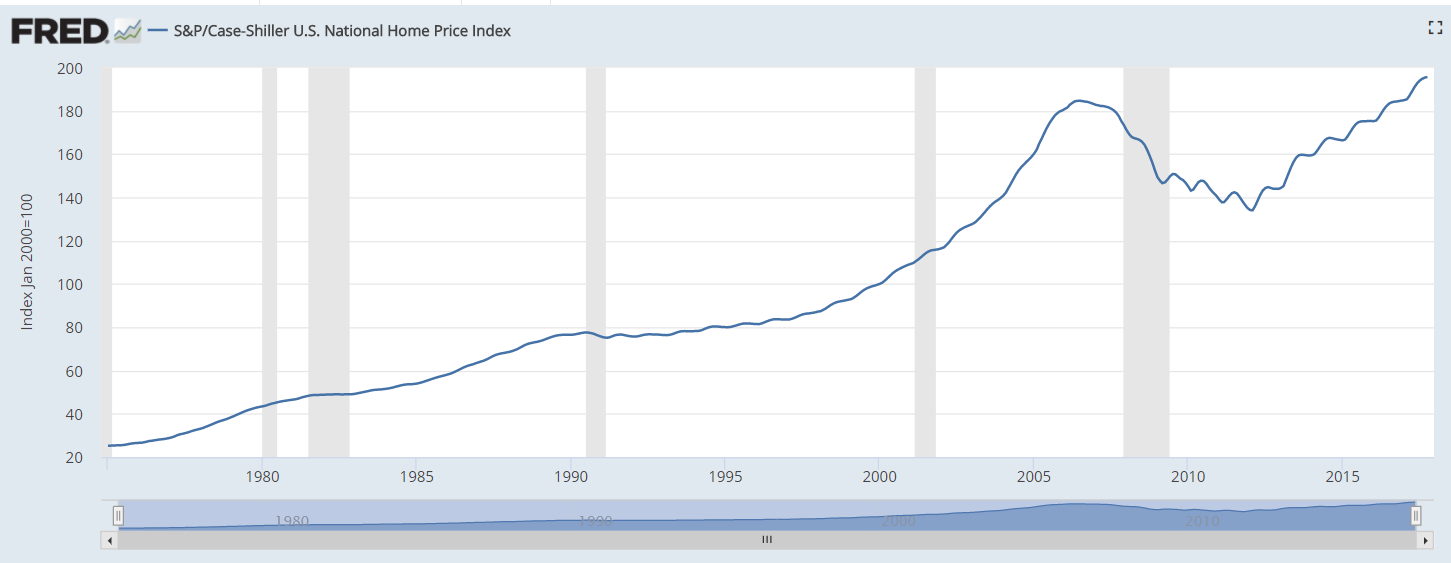

Or let us take a look at housing via the Case Shiller Index which actually looks at home sales prices:

Home values are up 95 percent since 2000. That is much higher than 43 percent or the 60+ percent reported in the CPI housing index.

So again, inflation is underreported and you can find this in many areas. The above merely points out some major areas where funds are being drained.

![]() If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!    Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!    Â

5 Comments on this post

Trackbacks

-

Bob Copeland said:

So real inflation is just shy of 4.5%?

January 29th, 2018 at 6:08 am -

billy said:

notice that nothing was mentioned about the amount of food in i package. candy bars are smaller, coffee is no longer in a 1 lb can…

January 29th, 2018 at 7:43 am -

sharonsj said:

I have been complaining about this for 10 years. In the two years after the 2008 financial implosion, prices went up between 25% and 100%. None of it was covered in the news media or in the print media. I am on a fixed income and, although I am handicapped, the cost of living has forced me to go out and find new ways of making money or I will lose ownership of my house. (Sometimes I think this is all planned by “the powers that be.”) Most old folks I know are in the same boat.

January 29th, 2018 at 3:18 pm -

libertarian jerry said:

Inflation,or the devaluation of the currency by the over creation of fiat money and credit,is nothing more than a hidden tax. Since the year 2000 government spending on all levels,but especially the Federal level, has expanded at an enormous pace. Numerous wars,the growth of the Welfare State plus corruption and waste on a massive scale has forced the government to tax borrow and inflate at an ever increasing rate. Eventually,like Rome,America will become fiscally bankrupt and the currency will become worthless. This is why the Founding Fathers,when they created the original Constitution,put into that document,as a bulwark against fiscal irresponsibility,the Gold and Silver clause. Once that clause was ignored the road to economic ruin was opened for the American Republic. In the end,our economy,like our currency,will be destroyed and with that destruction the last of our liberties. It is only history repeating itself.

January 30th, 2018 at 10:14 pm -

nichole said:

But with tax reform all our problems will be solved, right? The years of rising prices, dollar debasement, and inflation. What about the federal increase to gas tax? They give us a tax break for relief but then propose screwing us with a “new and improved” tax on something we have to buy. Such a circus.

March 1st, 2018 at 7:26 am