Bank of America: Third Quarter Earnings, $1.18 Billion. Countrywide Loan Settlement, $8.6 Billion. One of the Biggest U.S. Banks Unable to do Math, Priceless.

- 0 Comments

I’m sure it is difficult for most people who are struggling with the day to day items of life to focus on the macro problems plaguing the economy. Many families are hearing more and more everyday about a neighbor or friend that has lost a home to foreclosure and deep down many are feeling a pit in their stomach that they may be next. This is not only a financial crisis but one that will test the fortitude of many.

That is why the decision for Bank of America to gobble up Countrywide Financial in the midst of the worst housing correction in our history was puzzling. I understand that they wanted a major position in the mortgage servicing market but to risk your company for this one piece of the pie was a bad move. That bad move has come back to cost Bank of America in large fashion:

“(Forbes)Â Bank of America today announced a settlement with state attorneys general that could cost as much as $8.6 billion to modify loans in 11 states.

The company will offer more affordable and sustainable mortgage payments for borrowers who had financed their homes with subprime loans or adjustable-rate mortgages serviced by Countrywide, the troubled mortgage lender that Bank of America acquired last summer.

The deal will enable eligible subprime and pay-option mortgage borrowers to avoid foreclosure by obtaining a modified and affordable loan. The loans covered by the settlement are among the riskiest and highest defaulting loans, which are at the epicenter of America’s foreclosure meltdown. The deal may help over 400,000 borrowers stay in their homes.”

Countrywide was notorious at pumping out most of the exotic mortgages in the market and led the way in setting the tone for other mortgage providers to follow its path. This current settlement is the largest of its kind and amazingly will cost 7 times what Bank of America earned this quarter. I’ll repeat that one more time since it really shows what a bad move this was. Bank of America which earned $1.18 billion in the third quarter of 2008 is going to shell out what could be up to $8.6 billion.

It isn’t that the money will be flying out like the $810 billion bailout. This money is going to go directly to modifying home mortgages. You can consider this the largest home loan modification program that we have yet to see and is expected to help 400,000 borrowers stay in their home.

How are they going to keep borrowers in their home? Bank of America is going to look at freezing rates potentially and also trying to put homeowners into government loans which will force the bank to take a principal reduction hit. Either way, this is going to cost the bank some hefty costs. It is also unclear how they are going to get approval from large investor groups but there it is, the largest loan modification program in the United States history.

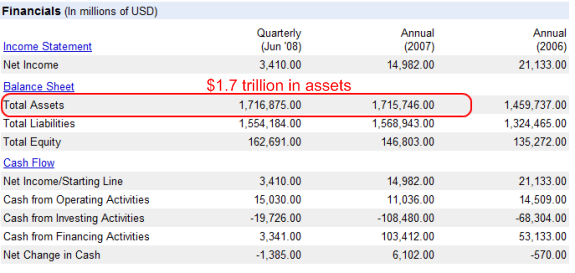

Let us take a look at some key financial points from Bank of America:

Now you may be wondering how a company like Bank of America with $1.7 trillion in assets can make such a poor move in buying up Countrywide Financial. The first assumption is that when the deal was in the works, many top level executives did not envision a market collapse as the one we are seeing. Even late in 2007 the housing market was not down in double digits so most of the damage has occurred in 2008 which still has 3 months to go including the ominous October month.

That was the first mistake assuming the market would recover. I also believe Bank of America underestimated the extent of toxic mortgages that Countrywide would have on its books.  Now with this lawsuit, they are going to have years of litigation just to clean up the previous mess.

I want to draw you attention also to the annual earnings portion above. What is stunning that with the current quarter, Bank of America is running at an annualized earnings per year of $4.72 billion.  Take that into consideration with the $21 billion it earned in 2008.

The credit crisis is going to prove to be a challenge even for large well established banks like BofA.

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!

If you enjoyed this post click here to subscribe to a complete feed and stay up to date with today’s challenging market!