The un-American savings rate: Americans savings rate heads to a record low. Americans saving about 2 percent per year and the near extinct pension.

- 1 Comment

For a brief period during the height of the recession, Americans resorted to saving more money as credit markets around the world tightened up. As data is now showing, this turned out to be a very brief anomaly in the market. Americans are back to not saving money. The debt markets are creeping back in and since household incomes are back to levels last seen in the 1990s adjusting for inflation, many people are simply supplementing this lack of income growth with high levels of debt. This works out for a brief period but when the savings rate is near 2 percent, close to a record low, you realize that many people are simply living day to day and using debt as a bridge to having access to a certain standard of living. The two-income household is almost a necessity for a middle class lifestyle. So why is it that Americans living in the richest nation on the planet, have such a hard time saving?

The un-American savings rate

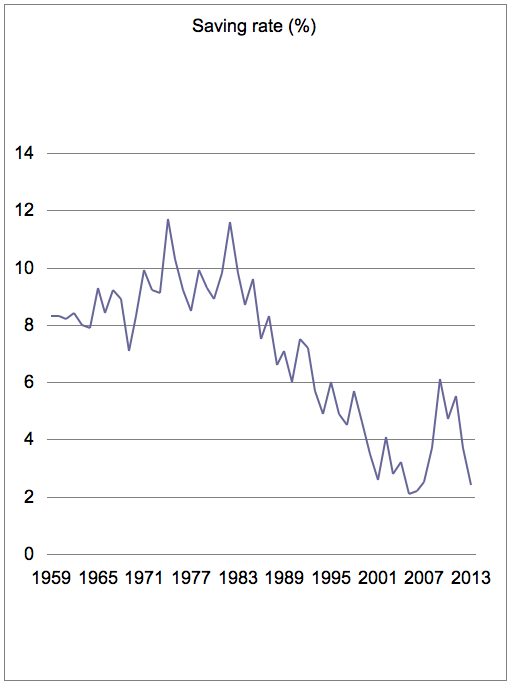

The below savings rate chart should be startling but not shocking at all:

Source:Â FRED

What is interesting about the above chart is that the savings rate was already falling steadily starting in the 1980s. The recent recession was really a reversal of a 30 year trend. However, this push up was not caused by healthy economics but by a total shutdown in global credit markets. People were forced to save for a few years. Even though the financial crisis was brought on by people taking on more debt than they could reasonably manage, people are now back to saving very little money. The trend is still firmly in place.

You can see this in the volume of 0 percent automobile financing offers and the amount of credit card offers now coming to your home via mail. The fact that the Fed is essentially buying $85 billion a month in mortgage backed securities highlights that debt is going to be their solution out of a debt based crisis. The drop in the savings rate has to do with the fact that the average per capita wage in the US is around $26,000. Household median income is at $50,000. With the cost of housing, healthcare, education, and other items going up a lot of money is simply being eaten up by the basics.

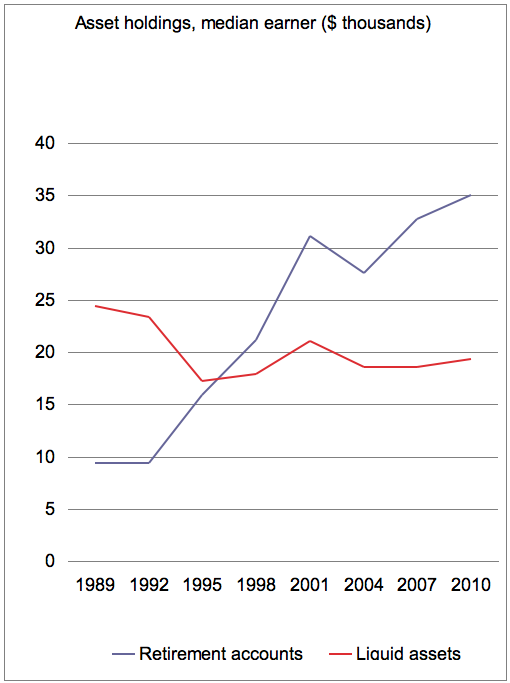

Americans have some money stashed in retirement accounts:

What is interesting is that liquid assets have not changed by much since the late 1980s. I would argue that this has to do with the abysmal rates being offered for those looking for safe investments like CDs or regular bank savings accounts. Most accounts pay 0 percent or close to that so you effectively are losing money when inflation is counted.

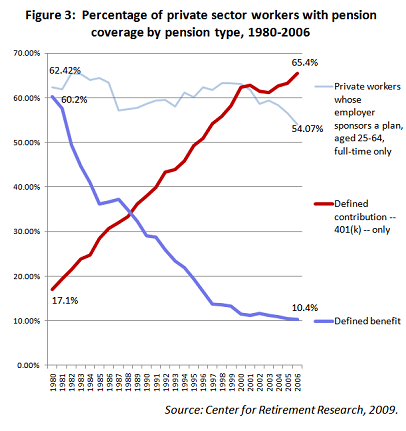

While the amount of retirement accounts has increased, $35,000 as the median retirement account is not really going to get you far especially with 75 million baby boomers hitting retirement age. The shift has also occurred because of the going away of pensions:

Only about 10 percent of the private sector even has a pension option anymore versus 60 percent back in 1980. Coincidence that the savings rate also fell during this time? Seems like Americans have doubled-down on debt. So that push up in the retirement account data is even more troubling in light of the above. So Americans are now simply relying on other outside options for retirement including Social Security. There are major funding gaps with pensions:

“(The Atlantic) In addition, states have funded only about 80 percent of their pension liability, leaving a $3.32 trillion funding gap. Ohio and Rhode Island are in the worst shape, having underfunded their pensions by almost 50 percent of their gross state product. Other liabilities, such as retiree health and dental insurance, also are underfunded. City governments similarly are plagued by underfunded pensions, with Los Angeles underfunding its public pension liabilities by $3.53 billion, with an additional $2.43 billion owed for other employment benefits such as healthcare. As of June 2009, New York City public pension programs had liabilities that exceeded their assets by $39.9 billion with an additional $65.5 billion owed for other benefits.

So both the private and public components of the U.S. pension system are under severe strain, as the Great Recession combined with pre-recession patterns of rising inequality and a diminishing social contract have taken their toll. With fewer workers covered by pensions, this leg of the three-legged stool of retirement security is too short — and growing shorter.â€

The plan for retirement and savings for many? There really isn’t one.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!1 Comments on this post

Trackbacks

-

Gnatman said:

In 1880 life expectancy was 40, now it is 80.

Pension plans had to compensate for this moving target – the growing number of participants and length of time as an annuitant. If the date of retirement was fixed the exit date was getting further out. Corporations had to contribute more for the extended life expectancy. And this actuarial exercise is requiring more and more funding even without a COLA.

COLA adds a terrific strain on the contributions, added life expectancy compounded by increasing payouts. That concept is understood by even less than the number of people who can compute compound interest.

April 12th, 2013 at 12:10 pm

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!