False prosperity through debt – 4 out of 10 Americans have less than $500. The dangers of building a consumption based nation.

- 4 Comment

If most Americans had to choose between saving and spending, they would decide to join the spending team. Americans are so drawn to spending that they will even purchase items they cannot afford. Another recent survey found that 40 percent of Americans have less than $500 saved. This aligns with a survey we found last year stating one out of every three Americans has nearly no savings. How is it possible that in the most prosperous nation in the world that we have an addiction to spending but also financing this spending through incredibly high levels of debt? We are reaching a level of peak debt for our nation and it is understandable that we cannot continue on this path. Of course platitudes and lip service abound but a national debt of over $16 trillion reflects a nation willing to go into massive debt to keep the dance going for a few more hours.

Financing a generation on debt

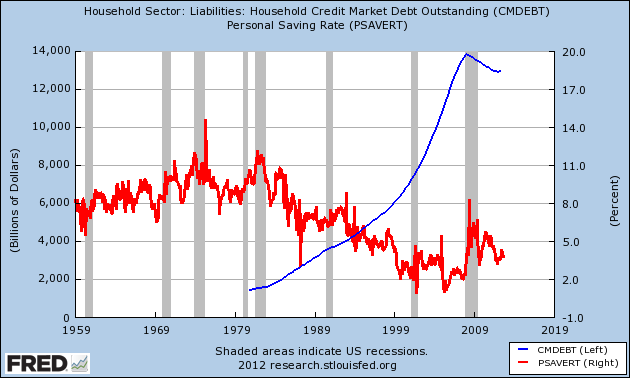

One of the more telling charts is looking at household debt versus the actual personal savings rate:

From 1950 to the early 1980s, Americans were saving roughly 10 percent of their income. Keep in mind this also occurred during a period where companies offered generous retirement plans and pensions. However, starting in the 1980s Americans started spending more of what they earned and financing much of their consumption. You can see this by looking at the blue line above. The party must have seemed like it would never end. Household debt went from the $1 trillion range in the 1970s all the way up to over $14 trillion at our recent peak.

Financing this misadventure must have appeared like a good idea to many. Buying houses people couldn’t afford and financing cars that many clearly could not sustain. As a nation we are hyper-consumers. This generation long obsession is reflected in how our government spends. We want it all but really don’t want to pay for it. The bill came due in the 2000s and this is why we now find our nation moving backwards and many households are struggling to get by. The major difference this time is that households have taken their austerity pill while the connected banks have taken on trillions of dollars of bailouts and continue to make money by socializing their defeats and privatizing their ill-gotten gains.

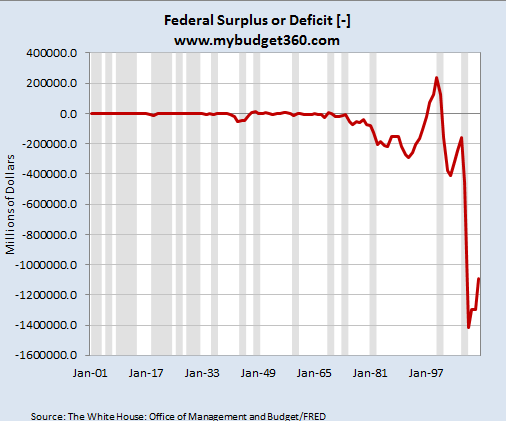

We are running incredible deficits:

This is a generational pattern here since this started in the 1970s. The reason the US is able to do this is the gains that have occurred over time. The foundation is strong but is getting eroded. You can gamble more after being hot for many years. Many Americans are now seeing the hidden costs to all of this in the form of household incomes going back to 1995 levels, 46 million Americans on food stamps, and the rising cost of many items. In other words the bill is coming due.

There is a false sense of prosperity that comes from confusing access to debt with actual wealth. No, the real wealth in this country is largely aggregated in a few hands. These surveys showing that Americans barely have enough to get by with one missed paycheck show a deeper issue at hand. Many are being pushed into a low wage capitalism system. Spending this much via banking bailouts, gifts to the too big to fail banks, and the Fed making it cheaper for people to borrow simply pushes the bill out further into the future.

Spending money you do not have is not a wise financial decision. If you pause for a second and think about it there is logic behind this. Yet voodoo finance and other nonsense has convinced many in the public to be like zombie hamsters and continue spending even if they are unable to support this with their declining disposable income. The media for the most part is like a Valium pill keeping people calm enough with their reality TV and iPhones to stay occupied. Otherwise people would realize that something is awry when half your country is nearly broke.        Â

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!4 Comments on this post

Trackbacks

-

Paul Verchinski said:

In the 50″ and 60’s it was very difficult to get credit cards. After banks found out how lucrative fees and exorborant interest rates were, credit cards were given out like candy, i. e. freshman at colleges, etc. Savings subsequently dived and have never recovered. This is a finance based economy yet high schools do not teach rudimentary financial survival. Just pay the minimum monthly payment at up to 25% interest!!! Bernanke by keeping interest rates nonexistent is discouraging saving and is giving the nasty finger to those on fixed incomes. He is effectively picking the pockets of savers to the tune of about $450 billion annually to support the bankers.

October 22nd, 2012 at 5:17 am -

clarence swinney said:

ROMNEY LOVES BORROWING

He wants to cut taxes—from 38% top to 28%–eliminate the estate tax where one family has more wealth than 90% of families—keep capital gains at 15%–where 25 Hedge Fund managers made 22 Billion in 2010—and paid little if any Payroll Tax—paid a 15% individual income tax—offset loss of revenue by closing loopholes—Ha! Each loophole has a proponent—increase military spending—800 bases worldwide-Infrastructure in shambles—pursue free trade agreements to ship jobs overseas—58,000 plants closed in last decade—how many opened in China—we must demand better self serving policies—Tariff imports—High 1945-1980 type tax rates—middle class has been hurt badly—60% of jobs once had pensions now it is 20%–protect safety nets which have served us so well—

Mitt Romney is a rich mans candidate and will attempt to change safety nets to enrich the rich

who gained so much wealth since 1980. Since 1980, we borrowed $15,000 Billion instead of taxing to pay our way. Richest nation with a national income of $14,000 Billion will not tax to balance its budget but in 2011 borrowed 1100B while the rich just got much richer.

MITT SCARES ME TO TEARSOctober 22nd, 2012 at 1:03 pm -

Varian said:

Over the next 8 years, the government will be collecting the payment for that bill – the average American’s federal taxes will go up at least 120% based on this study that projects life year-by-year up to 2020 based on US Government documents. Link to study: http://www.scribd.com/doc/107058480/Life-in-2020

October 23rd, 2012 at 9:40 pm -

clarence swinney said:

thanks for tolerating me—you are the best

SIMPLE SOLUTIONS

We must get away from being 4th on Inequality and 3rd Least taxed in OECD nations.

Least taxed led to Inequality

1. Fed fund campaigns and elections—

hang corporate person—

Six months—3 primary 3 general—

Free equal tv time—use no $$$$$ personal or donations

Debate a week=12=adequate to evaluate candidates2. Federal employees can accept nothing with a financial value

3. Progressive Tax system—Burn tax book start over—tax enough to pay our way– and pay down horrid debt—We did it 1945-1980—Since 1980, we borrowed $15,000 Billion as the rich became ultra rich partly on borrowed money. Richest on earth cannot pay its way. DUMB. In 2012, we taxed 2450B of 14,000B income for 17.5% tax rate. We needed $1100 more in taxes to pay our way. 8% more of our income. We can afford it. We are better than Chile and Mexico?? Pay our way.

Clarence Swinney peeved in North CarolinaOctober 24th, 2012 at 7:50 am

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!